From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Update: Neutral Sentiment Following Export Restrictions and Plant Activity Trends

In Ukraine, recent developments in the steel industry have unfolded against a backdrop of significant regulatory changes. Articles such as “Temporary restriction of scrap exports from Ukraine does not threaten Polish metallurgy-analysts“ and “Ukraine reduced iron ore exports by 34.4% y/y in January“ illustrate ongoing issues surrounding raw material exports and production levels. No direct relationship between these news articles and satellite activity changes for steel plants could be established; however, they paint a vital picture of the current landscape.

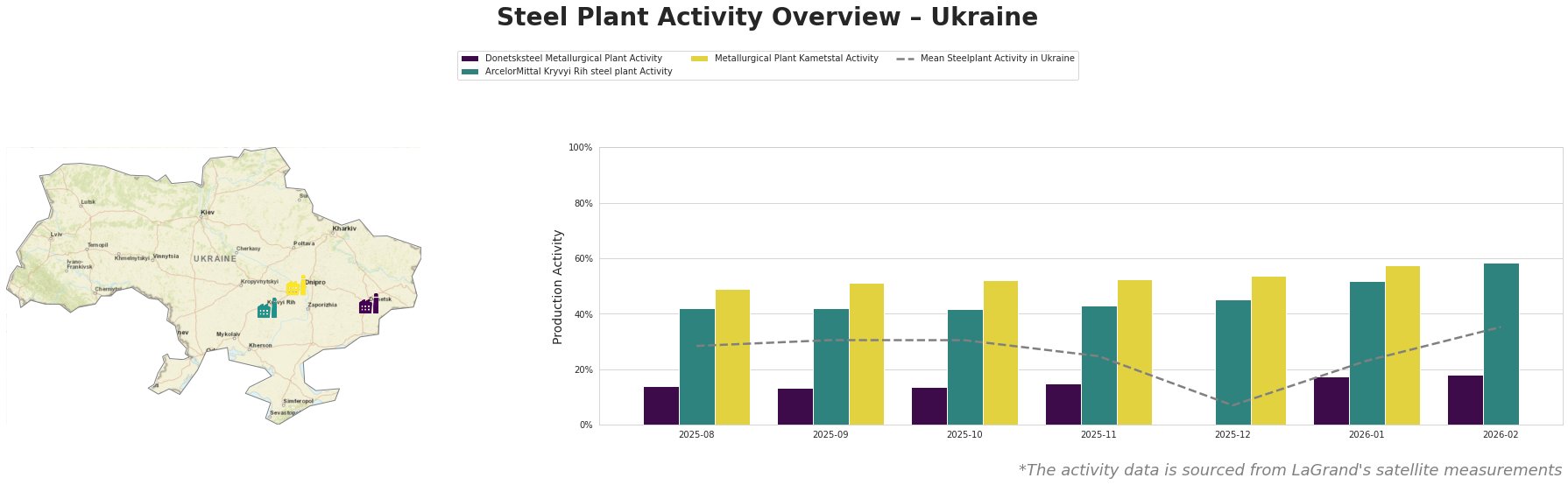

Notably, the Donetsksteel Metallurgical Plant experienced a sharp decline in activity in December 2025, dropping to 0% due to the plant being mothballed. ArcelorMittal Kryvyi Rih showed an increase from 45.0% to 59.0% by February 2026, signaling a recovery in operations, while Kametstal maintained a consistent high until January. The mean activity fluctuated, reaching its peak of 35.0% in February 2026.

Across plants, activity metrics suggest a rebalancing following the restrictive measures on scrap exports documented in “Abolition of «zero» quota on scrap exports will bring back old «schemes» – expert“. While these measures have aimed to bolster domestic supply chains, the overall effect appears to maintain a neutral market sentiment with implications for pricing and procurement strategies.

Importantly, supply chain interruptions are anticipated, especially if further export restrictions develop. Steel procurement analysts should prioritize sourcing domestically where possible, particularly from operating plants like ArcelorMittal Kryvyi Rih and Kametstal, given their higher activity levels. These plants’ engagement in local markets could mitigate risks associated with fluctuating import availability influenced by changing government policies affecting scrap and iron ore exports.

In conclusion, while the steel market in Ukraine demonstrates signs of stabilization, procurement strategies should evolve to adapt to these regulatory nuances and plant-specific production capabilities.