From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustria’s Steel Market Faces Challenges Amidst Negative Activity Trends and Supply Concerns

A downturn is evident in Austria’s steel market, influenced by recent reports on operational disruptions. The referenced articles, “Australia’s Pilbara Ports reopens Port Hedland“ and “Peabody Energy restarts Australian coking coal mine,” indirectly highlight critical shifts in iron ore and coking coal supplies that may affect Austrian steel production, as these materials are vital for local steel plants.

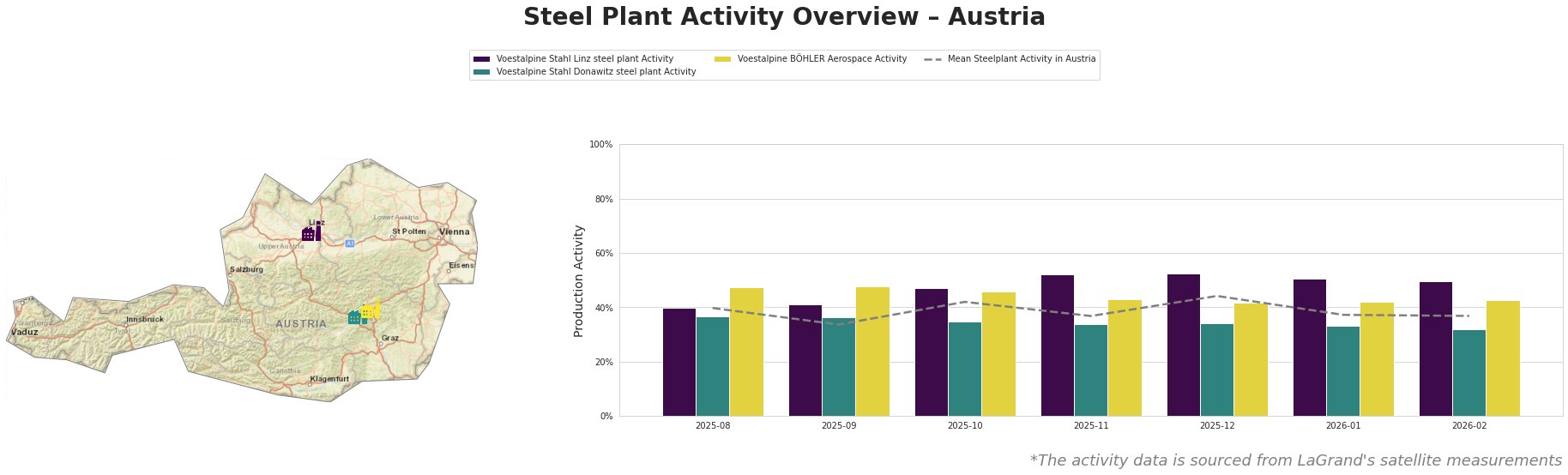

Measured Activity Overview

The recent data illustrates a general decline in plant activity, with the mean steelplant activity in Austria showing consistent drops from 44.0% in December 2025 to 37.0% in February 2026. Specifically, the Voestalpine Stahl Linz plant remained relatively stable yet showed a minor reduction, reaching 50.0% in February. However, Voestalpine Stahl Donawitz faced a more pronounced decline, decreasing to 32.0%, indicating operational challenges. These drops in activity levels could correlate to disturbances in iron ore supply chains as noted in the “Australia’s Pilbara Ports reopens Port Hedland” news, which covered closures that have significant implications for iron ore availability.

Voestalpine BÖHLER Aerospace shows a slight activity rebound, yet its contribution remains marginal relative to major facilities. The patterns observed here suggest a volatile supply situation, emphasizing the need for proactive procurement strategies in light of potential supply disruptions.

Evaluated Market Implications

The reopening of the Pilbara Ports and the resumption of coking coal production by Peabody Energy hint at a slow recovery in supply; however, the lag in activity at key Austrian plants indicates persistent issues. Voestalpine Stahl Donawitz’s substantial decline in output (to 32.0%) suggests vulnerability in sourcing raw materials, which makes it crucial for procurement professionals to monitor Australian export flows closely. Steel buyers should consider diversifying their supply chain to mitigate risks associated with the reliance on these sources.

It is recommended that procurement teams conduct immediate assessments of supply continuity strategies, including potential alternative sourcing for both iron ore and coking coal, as supply disruptions are highly likely in the near future given the operational volatility highlighted.