From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Growth in India’s Steel Market: Voestalpine’s Strategic Expansion Signals Opportunities Ahead

India’s steel market is poised for growth, underscored by Voestalpine’s ambitious plans as outlined in the articles “Voestalpine is banking on India and new acquisitions for growth“ and “Voestalpine plans plant in India, eyes further acquisitions.” These announcements correlate with robust satellite-observed activity in India’s key steel plants, suggesting an upward trajectory in market dynamics.

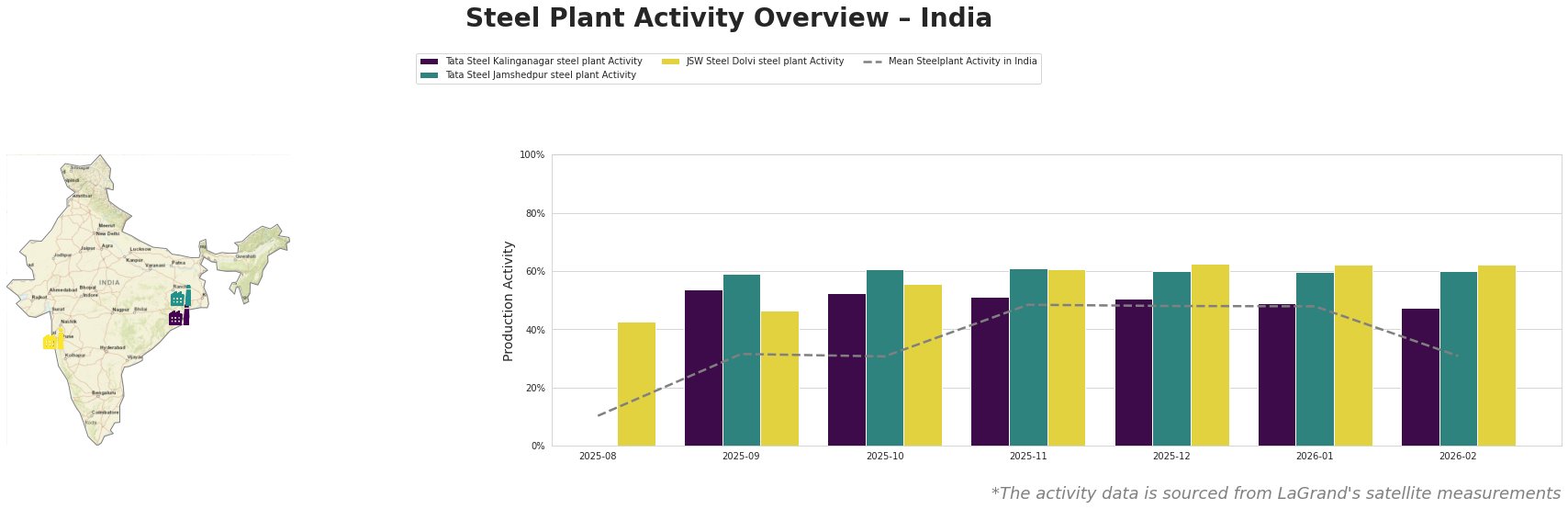

Activity levels across Indian steel plants show significant variance, with a remarkable peak observed in November 2025 at a mean of 48%. Notably, Tata Steel Jamshendur and JSW Steel Dolvi maintained high operational activity with 61% and 63% in December 2025, respectively, aligning positively with Voestalpine’s expansion plans. The reduction in activity recorded in February 2026 could reflect temporary adjustments as companies align with new strategies.

The Tata Steel Kalinganagar steel plant, located in Odisha, reported a notable drop to 47% activity in February 2026, following a peak of 54% in September 2025. This aligns with Voestalpine’s strategic focus, suggesting that competitive pressure may influence production schedules. The plant supports the automotive sector with a crude steel capacity of 3,000 MTPA generated through integrated blast furnace technology.

Tata Steel Jamshedpur, with its substantial capacity of 10,000 MTPA and diverse product lines, remained steady around 60% activity, showcasing resilience in the face of anticipated market shifts. The firm’s diversified output may mitigate risks as they adapt to competitive dynamics in the coming fiscal period.

The JSW Steel Dolvi plant has shown consistent performance, maintaining activity above 60% which reflects strong demand for their finished rolled and semi-finished products pivotal in infrastructure and automotive sectors. Despite a slight decrease to 62% in February, prolonged high operational levels emphasize ongoing market confidence.

In light of Voestalpine’s commitment to the greentec steel program, steel buyers should prepare for potential supply adjustments as new capabilities come online, particularly in specialized products. This growth trend suggests a solid foundation for procurement strategies, particularly in anticipating market needs for automotive and infrastructure projects.

Steel buyers are advised to engage suppliers immediately, aligning with the expected growth trajectory highlighted by Voestalpine, to secure favorable procurement terms ahead of potential capacity expansions. Monitoring satellite activity for signs of operational shifts will be crucial to navigate upcoming market demands effectively.