From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Report: January 2026 Overview Indicates Neutral Sentiment Amid Activity Fluctuations

Steel plant activity across Europe has shown a fluctuating trend during January 2026, driven by notable developments in raw material exports and regulatory changes in Ukraine. The uptick in Australia’s iron ore exports, as reported in “Australia increased exports of raw materials by 19.8% y/y in January,” hints at potential supply availability. However, the corresponding decline in Ukrainian iron ore exports, detailed in “Ukraine reduced iron ore exports by 34.4% y/y in January,” coupled with the implications of scrap metal export restrictions from Ukraine, suggests a complicated supply landscape without an immediate correlation to plant activity.

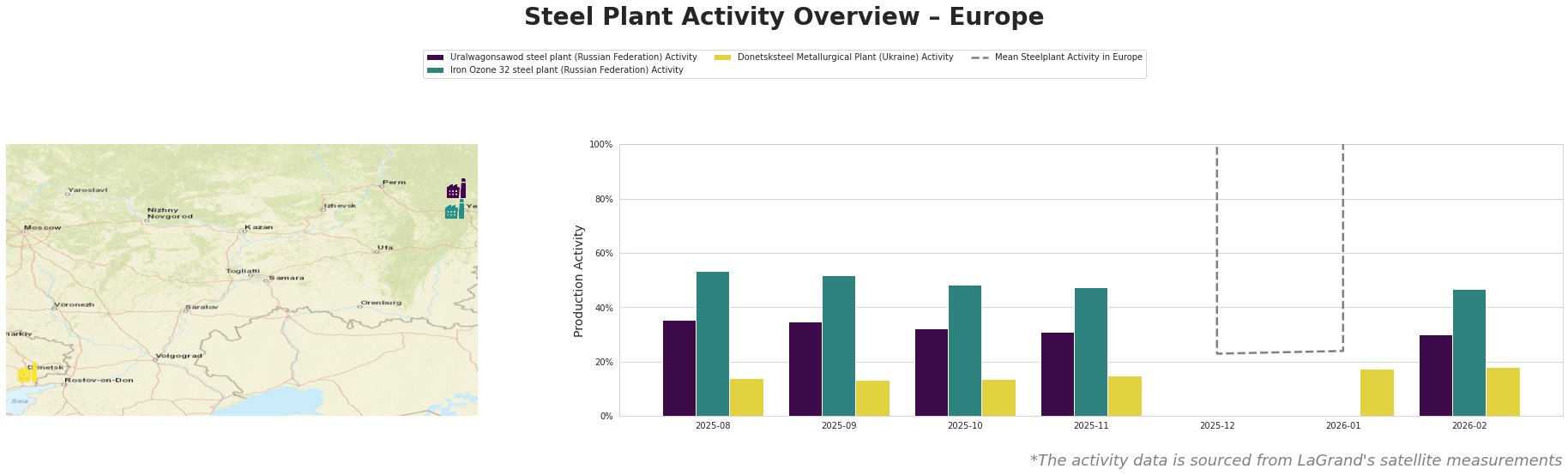

The activity at Uralwagonsawod and Iron Ozone 32 steel plants displays stability around the mean activity levels, with Uralwagonsawod remaining at approximately 30% and Iron Ozone at 47% as of February. Notably, Donetsksteel Metallurgical Plant registered a decline in January to a 17% activity level. This drop may correlate with the broader implications of Ukraine’s impending “Abolition of «zero» quota on scrap exports will bring back old «schemes» – expert,” wherein concerns about supply inconsistencies and regulatory challenges were raised. Except for the February increase to 18%, the plant faced sustained inactivity and production challenges as highlighted in “Kalenkov explained why Ukraine imposed a temporary restriction on scrap exports.“

The Uralwagonsawod operates without publicly available key production capacities or technologies, leaving uncertainties regarding its output’s responsiveness to changes in scrap availability. In comparison, Iron Ozone 32 remains more agile, leveraging electric arc production to adapt to shifting raw material flows.

With the expected “Temporary restriction of scrap exports from Ukraine does not threaten Polish metallurgy-analysts,” Polish steelmakers may source alternative inputs amid export limitations, yet their reliance on local scrap and production capabilities remains high. The strategic direction for procurement professionals is to monitor developments closely, particularly concerning Poland’s scrap market balance, as local supply remains robust.

Market Implications and Procurement Recommendations:

1. Anticipate potential supply disruptions, particularly from Ukrainian sources due to regulatory changes affecting scrap exports. Steel buyers should evaluate long-term purchasing strategies focusing on secure local sources or alternative imports.

2. Engage with Polish supply chains, leveraging their self-sufficient scrap capabilities, particularly amid fluctuations in Ukrainian imports. Establishing connections with local distributors can fortify procurement reliability and potentially lower costs amidst shifting market dynamics.

3. Maintain vigilance regarding shifts in activity levels among European steel producers, adjusting procurement strategies as steel plant performance fluctuates in response to global raw material supply trends.