From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Downturn Amidst Supply Risks and Plant Activity Declines

Recent developments in the European steel market indicate a negative sentiment, primarily due to specific production challenges and operational inconsistencies. Noteworthy articles such as “Australia’s Pilbara Ports reopens Port Hedland“ and “Peabody Energy restarts Australian coking coal mine“ provide context to the fluctuating activity levels observed in European steel plants, which show heightened concerns regarding supply stability but lack a direct relationship with local production outcomes.

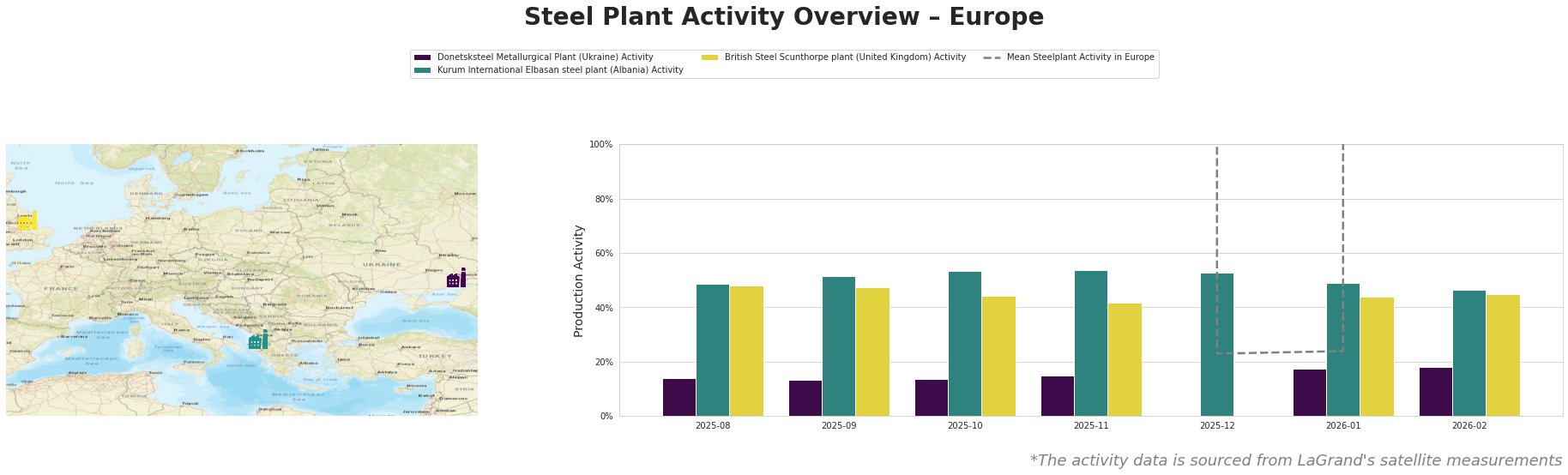

Measured Activity Overview

The average activity level across European steel plants saw fluctuations, peaking in September 2025 at 44%, before experiencing a sharp decline to a low of 23% in December 2025. Legacy production from the Donetsksteel Metallurgical Plant remained critically low, with a recent uptick in activity to 18% in February 2026, likely influenced by regional supply dynamics, though no direct correlation from the news articles could be established. Meanwhile, Kurum and British Steel plants displayed moderate activity but underperformed against their historical benchmarks.

Evaluated Market Implications

The reopening of crucial iron ore export hubs like Port Hedland reveals ongoing volatility in global supply chains, which can significantly impact European steel procurement. Buyers should prepare for potential disruptions linked to limited input availability, particularly affecting plants with poor activity levels like Donetsksteel and British Steel, which are already struggling at 18% and 45%, respectively.

Given the revival of operations in mining sectors such as coking coal in Australia (as noted in “Peabody Energy restarts Australian coking coal mine”), procurement strategies should be aligned to secure supplies proactively, especially from regions less susceptible to extreme weather disturbances, ensuring adequate feedstock availability amidst fluctuating global production patterns.

Steel buyers are advised to closely monitor the ongoing developments in port operations and plant output, adapting procurement strategies to account for supply insecurities and higher pricing pressures due to limited output. Engaging directly with suppliers about production expectations and maintaining flexibility in sourcing could mitigate risks.