From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Report: Activity Drops Amid Price Pressure and Supply Concerns

Recent developments in Oceania’s steel market reveal a nuanced landscape primarily influenced by external pricing pressures and fluctuating production activity. Notably, the article European HRC prices for HRC have increased; CBAM adds a “gambling” element to imports sheds light on ongoing price stability in Europe, which indirectly impacts local market expectations. While no direct correlation between observed plant activities and this article exists, the external pressures highlight international trends that could reverberate in Oceania.

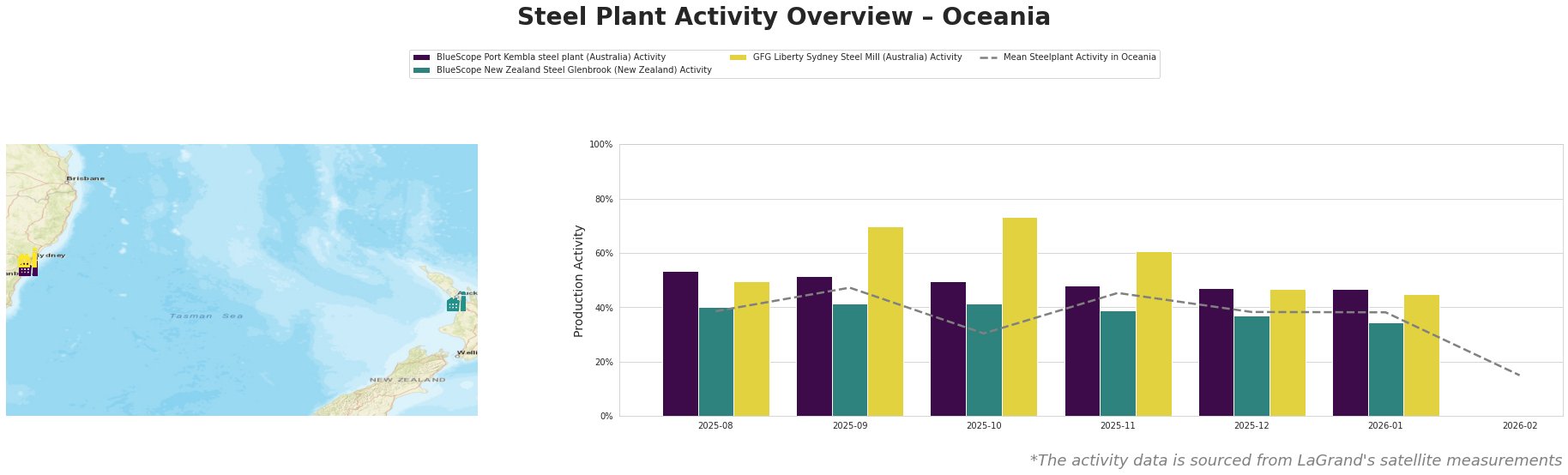

Measured Activity Overview

The satellite data indicates a significant drop to 15% in overall activity for January 2026, markedly lower than the previous month, where activity ranged from 38% to 47% across three facilities. This drastic decline highlights operational adjustments possibly in response to external pressures such as fluctuating steel prices.

BlueScope Port Kembla Steel Plant

Activity at the BlueScope Port Kembla steel plant in New South Wales remained relatively stable at 47% in January 2026, consistent with historical averages. Its operations are primarily integrated with a capacity of 3,200 tonnes of crude steel, focusing on semi-finished and finished rolled products vital for the building and infrastructure sectors. The observed steadiness contrasts with the overall market slowdown but does not directly align with the recent price fluctuations reported in European steel prices attributed to the CBAM.

BlueScope New Zealand Steel Glenbrook

BlueScope New Zealand Steel Glenbrook, situated in South Auckland, experienced a notable drop in activity, reported at 34% in January 2026, down from 39% in the previous month. This plant focuses on DRI technology, which may face challenges when influenced by international market shifts as highlighted in European HRC prices in slow, steady rise amid fears over higher-cost imports. The connection here suggests that as markets tighten globally, local plants may struggle with efficient operation levels due to demand fluctuations.

GFG Liberty Sydney Steel Mill

The GFG Liberty Sydney Steel Mill exhibited a decrease in activity to 45% by January 2026, down from 61% in November 2025. This electric arc furnace facility, with a production capacity of 750 tonnes, services critical end-user sectors such as building and infrastructure. The mill’s reduced activity aligns with the broader industry sentiment that reflects sluggish demand basic materials suggested by European market dynamics from articles like European rebar buyers push back on mills’ attempts to raise prices.

Evaluated Market Implications

The recent decline in activity, particularly evident across multiple plants in Oceania, signals potential supply disruptions as demand constricts under rising price pressures from international markets. Steel buyers should consider:

- Procurement actions: Given the upward pricing trends highlighted in European HRC prices firm as CBAM tightens supply, immediate procurement may be advisable to hedge against expected price increases.

- Monitoring local outputs: With the local activity more volatile than the European market trends, closely tracking operational statuses will be crucial for timely decision-making.

In summary, understanding these dynamics can provide steel buyers with informed strategies about procurement and positioning in the evolving Oceania steel market.