From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Outlook: Critical Risks Emerge Amid Declining Activity and Call for Government Action

The steel market in Europe, particularly in the UK, faces severe challenges as highlighted by “Tata Steel warns government as UK steel sector faces critical risk“ and “UK has eight weeks to save its steel industry: Tata“. Recent satellite observations indicate significant reductions in activity at major steel plants, particularly in the UK, which correlates with Tata Steel’s alert regarding the impact of low-priced imports, primarily from China.

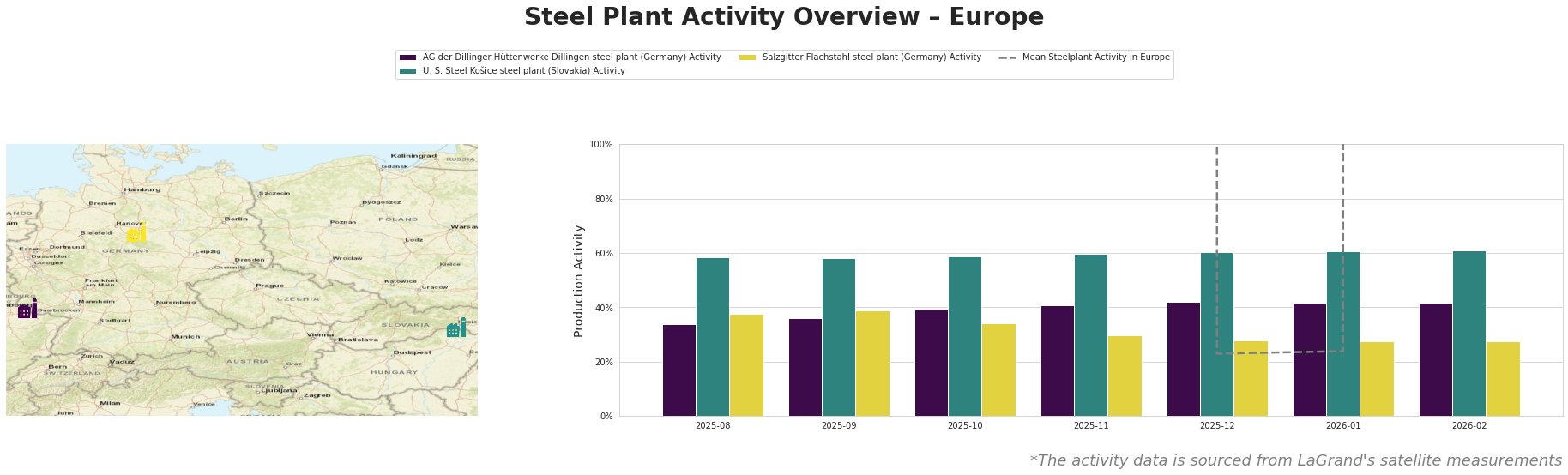

Activity levels across European steel plants have predominantly trended downwards, with notable declines in December and January coinciding with Tata Steel’s reports of decreased shipments by 8.7% and revenue dips in the UK market. The AG der Dillinger Hüttenwerke plant has seen a steady decline, maintaining low activity near 34% to 42%. The Salzgitter Flachstahl plant recorded a significant drop from 39% to 30% during this period, which might reflect broader market challenges as indicated in “ISTA blames lack of investment for Tata UK issues“.

The U. S. Steel Košice plant has recently stabilized but remains below optimal activity levels, mirroring challenges indicated in Tata Steel’s mixed market conditions report. The notable decrease in overall steel activity aligns with financial pressures mentioned by Tata, underscoring critical risks identified in the news as both local and international dynamics change.

The declining activity levels suggest potential supply disruptions in the UK particularly, as Tata Steel has called for urgent government intervention to prevent the sector from declining further. Steel buyers should be particularly wary of sourcing from the UK market, where protective measures are in a state of flux until July 1, 2026, potentially leading to acute shortages or heightened prices.

Recommendations for Steel Procurement:

- Prioritize sourcing from EU plants: With Tata’s reported improved conditions in the EU market, consider increasing orders from AG der Dillinger and U. S. Steel Košice, which showed relatively higher levels of activity.

- Monitor UK product quotas and tariffs closely: As dynamics evolve with the impending government decisions, engage in negotiations well in advance to ensure stable pricing and supply security.

- Invest in predictive logistics: Given the urgent timeline cited by Tata Steel, steel buyers should prepare for potential shortfalls in UK supply and develop backward strategies for procurement to mitigate impact.

In summary, the European steel market, particularly the UK’s sector, stands at a critical juncture with significant implications for procurement strategies. The importance of government intervention and strategic sourcing cannot be overstated amid rising pressures from global competition, particularly China.