From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Faces Decline Amid Stringent EU Environmental Policies and Plant Activity Level Drops

Asia’s steel market sentiment has turned very negative, primarily driven by the criticisms articulated in the news articles “EU environmental policy hinders industrial development – Federacciai president“ and “Federacciai’s Gozzi: EU environmental policies are blocking industrial development.” These pieces highlight the adverse effects of stringent EU regulations on industrial competitiveness, particularly linking to observed declines in activity levels at various steel plants.

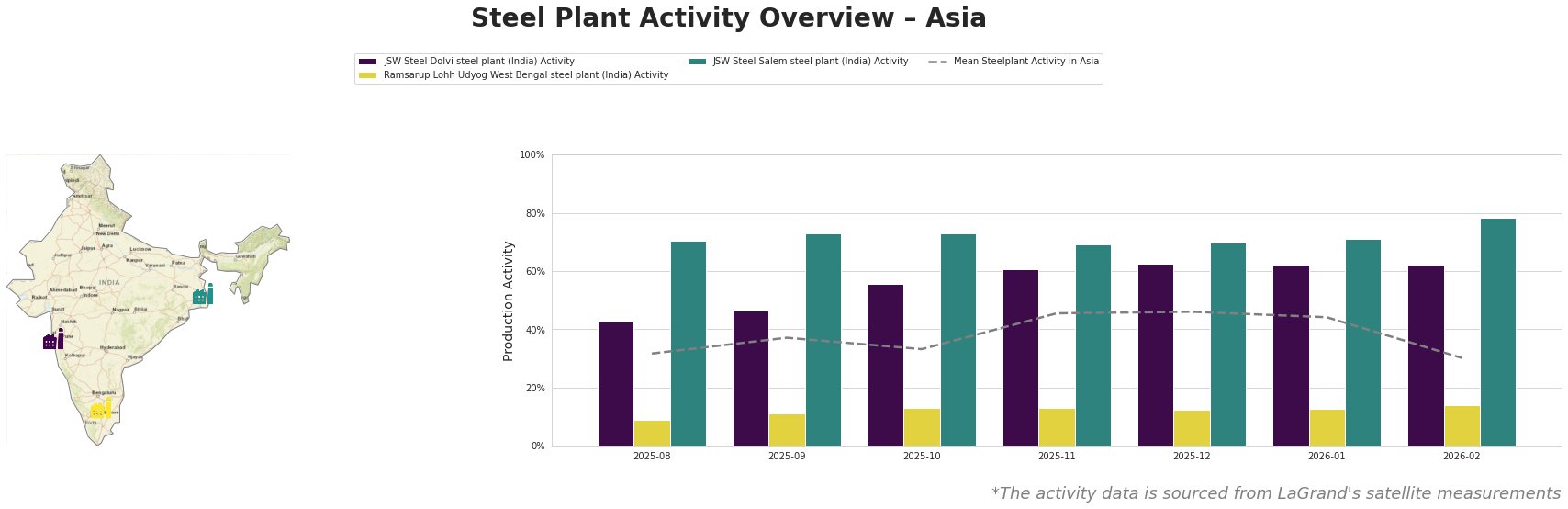

Recent satellite data shows that monthly activity at major steel plants in Asia has experienced significant fluctuations, reflecting the ongoing challenges in the sector:

The data indicates a notable drop in the mean activity level to 30% by February 2026, a stark contrast to previous months as the impacts of regulatory pressures start to take hold. The JSW Steel Dolvi plant exhibited a decrease to 62%, maintaining relative stability, while Ramsarup Lohh Udyog is witnessing a lower activity level stagnating at 14%, reflecting a significant underperformance when compared to the other facilities.

JSW Steel Salem, despite its fluctuations, rose to 78%, indicating resilience against the regulatory backdrop but still faces uncertainties ahead. These activity levels hint at tightening supply chains within the steel market.

With reference to the critiques by Gozzi regarding the environmental policies curbing industrial investment, it becomes evident that regulatory challenges are inhibiting development and competitiveness within Asia’s steel sector. The connection between these declines in operational activity and Gozzi’s assertions about the negative impact of EU policies reinforces the sentiment reflected in the data.

Steel buyers should anticipate potential supply disruptions, especially from lower-performing plants like Ramsarup Lohh Udyog where activity is notably reduced. Therefore, procurement strategies should consider diversifying suppliers and re-evaluating commitments to plants facing regulatory challenges. Meanwhile, securing orders from relatively stable plants, such as JSW Steel Dolvi and JSW Steel Salem, may provide leverage against the impending market instability, thereby ensuring continued access to critical steel supplies.