From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Insights: Cautious Optimism Amidst Mixed Signals in 2026

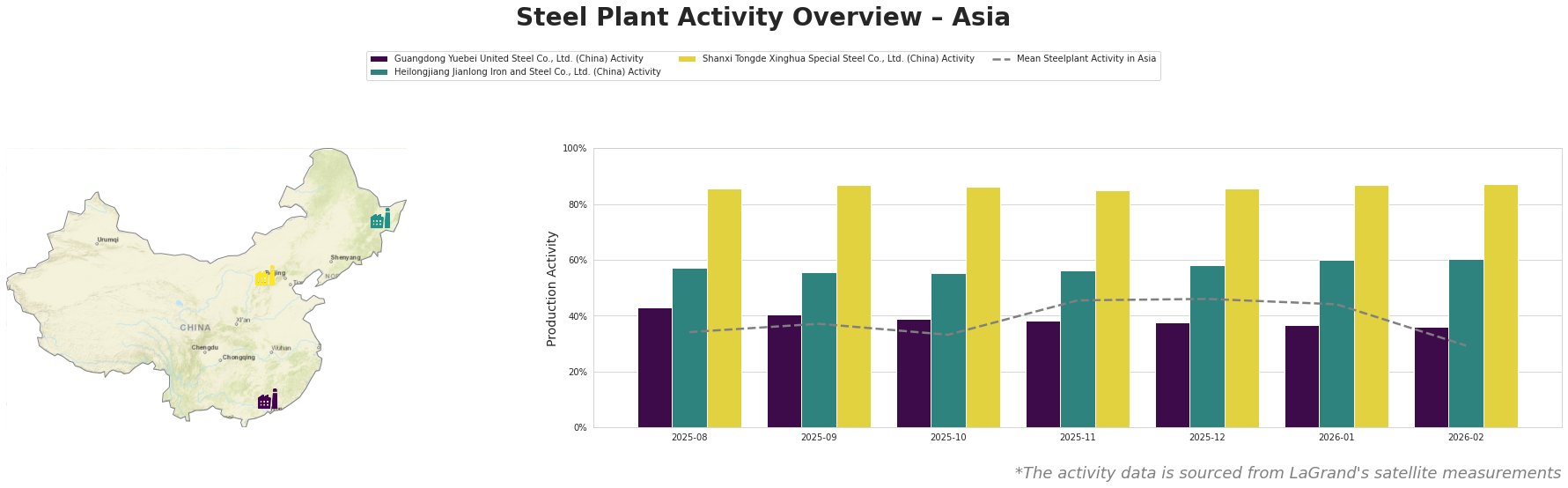

In Asia, recent developments indicate a cautious and neutral market sentiment. The IREPAS Short Range Outlook: February 2026 highlights a cautious buyer approach driven by weak demand and geopolitical tensions, which is echoed in satellite-observed activity reductions, particularly at Guangdong Yuebei United Steel Co., Ltd., where activity fell from 46% to 29% between December 2025 and February 2026. Conversely, California Prices for rebar showed mixed dynamics at the beginning of the year indicates that while rebar prices rose in the US, China experienced demand-related price declines, particularly affecting regional supply balances.

Guangdong Yuebei United Steel Co., Ltd. has seen a significant drop in activity from 46% to 29% by February 2026, reflecting the mentioned weakening demand due to geopolitical tensions impacting buyer confidence as outlined in the IREPAS Short Range Outlook: February 2026. The mill, which mainly produces finished rolled products like rebar, may struggle as domestic consumption wanes.

Heilongjiang Jianlong Iron and Steel Co., Ltd. maintained a steady activity level at 60%, signaling resilience amidst mixed price dynamics for rebar and potential supply influence from external markets based on the recent analysis of price trends. This suggests that their production capabilities are not presently threatened, but market conditions warrant watching due to fluctuating global demand linked to the IREPAS report.

Shanxi Tongde Xinghua Special Steel Co., Ltd. remained stable, with activity levels at 87% in February 2026. The mill’s consistent performance indicates a robust internal demand capacity, though it must stay vigilant about regional market shifts indicated by potential oversupply concerns elsewhere as per the Prices for rebar showed mixed dynamics at the beginning of the year article.

Given the data and trends observed, procurement professionals should consider the following actions:

– Monitor Guangdong Yuebei’s capacity closely for potential supply disruptions, particularly given their significant decrease in activity and decreasing demand.

– Evaluate sourcing opportunities from Heilongjiang, where production remains resilient, but remain cautious of longer-term demand fluctuations that may arise from geopolitical conditions.

– Continue purchasing from Shanxi Tongde as their strong operational levels may provide a more stable source in uncertain times, aligning with the survey of mixed price trends but stable demand fundamentals.

Attention to these dynamics can facilitate informed purchasing strategies that leverage timely insights from market activities in Asia.