From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Shifts in Ukraine’s Steel Market: Recent Activity and Trends

In Ukraine, significant fluctuations in steel market dynamics have recently been observed. Notably, the article “Domestic prices for construction steel rose by 2.5–2.7% in January“ indicates rising domestic steel prices despite low demand. Concurrently, “Ukraine reduced rolled steel production by 15.4% y/y in January“ highlights a decrease in production, aligning with a decrease in satellite-observed plant activities.

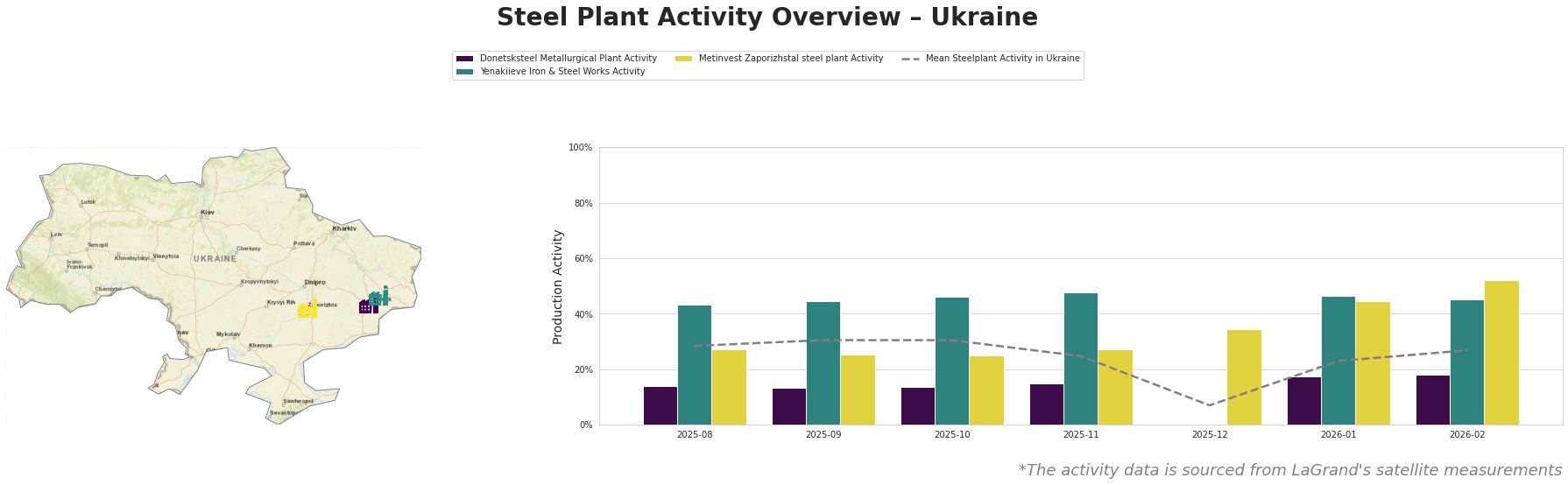

The overall trend shows that the average activity of steel plants hit a low of 7% in December 2025 before recovering to 27% by February 2026. This positive trajectory reflects the recovery in production processes after the export restrictions, particularly for hot-rolled sheets, as evidenced by the “Domestic prices for construction steel rose” article. However, the sharp decline in January production was critical, with Metinvest Zaporizhstal exhibiting a particularly high rebound, increasing from 44% to 52% activity. This increase aligns with growing prices in construction steel, suggesting a demand rebound for finished rolled products, especially in sectors like automotive and machinery.

The Donetsksteel Metallurgical Plant, primarily producing pig iron, faced lower activity, peaking at only 17% as of January 2026, driven by the production shortfall linked with scrap export restrictions noted in “Kalenkov explained why Ukraine imposed a temporary restriction on scrap exports.“ Supply limitations hindered steel outputs, which coincided with a notable 15.4% decrease in rolled steel production in January.

Conversely, the Yenakiieve Iron & Steel Works displayed consistent output ranging between 43% and 48%. This stability may be attributed to its diversified semi-finished and finished product offerings, particularly in rebar and wire rods, essential in construction, despite the overall market’s retraction.

Given the assessment of these trends, steel procurement professionals are urged to act on these insights for strategic sourcing. Specifically, with rising prices indicating a supply-demand mismatch, immediate procurement from Metinvest Zaporizhstal may safeguard against future shortages. Conversely, exercising caution when engaging with Donetsksteel or Yenakiieve might be beneficial until production stabilizes post-export subsidy adjustments.

In conclusion, while the sentiment remains positive, the need for strategic procurement is evident as market conditions evolve following recent restrictions and price adjustments.