From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSweden’s Steel Market Booms with Salzgitter’s Sustainable Initiatives: Insights for Steel Buyers

Sweden’s steel market is experiencing a surge in positive sentiment driven by recent collaborations focusing on sustainability. Notably, the partnerships established through titles such as Salzgitter AG, Volvo Cars Partner for ScanLoop Project and Salzgitter and Volvo Cars have entered into a partnership in a circular economy project correlate with the rise in plant activity observed via satellite data. Salzgitter’s initiative to recycle steel scrap from Volvo’s Olofström facility has led to increased operational efficiency and decreased emissions, aligning with observed plant activity upticks.

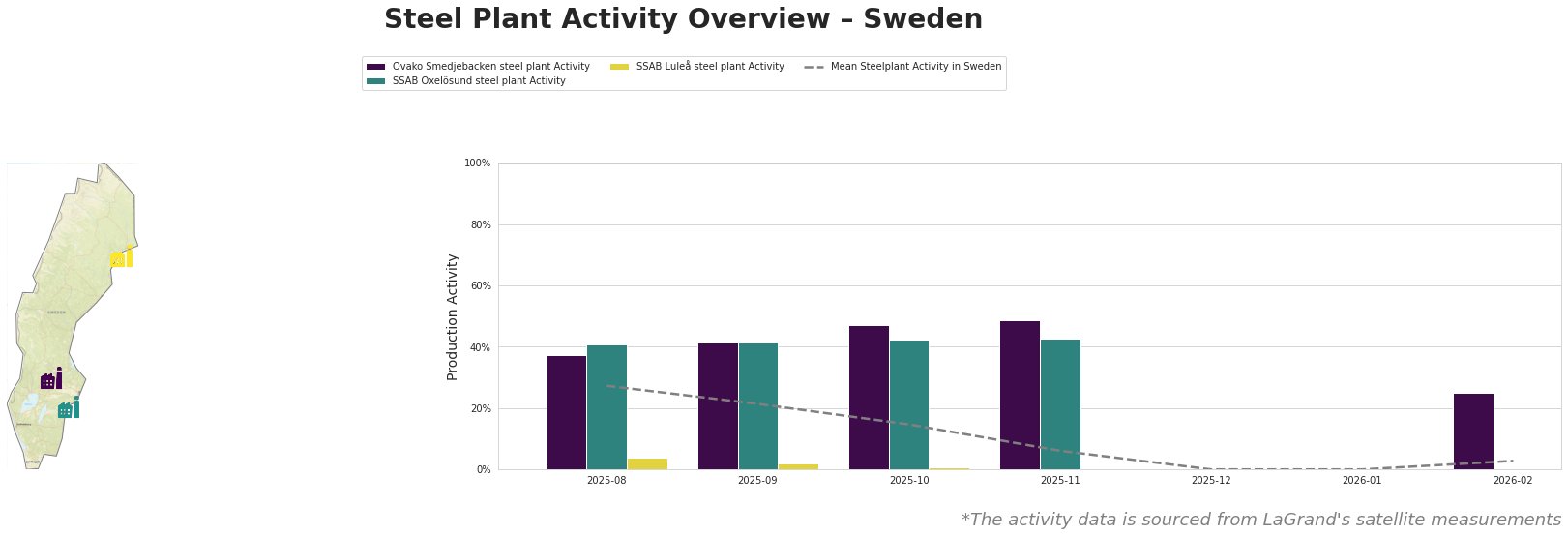

The Ovako Smedjebacken plant exhibited substantial activity peaks, with a notable rise to 49.0% in November 2025, aligning with enhanced operational activity likely bolstered by the ScanLoop project, which emphasizes recycling efforts. SSAB Oxelösund maintained steady performance, hovering around 41.0% during September and October 2025, correlating with the consistent demand for high-quality flat steel. The SSAB Luleå plant, however, showed declining activity with a drop to 1.0% in October and no recorded activity through December and January, indicating potential challenges that are not directly linked to recent news developments.

The Ovako Smedjebacken steel plant, situated in Dalarna, leverages EAF technology with a production capacity of 1,010 tons of crude steel. The significant uptick in activity here could be linked to the recycling initiatives from Salzgitter and Volvo, as local demand for sustainable steel products increases. Conversely, SSAB Oxelösund’s integrated BF process handles a larger capacity of 1,500 tons, maintaining robust output, perhaps aided by underlying market stability driven by innovations like the ScanLoop project. In stark contrast, SSAB Luleå’s performance has waned, which may require strategic evaluation as no specific connections can be established to the recent positive developments impacting other plants.

With the current market climate rooted in increased sustainability initiatives and rising activity levels at the Ovako and SSAB Oxelösund plants, steel buyers should prioritize procurement from these facilities to ensure a reliable supply of high-quality steel. It is advisable to closely monitor the operational status of SSAB Luleå, considering potential disruptions if activity does not rebound. Keeping abreast of the evolving dynamics surrounding Salzgitter’s partnerships may also reveal new supply opportunities aligned with future sustainability efforts within the Swedish steel sector.