From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Europe’s Steel Market: Activity Trends and Supply Insights

In Europe, recent developments in the steel sector reveal a positive market sentiment, primarily influenced by changes in Ukrainian iron ore exports and domestic production challenges. The article “Kalenkov explained why Ukraine imposed a temporary restriction on scrap exports.“ highlights significant shifts in steel production dynamics due to a shortage of scrap, which cascaded effects on output levels. Moreover, data indicates a 15.4% year-on-year decrease in rolled steel production, as noted in “Ukraine reduced rolled steel production by 15.4% y/y in January.” These changes correlate with recent satellite-observed activity data indicating varying trends across European plants.

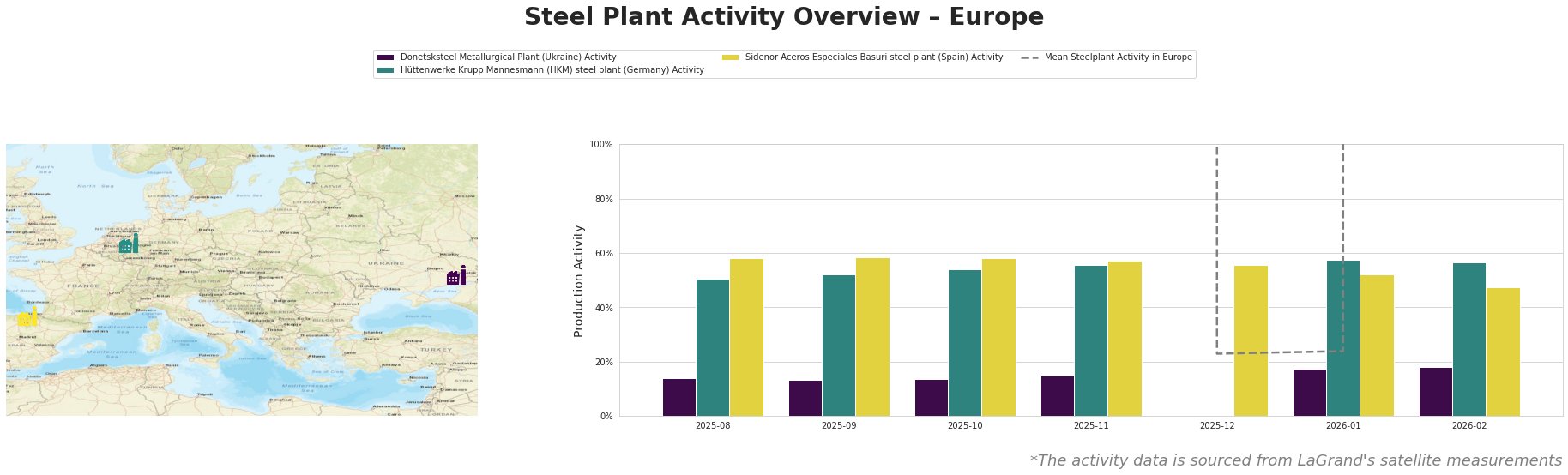

In January 2026, activity at the Donetsksteel Metallurgical Plant displayed a modest recovery to 17% after significant lows, illustrating the impact of domestic production shortfalls noted in the “Ukraine reduced pig iron exports by 27% y/y in January“. Meanwhile, HKM recorded stable activity at 58%, indicative of its consistent production capabilities amidst market fluctuations. Sidenor faced a slight decline to 52%, with connections to diminished domestic scrap availability and decreasing demand, despite circumventing scrap export regulations to ensure continued operations.

As supply chains tighten, evident disruptions loom from Ukraine’s reduced production and export volumes. The statistics indicate a critical reliance on imported raw materials, particularly iron ore, as reflected in “Ukraine reduced iron ore exports by 34.4% y/y in January“ and could lead to potential delays in fulfilling contracts for buyers across Europe.

Steel procurement professionals should consider expanding sourced alternatives and securing contracts with plants maintaining stable output levels, such as HKM. Additionally, revisiting supply agreements with Sidenor may yield benefits, provided they adjust to overcome local availability challenges. Monitoring developments around Ukrainian exports will be vital; upcoming regulations might prompt upward price adjustments or unanticipated supply chain adjustments.