From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in Asia: Activity Rebounds Amid Economic Plans

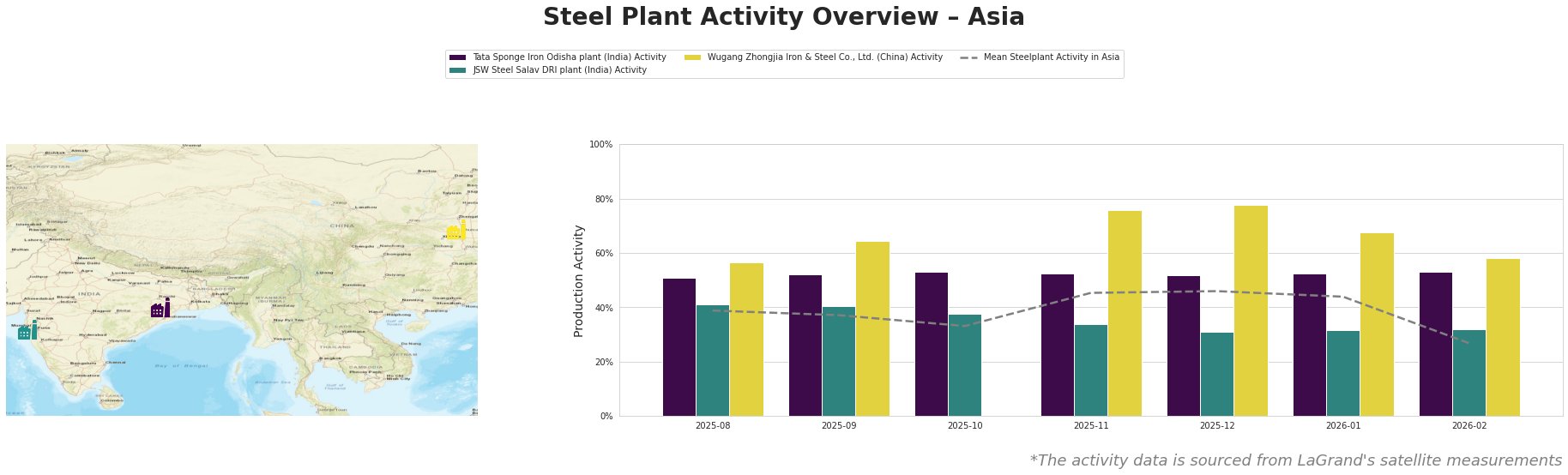

Recent monitoring of steel plant activities in Asia reveals positive momentum driven by governmental strategies and budgetary initiatives. The article titled Budget 2026: Big Push For Growth, Jobs And A New Tax Era To Power Viksit Bharat outlines key plans for economic development, which may correlate with improved plant activity. Although broader stock movements remain subdued, we observe significant changes in output levels as seen in satellite imagery.

The Tata Sponge Iron plant in Odisha has maintained consistently high activity levels, peaking at 53% in February 2026, which aligns with the emphasis on supporting MSMEs and job creation noted in Budget 2026. However, activity levels at the JSW Steel Salav DRI plant have shown a decline to 32% in January 2026 from a peak at 34% in November 2025, reflecting potential temporary operational challenges or other influences as broader market dynamics play out.

Conversely, Wugang Zhongjia Iron & Steel in China experienced its peak activity at 78% in December 2025 but saw a slight reduction to 58% by February 2026. This fluctuation could be attributed to ongoing global market uncertainties, as mentioned in the Budget 2026 summaries.

The Budget presentation impact suggests a significant commitment to infrastructure and economic stability, potentially influencing these operational dynamics positively. Nevertheless, with anticipated fluctuations in demand, particularly in fertilizer markets referenced in India outlines 2026-27 urea subsidy, there’s a cautionary note for downstream steel users regarding procurement strategies.

To mitigate potential supply disruptions linked to these fluctuating activity levels, steel buyers should consider increasing short-term procurement from high-performing plants such as Tata Sponge Iron Odisha. Locking in contracts while the plant operates at favorable activity levels is advised, especially before anticipated changes in market sentiment as outlined in these recent governmental strategies. Further, it may be prudent to monitor underlying economic indicators and adjust buying patterns accordingly as the market evolves in response to these substantial fiscal policy changes.