From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Outlook: Positive Price Trends Amid Regulatory Changes

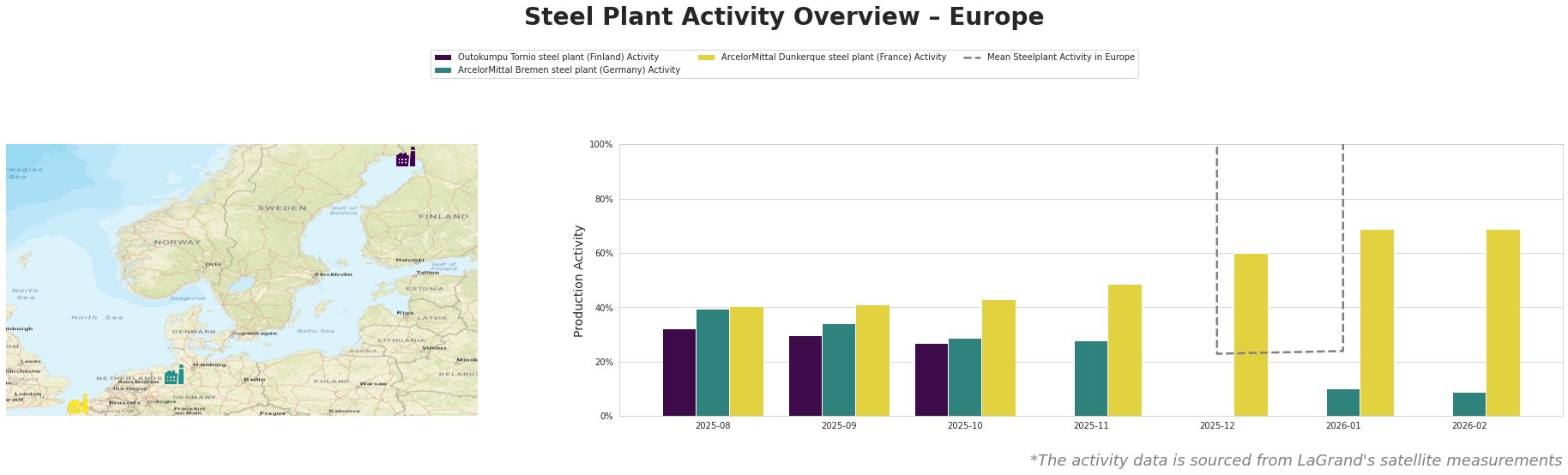

In Europe, the steel market is experiencing a very positive sentiment as domestic prices rise, particularly for hot-rolled coil (HRC) and heavy plates, indicated by the news article “European domestic HRC prices rise as pressure from import reduces.” In correlation, satellite data reveals notable fluctuations in operating activity at key steel plants, enhancing the understanding of market dynamics.

The article “Northern European steel heavy plate prices rise; Italy market stable amid bullish offers“ highlights that heavy plate prices have seen a substantial increase due to heightened demand against a backdrop of weak trading, linking to observed increases at select plants. The market transition is also influenced by the evolving EU Carbon Border Adjustment Mechanism (CBAM), which has caused significant adjustments in both pricing and supply chain behaviors.

From the satellite data, the means of activity at observed plants indicate a general decline from August 2025, reaching a low of 23% by November 2025 but rebounding slightly in early February 2026 to 29%. Notably, the ArcelorMittal Dunkerque steel plant has shown considerable strength, peaking at 69% in January 2026, likely correlating with price raising tendencies discussed in the HRC price increases.

Outokumpu Tornio Steel Plant

The Outokumpu Tornio steel plant in Finland has traditionally held a significant market position, with activity levels declining to N/A in recent months, representative of strategic operational adjustments probably influenced by the regulatory climate and changing demand patterns highlighted in the news. This dynamic reflects broader trends within the region.

ArcelorMittal Bremen Steel Plant

The ArcelorMittal Bremen facility has seen a drop to 10% in January 2026, contrary to the regional increase in demand for domestic HRC, as per the article “European domestic HRC prices rise as pressure from import reduces.” This decline could indicate logistical issues directly tied to the CBAM implementation challenges, where increasing certificates impact overall pricing strategies.

ArcelorMittal Dunkerque Steel Plant

Conversely, the Dunkerque steel plant reported its operational activity at 69% during the same period. This increase highlights its adaptability and capacity utilization amid changing market forces, particularly those noted in “Italian coil derivative prices increase,” as downstream consumption persists.

In light of these insights, potential supply disruptions could arise if current market regulations continue to impact the import and pricing dynamics in key regions. Steel buyers should consider prioritizing procurement from ArcelorMittal Dunkerque, leveraging its robust operational capacity aligned with positive price forecasts and stable demand, as indicated in the news. Moreover, progressing engagement with local suppliers will be crucial amidst rising external costs linked to the CBAM framework.