From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in the European Steel Market: Increased Activity and Price Adjustments

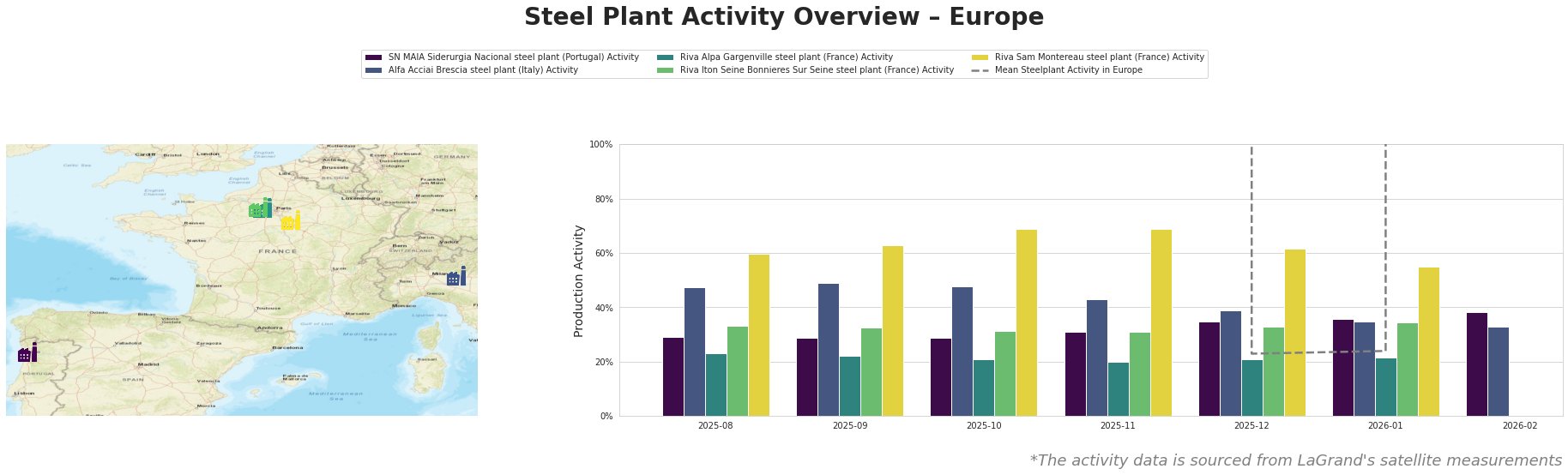

The European steel market exhibits a positive sentiment driven by recent increases in rebar prices and observed plant activity levels. Key insights from the articles “Growing costs push European domestic rebar prices higher“ and “Italian rebar makers seek increases“ highlight the ongoing adjustments in prices and consumption patterns amid rising production costs. These trends correlate with satellite observations indicating variances in steel plant activity across the region.

The SN MAIA Siderurgia Nacional plant has shown a notable increase in activity from 36% to 38% by February 2026. This uptick may correlate with the urgency from producers highlighted in the article “Italian rebar makers seek increases”, where rising production costs are pushing manufacturers to enhance output despite weak demand. Similarly, “Growing costs push European domestic rebar prices higher” notes generally rising prices, which implies that higher operational capacity may be necessary to meet domestic needs effectively.

Conversely, Alfa Acciai Brescia reflects a drop in activity from 35% to 33%. The challenging pricing environment and the surging costs, as discussed in the aforementioned articles, likely contribute to this decline, putting pressure on operational effectiveness.

Riva Alpa Gargenville, as well as Riva Iton Seine and Riva Sam Montereau, saw fluctuations but with missing data points for February 2026. The previously recorded activity was significantly higher in January, particularly at Riva Sam Montereau with 55%. The maintenance issues and price adjustments reported may explain this variation, showcasing the impact of operational challenges on observed activity levels as addressed in various articles.

Recommendations for Steel Procurement:

1. Focus on Reliable Sources: Engage with suppliers like SN MAIA and Riva Sam Montereau that have demonstrated improved performance amidst rising prices, considering their improved activity levels and adaptability to market pressures as per “Italian rebar makers seek increases”.

2. Be Wary of Variability: As shown in the activity levels, purchasing strategies should incorporate flexibility to account for potential operational disruptions, particularly in light of reported price volatility detailed in “Growing costs push European domestic rebar prices higher”.

3. Monitor Price Trends: Watch for ongoing fluctuations in rebar prices due to rising scrap costs, as noted across various plants. Timing procurement could be advantageous amidst fluctuating market conditions.

These actionable strategies derive directly from the identified trends in plant operations and current pricing dynamics reflecting a recovering yet cautious steel market environment in Europe.