From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineVery Positive Outlook for Italy’s Steel Market Amid Rising Prices and Increased Activity

Italy’s steel market is witnessing a notable upturn, primarily driven by increasing prices for rolled products due to the Carbon Border Adjustment Mechanism (CBAM) outlined in “The cost of Italian heavy rolled products has increased amid rising prices for CBAM plates.” As observed through satellite data, activity levels in key steel plants remain stable, even as S235 sheet prices climb to approximately 750 euros per ton, against a backdrop of satisfactory order volumes.

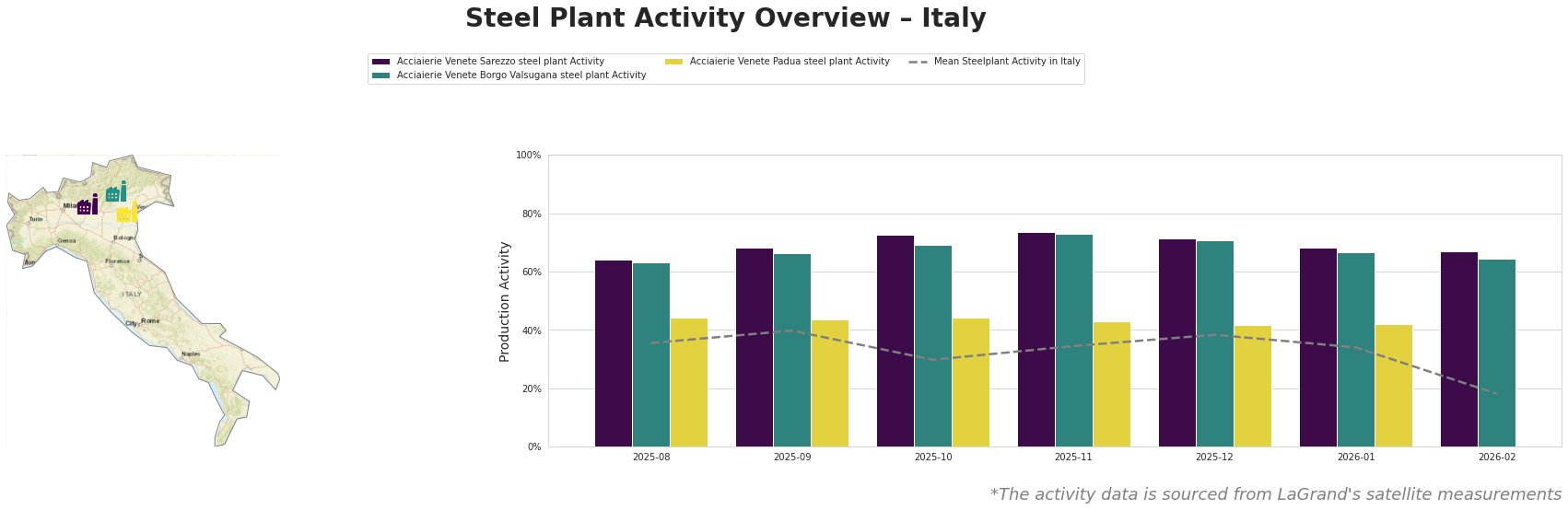

Recent reports highlight stable activity in Italy, elucidated in “Prices for rolled steel products in Europe remained unchanged amid new orders in Italy and subdued growth in the Nordic market.” Here, it was asserted that new orders are bolstering the demand outlook, even as other European markets display less resilience. While the observed data indicates a slight decrease in mean activity from 34% in January to 18% in February, specific plants like Acciaierie Venete Sarezzo have maintained high activity levels, indicative of robust operational health.

The Acciaierie Venete Sarezzo steel plant, located in Brescia, exhibits a high activity level at 68% in January, slightly tapering to 67% in February. This plant specializes in electric arc furnace (EAF) technology and is positioned in sectors such as automotive and building infrastructure. Notably, its activity level drop of 1% aligns with rising prices reported in the market, suggesting strong order fulfillment against a backdrop of heightened pricing dynamics.

At Acciaierie Venete Borgo Valsugana, with a January activity level of 67%, stability in operations is evident. The connection to increasing slab prices due to CBAM could indicate a cautious approach to new orders, limiting excessive price increases while still accommodating existing demand.

Conversely, Acciaierie Venete Padua remains stable, with no recent fluctuations documented. Its position echoes the market’s broader sentiment as articulated in “Northern European steel heavy plate prices rise; Italy market stable amid bullish offers.” While other regions face pricing pressures, Italy’s stability may afford steel buyers transient pricing advantages.

Evaluated Market Implications:

Supply disruptions are unlikely in the short term given the stability observed at major plants, though potential pressure exists from rising raw material prices influencing profit margins. Steel buyers are advised to consider locking in contracts at current prices while demand remains strong, especially since manufacturers anticipate future increases amid CBAM uncertainties. Engaging in timely procurement could mitigate risks associated with potential future price escalations, especially as the future landscape shapes up under the influence of protectionist measures.