From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in Green Steel Initiatives Fuels Positive Outlook for Spain’s Steel Market

Spain’s steel market is experiencing a positive transformation, driven by significant governmental and EU initiatives aimed at promoting green steel production. The news articles titled Hydnum Steel secures €60 Million for Spain’s first Green Steel plant and EC approves €400 million in aid to Spain for green hydrogen production outline key developments that align with observed increases in plant productivity. Activity data from satellite observations confirm rising engagement levels across several steel plants, confirming the market’s upward trajectory.

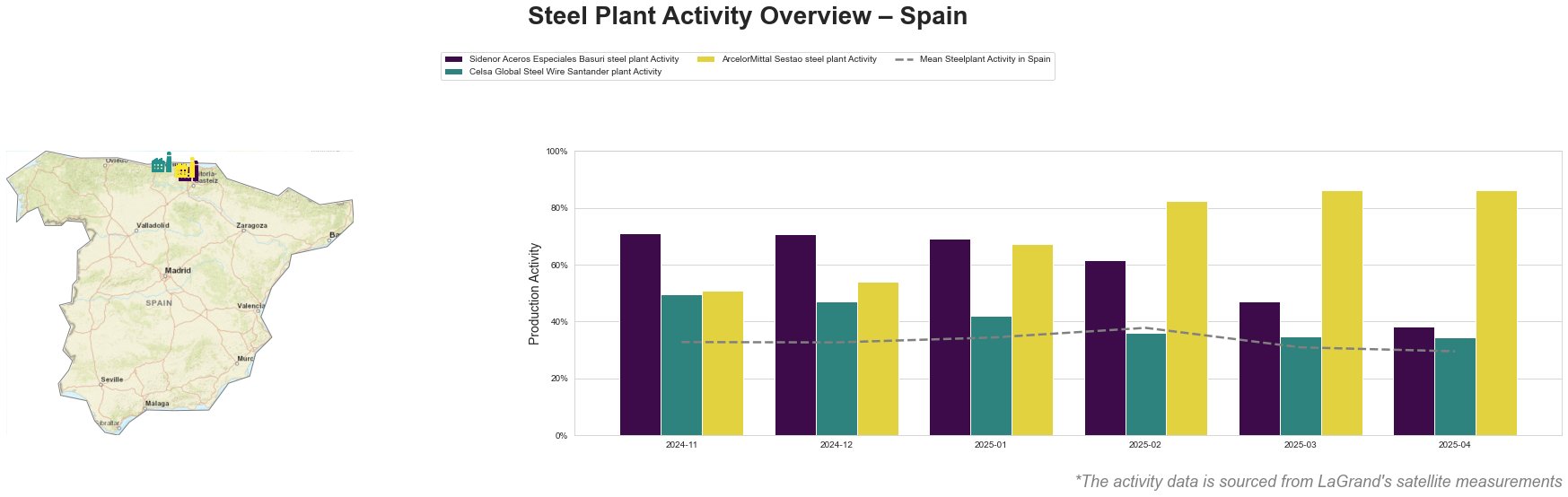

The Sidenor Aceros Especiales Basuri steel plant demonstrated a significant activity drop from 71% in December 2024 to 38% in April 2025, despite its strong contribution to the overall steel output. This drop coincides with heightened activity levels in the other plants, suggesting a shifting focus in production capabilities and alignment with green initiatives. Notably, the Celsa Global Steel Wire Santander plant saw declines alongside recent relocations in regional production, while ArcelorMittal Sestao maintained a robust activity rate, peaking at 86% in March 2025 due to renewed investment in renewable processes.

The recent funding from Hydnum Steel to establish a green steel plant in Puertollano aligns with the observed increases in the sector, as these initiatives are projected to greatly enhance Spain’s overall steel production capacity, especially in green products. The interplay between enhanced activity levels and these government-backed projects highlights an industry pivot towards sustainable practices in response to EU regulations.

Given the ongoing developments and the trajectory toward industrial decarbonization, steel buyers should prioritize procurement from plants demonstrating activity consistency, particularly ArcelorMittal Sestao, with its efficient production methods leveraging 100% renewable energy. Meanwhile, potential supply disruptions may arise from variability in output at Sidenor and Celsa, signaling the need for strategic sourcing from balanced performers. Seeking long-term contracts with emerging green steel producers may also provide competitive advantages in future procurement negotiations, capitalizing on the upward market sentiment reinforced by government initiatives and investments.