From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market: Activity Levels Increase Amid Recent Import Changes

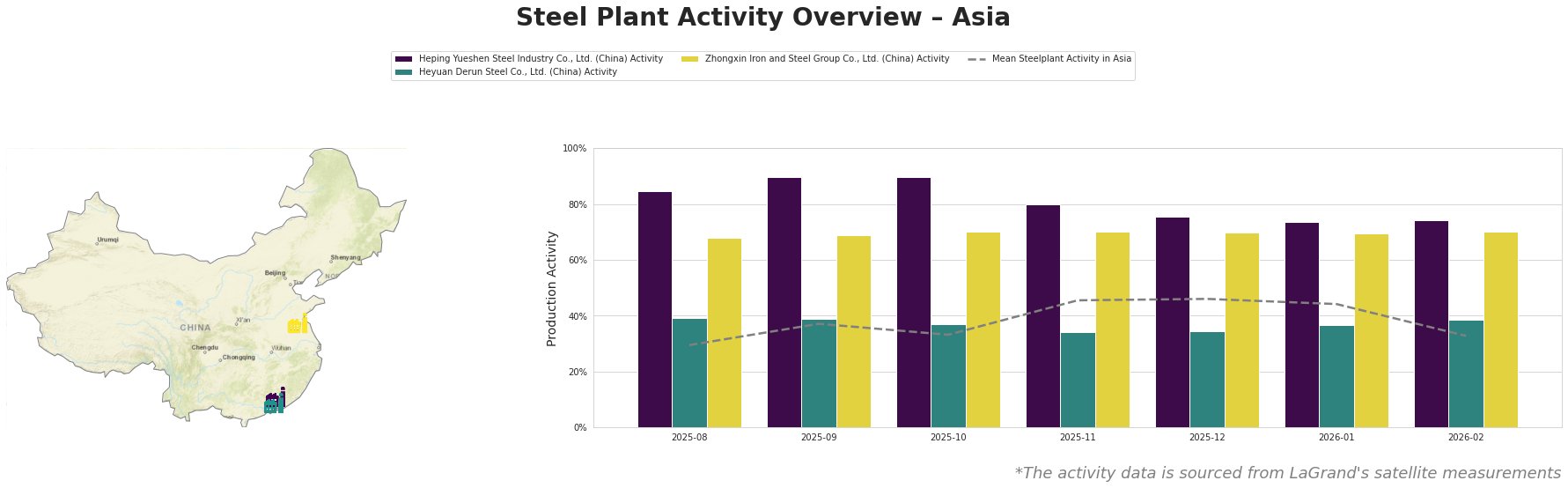

Recent satellite observations have indicated a positive shift in steel plant activities across Asia, despite fluctuating import statistics. Notably, US OCTG imports down 24.8 percent in November 2025 from October signals a changing landscape in demand, potentially benefiting Asian suppliers. This shift correlates with observed activity levels, particularly notable in plants such as Heping Yueshen Steel Industry Co., Ltd., where activity has stabilized at 80% as of November, although it decreased slightly to 75% by December.

Heping Yueshen Steel Industry Co., Ltd., specializes in finished rolled products, predominantly hot rolled rebar, and has seen its activity levels stabilize at 80% in November before dipping to 75% in December. Given the decrease in US imports, especially from leading suppliers like South Korea, there could be an opportunity for Heping Yueshen to enhance its export performance as competition eases.

Heyuan Derun Steel Co., Ltd., experienced a decline in activity to 34% in November, correlating with decreased demand in certain segments. However, their production mainly serves local markets, which may continue to stabilize due to regional demand resilience.

Zhongxin Iron and Steel Group Co., Ltd., known for its sizable production capacity (5,700 MT) and an extensive product range, maintained a steady activity level of 70%. While the recent US line pipe imports up 45.2 percent in November 2025 from October might indicate a temporary boost in demand, no direct links to Zhongxin’s performance can be established.

The current market sentiment remains positive, offering steel buyers a chance to negotiate favorable terms, especially with Heping Yueshen and Zhongxin appearing well-poised for steady supplies. Procurement teams should consider advancing orders to capitalize on rising activity levels, particularly from suppliers likely to gain from reduced import competition. Engage with these facilities directly to secure contracts that exercise favorable pricing before anticipated upticks in regional demands start affecting supply chains.