From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Decline in Asia: Satellite Data Confirms Activity Dips Amid EU Policy Uncertainty

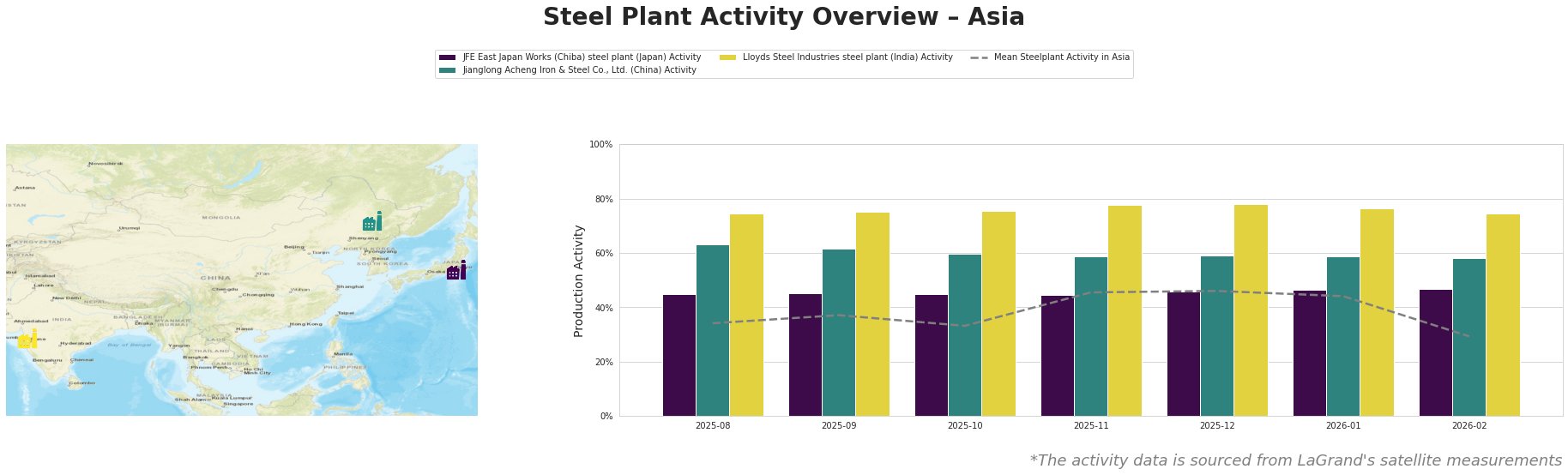

Recent analysis shows significant declines in steel production across Asia, contributing to a Very Negative market sentiment. Specific changes in plant activity levels align with concerns over regulatory impacts on competitiveness as outlined in several critical articles: Deutsch-französisches Stottern vor dem EU-Wettbewerbsgipfel, Carbon — In Focus: EU ETS in political crosshairs, and EU-Wirtschaftsgipfel: Große Worte, kleine Listen. The observed dips in production, particularly from Jianglong Acheng Iron & Steel Co., Ltd. and the Lloyds Steel Industries plant, reflect potential disruptions linked to ongoing EU policy discussions and geopolitical tensions.

Activity levels show a marked decrease in February 2026, with the mean activity in Asia dropping to 29%, a new low. Jianglong Acheng’s activity decreased to 58%, while Lloyds Steel Industries fell to 74%. This downward trend seems consistent with the concerns addressed in Carbon — In Focus: EU ETS in political crosshairs, where carbon price fluctuations are complicating the economic landscape due to rising costs and competitive pressures highlighted by German Chancellor Friedrich Merz in the context of the EU emissions trading system (EU ETS). Even with slight stability in some plants, significant declines directly relate to overarching policy uncertainties discussed at the recent EU summit.

JFE East Japan Works maintained steady activity levels at 45-47%, yet this represents a broader stagnation in a market where higher output is necessitated for recovery. The integration of JFE’s activities and the repeated calls for EU regulatory tweaks in the aforementioned articles imply that unless competitive factors are addressed, production rates may not sustain a rebound.

Supply disruptions are likely, particularly from Jianglong and Lloyds Steel, whose recent declines indicate vulnerability amid the current downturn. Given the EU’s focus on revising policies—exemplified in EU-Wirtschaftsgipfel: Große Worte, kleine Listen—procurement professionals should prepare for potential shortages by evaluating multiple suppliers across the region, especially those not overly reliant on EU markets.

Steel buyers are advised to adopt a cautious procurement strategy, focusing on long-term relationships with suppliers demonstrating adaptability to regulatory changes. Given the uncertainty surrounding EU emissions regulations discussed by leaders, purchasing contracts should include clauses for flexibility to respond to future price variances or sourcing issues.

In summary, the current state of the steel market in Asia, characterized by plummeting activity levels and a very negative outlook, calls for proactive measures from buyers to secure supply and navigate the implications of evolving EU policies impacting operational costs and market dynamics.