From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Europe’s Steel Market Amid Ukraine’s Export Restrictions

Recent developments in the European steel market indicate a positive sentiment driven by changes in scrap and iron ore export regulations in Ukraine. The article Temporary restriction of scrap exports from Ukraine does not threaten Polish metallurgy-analysts has highlighted that Polish metallurgical companies maintain robust supply chains, lessening dependency on Ukrainian scrap. Additionally, the article Ukraine reduced rolled steel production by 15.4% y/y in January corresponded to a notable decline in Ukrainian production, affecting the broader European steel supply dynamics, particularly in light of ongoing demand growth.

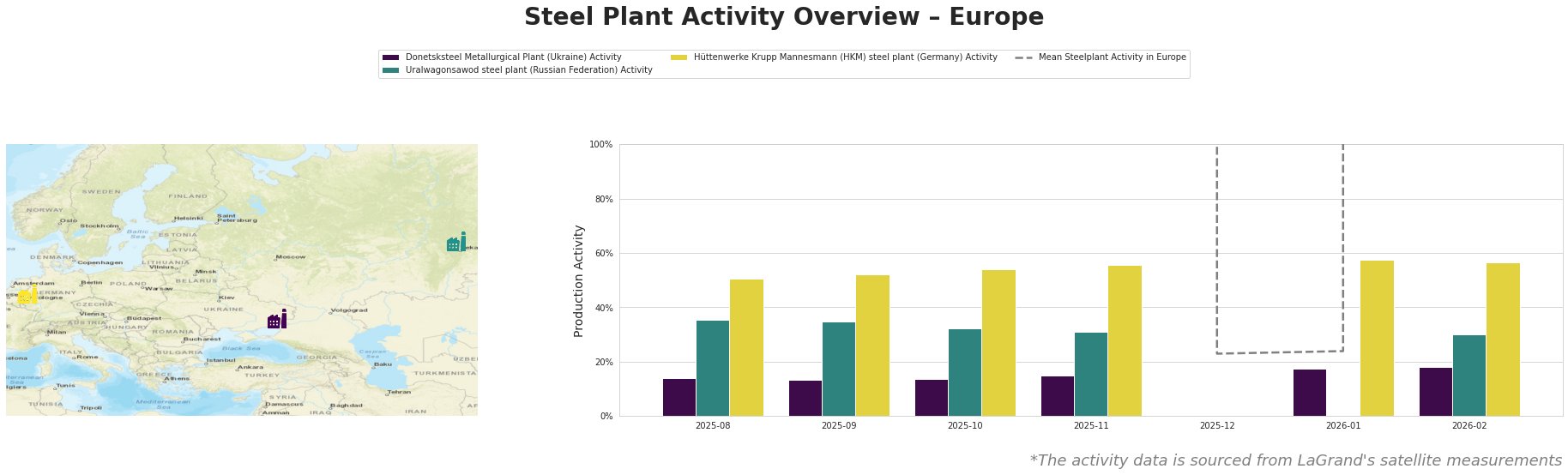

The Donetsksteel Metallurgical Plant observed a 14.3% rise in activity from December 2025 (15%) to January 2026 (17%). Although there is no direct link to the news articles, its gradual activity increase signifies resilience in alignment with Poland’s self-sufficiency amid Ukraine’s export restrictions.

Conversely, the Uralwagonsawod steel plant shows a decline in activity, registering a static performance through most of the measured period, which correlates with the overall decrease in demand for Ukrainian exports, particularly following Ukraine reduced iron ore exports by 34.4% y/y in January.

For the Hüttenwerke Krupp Mannesmann (HKM) plant, activity increased from 56% in November 2025 to a peak of 58% in January 2026, subsequently stabilizing at 57%. This aligns with the heightened demand in Europe anticipated due to new steel import regulations amid shifting sources of materials, particularly as described in Ukraine reduced pig iron exports by 27% y/y in January.

In terms of market implications, the reduced availability of Ukrainian scrap could encourage buyers to fortify contracts with reliable suppliers in Germany and the Czech Republic. Procurement teams in Poland should focus on contractual partnerships, ensuring access to domestic scrap sources to mitigate potential disruptions—supported by the insights from Temporary restriction of scrap exports from Ukraine does not threaten Polish metallurgy-analysts.

Furthermore, the anticipated decrease in Ukraine’s iron ore and pig iron exports reinforces the need for buyers to explore alternative sourcing strategies, particularly from regions prioritizing their domestic markets. Accessing local suppliers could become increasingly important in light of ongoing geopolitical challenges affecting Ukrainian exports.