From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Europe’s Steel Market: Insights from Ukraine’s Industry Dynamics

In Europe, particularly Ukraine, the steel market is experiencing a positive sentiment amidst fluctuating production levels. Notably, the article “Domestic prices for construction steel rose by 2.5–2.7% in January“ indicates that despite low demand, prices for construction steel products increased significantly. This is contrasted by reported declines in production levels as noted in “Ukraine reduced rolled steel production by 15.4% y/y in January,” which reflects ongoing challenges in maintaining production amid tightening raw material supplies and export restrictions detailed in “Kalenkov explained why Ukraine imposed a temporary restriction on scrap exports.“ The imposition of these restrictions was driven by a 200,000-ton shortfall in scrap availability, directly impacting the steel output.

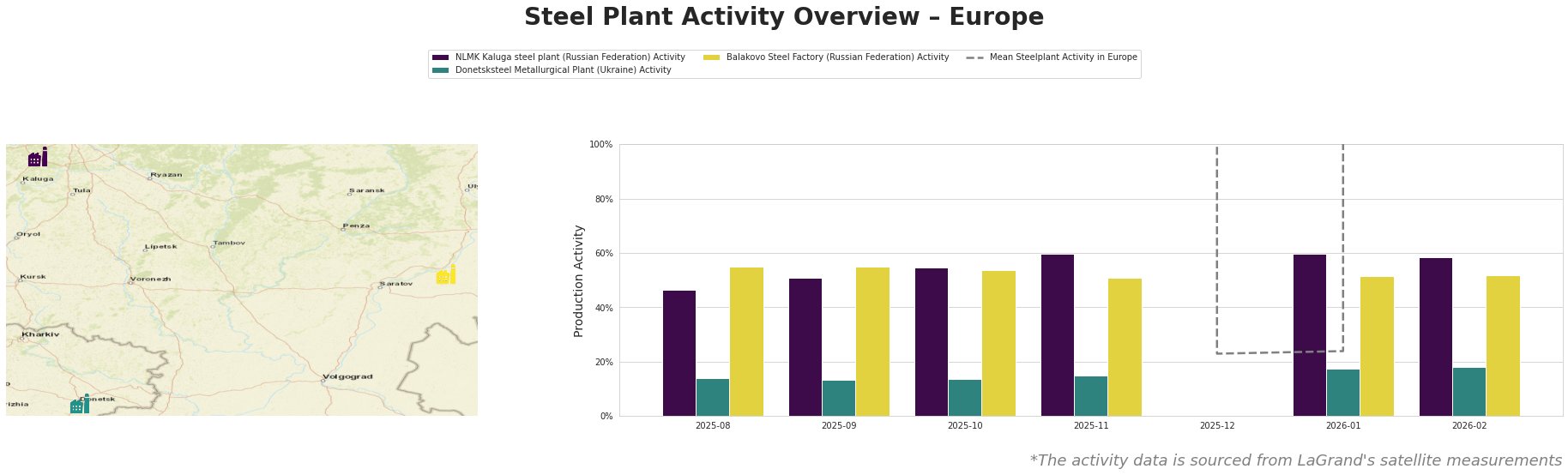

The data reveal significant shifts in activity levels across selected steel plants. The NLMK Kaluga plant consistently maintained activity levels around 58%-60%, demonstrating robust performance. In contrast, Donetsksteel’s activity dropped significantly from 15% in November to just 17% in January 2026, aligning with the production constraints cited in recent news articles. Meanwhile, the Balakovo Steel Factory showed stability, remaining around 52%, indicating less volatility than its Ukrainian counterpart.

The overall mean activity across plants dropped sharply to 24% in January, a likely consequence of the “Ukraine reduced rolled steel production by 15.4% y/y in January”, indicative of broader regional challenges. However, this revived in February, reflecting potential recovery phases.

NLMK Kaluga operates largely as an electric arc furnace (EAF) facility, focusing on semi-finished and finished products, consistent with stable market prices despite logistical challenges. Donetsksteel, reliant on integrated processes for pig iron, faced notable production declines aligning with the domestic scrap shortages highlighted in Kalenkov explained why Ukraine imposed a temporary restriction on scrap exports. Lastly, Balakovo’s EAF-based operations ensure a versatile approach to product categories, providing some resilience during market fluctuations.

The tightening of raw materials, especially highlighted in the news regarding scrap export restrictions, could lead to potential supply disruptions for players reliant on Ukrainian scrap. As such, procurement professionals should consider diversifying sources for scrap and raw materials, potentially tapping into alternative markets or local suppliers to mitigate risks associated with Ukrainian exports.

In conclusion, the steel industry’s evolving landscape in Europe presents both challenges and opportunities. Steel buyers are advised to monitor production trends closely, particularly in light of Ukraine’s export limitations, to ensure strategic sourcing and negotiate favorable contracts amid rising steel prices.