From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: Positive Momentum Amid Changing Dynamics

In Asia, recent shifts in steel plant activities reflect a positive market sentiment, influenced by the production changes outlined in key news stories. The article titled “Japan’s steel exports down 4.2 percent in 2025” highlights a nuanced landscape for Japanese steel, while “The US reduced its imports of rolled steel products by 18.7% m/m in November“ signals potential opportunities for Asian suppliers due to reduced competition from US imports. Both articles connect to observed changes in plant activities, particularly in Japan and the broader Asian market.

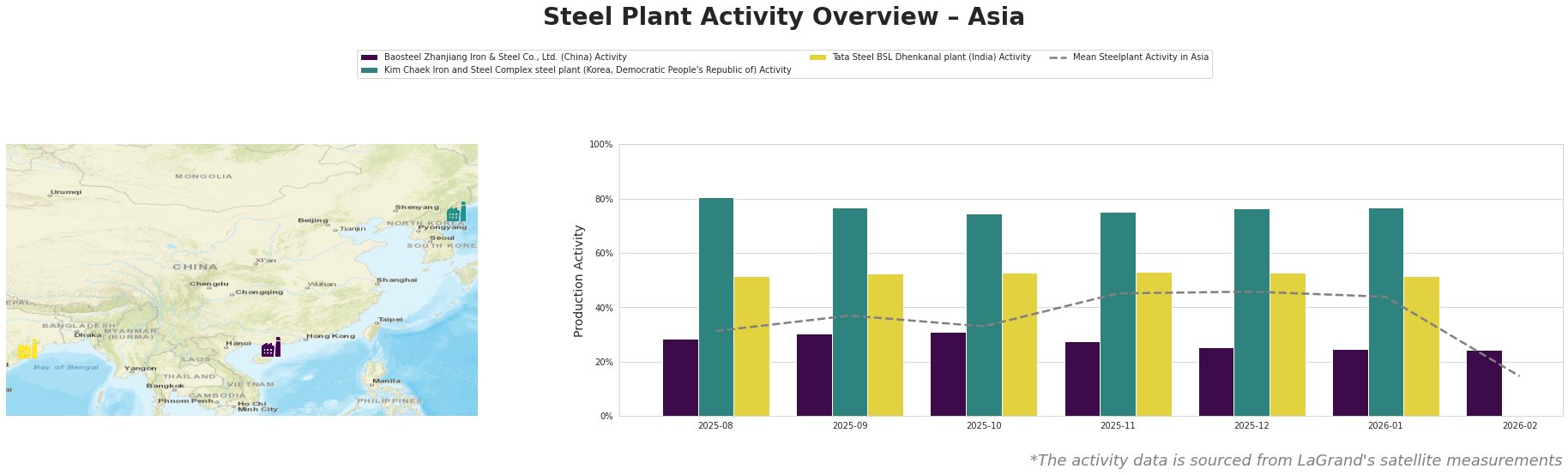

Activity at Baosteel Zhanjiang Iron & Steel Co., Ltd. has seen a downward trend, recording a notable decrease from 31.0% in August 2025 to 24.0% in February 2026. Despite the reduction, the plant remains crucial for China’s finished rolled steel market. However, the broader competitive landscape may improve given the decline in US imports, as reported in “The US reduced its imports of rolled steel products by 18.7% m/m in November.”

The Kim Chaek Iron and Steel Complex‘s activity has remained relatively high, although it declined to 77.0% in January 2026 from 81.0% in August 2025. Its diverse product offerings may aid adaptability in responding to varying demands in regional markets, aligning with Japan’s export changes noted in “Japan’s steel exports down 4.2 percent in 2025.”

Similar stability is observed at the Tata Steel BSL Dhenkanal plant, maintaining a steady activity level around 52.0% to 53.0% over the past months. This indicates resilience amidst international competition and shifts in export rates.

The observed patterns suggest potential supply disruptions, particularly at Baosteel, which may be underperforming relative to shifting market dynamics, including decreased US rolled steel imports. Steel buyers should focus on procurement from Kim Chaek and Tata, given their stable performance and product diversity.

Given these developments, it is advisable for analysts and buyers to reassess supply chains, potentially increasing reliance on Asian producers, especially those maintaining more robust activity levels amidst fluctuating global demand.