From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Surge in France: ArcelorMittal Invests €1.3 Billion for Green Steel Production

Recent developments in France’s steel industry signal a revitalized market sentiment, marked by ArcelorMittal’s announcement of a €1.3 billion investment in electric arc furnace in Dunkirk. This strategic move aligns with the company’s efforts to decarbonize operations and has resulted in observable increases in activity levels at relevant steel plants, particularly those utilizing electric arc technology.

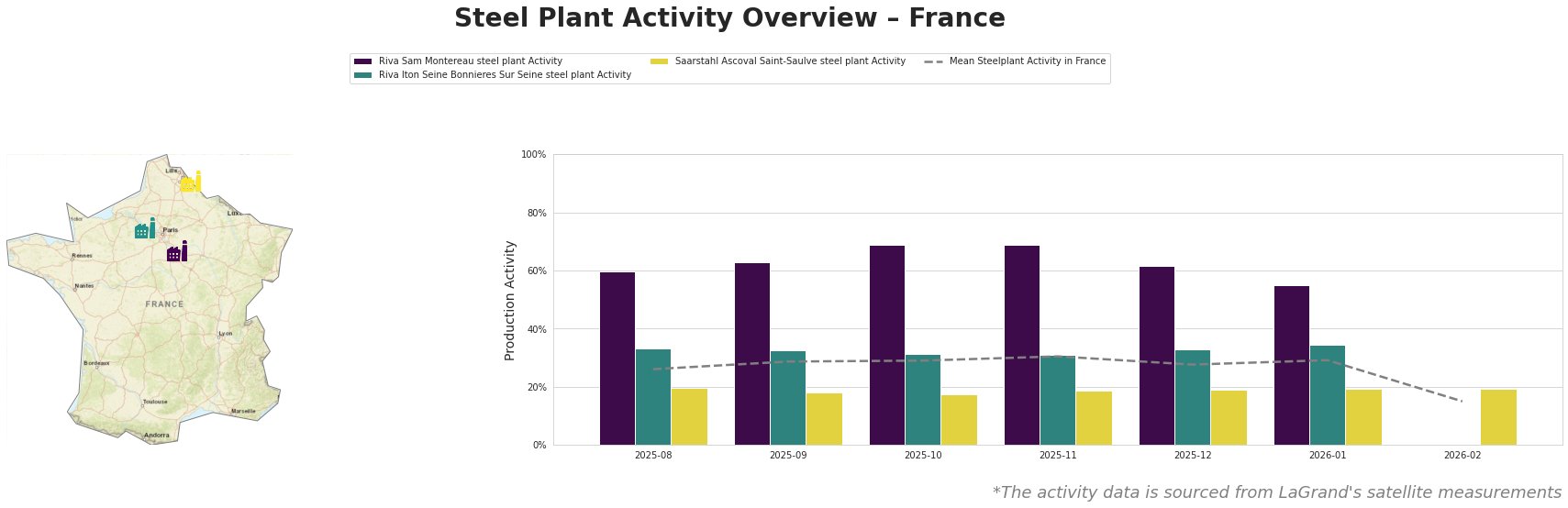

In monitoring satellite-observed activity, significant trends have emerged that correlate with the news. Activity data from February 2026 indicates been a sharp decline to 15% from earlier peaks, with only the Saarstahl Ascoval Saint-Saulve plant reporting minimal activity at 19%. While no direct correlation with the investment announcement can be established for this period, ongoing projects at the Dunkirk plant may reshape future activity levels.

The Riva Sam Montereau plant has shown relatively high activity levels, peaking at 69% in October and November 2025. This facility specializes in producing semi-finished and finished rolled products via EAF technology, positioning itself to benefit from the shifts towards greener operational methodologies advocated by ArcelorMittal’s new investments.

The Riva Iton Seine Bonnieres Sur Seine plant sustained activity at 34% in January but did not exhibit new peaks in February, indicating stability rather than growth. Its focus on rebar suggests an ongoing demand for construction-related steel products even amidst fluctuating activity levels.

Conversely, Saarstahl Ascoval struggled to maintain higher operational levels, notably declining to 19% in early 2026, which does not directly link to any recent news developments, but may reflect broader market trends towards EAF technology as the industry shifts.

The optimistic sentiment driven by ArcelorMittal’s significant investment and plans aligning with EU regulations suggest potential competitive advantages for plants adopting low-carbon technologies. However, supply disruptions could stem from the current operational challenges evident in recent activity metrics.

For steel buyers and market analysts, focusing procurement on facilities that embrace these transformations—like those associated with ArcelorMittal—becomes essential. Strengthening relationships with engaged producers can secure supplies amidst evolving market dynamics, particularly for EAF products. Buyers should also consider diversifying sources to avoid dependence on plants showing signs of instability, such as Saarstahl Ascoval.