From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Market Driven by Rising Prices and Stable Plant Activity

Recent developments in Europe’s steel market indicate a positive trend, highlighted by increased prices across several regions. Articles such as “The cost of Italian heavy rolled products has increased amid rising prices for CBAM plates“ and “Polish long steel prices keep climbing amid higher costs, less pressure from import“ illustrate significant price increases due to higher import costs and reduced import pressures from the anticipated Carbon Border Adjustment Mechanism (CBAM). These factors have positively impacted plant activities, demonstrating a relatively stable market post-Christmas, as highlighted by orders extending into March.

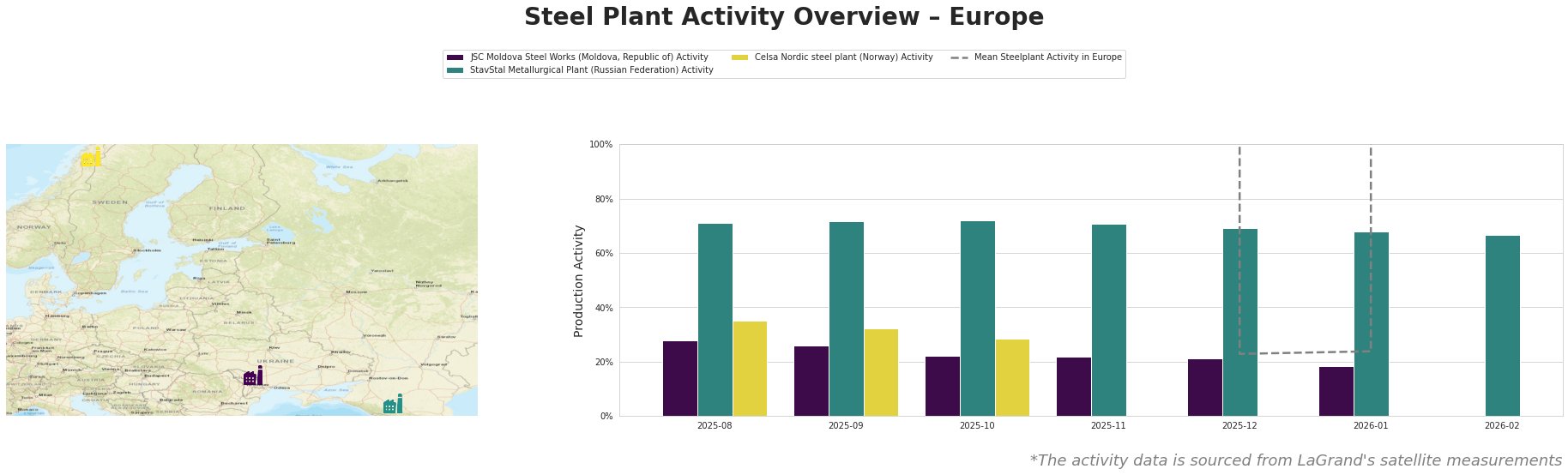

Activity at JSC Moldova Steel Works declined markedly from 28.0% in August 2025 to just 18.0% by January 2026, reflecting a 10% decrease which is not directly linked to the recent news but suggest market pressures. In contrast, StavStal Metallurgical Plant has maintained a stable activity level around 71.0%, with only slight fluctuations. This resilience may reflect a steady domestic demand supported by localized price increases as noted in “Polish long steel prices keep climbing amid higher costs, less pressure from import.” Celsa Nordic Steel Plant has shown a decrease from 35.0% to 29.0%, indicating potential pressures from increased costs, although no direct connection with specific news articles can be established.

JSC Moldova Steel Works operates with a capacity of 1 million tonnes for crude steel, focusing on semi-finished and finished rolled products such as wire rods and rebar. The observed decline in activity, from 22.0% to 18.0%, does not directly correlate with any specific news developments.

StavStal Metallurgical Plant has sustained robust activity levels (71.0%) due to its focus on semi-finished and finished rolled products, which include rebar and wire rod. The plant’s consistent output despite fluctuating prices in the region highlights a strong position bolstered by local demand.

Celsa Nordic Steel Plant, capable of producing 700 tonnes of crude steel primarily through electric arc furnaces, has observed reducing activity levels, from 35.0% down to 29.0%, although without direct news linkage to this drop.

The overall scrutiny suggests supply disruptions mainly from JSC Moldova could influence procurement strategies, while stable activity at StavStal enables consistent supply. Steel buyers should focus on StavStal and potentially engage more with Celsa Nordic, while also keeping an eye on developments related to domestic prices, particularly from Italian producers, to avoid future price shocks as prices could soar beyond €800 per ton if demand continues to outpace stability.

Strategic procurement actions include securing longer-term contracts with StavStal and Celsa Nordic to mitigate against volatile market shifts and engaging with Italian producers proactively to assess supply capabilities, ensuring adaptability to changing conditions influenced by the CBAM.