From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Update: Navigating Stability Amid Tight Supply and Price Pressure

Recent data indicate a Neutral sentiment in the European steel market, amid steady prices for flat steel while downstream long products experience slight increases. This assessment is underpinned by the news articles titled “Downstream flat steel prices in Europe steady while CBAM, AD probe limit import options,” “European longs prices tick up, market resistance remains,” and “European domestic HRC prices rise as pressure from import reduces,” each highlighting shifts in trading dynamics and supply constraints linked to recent market changes.

As highlighted in “Downstream flat steel prices in Europe steady,” the stability in CRC and HDG prices reflects limited import availability, exacerbated by the EU’s Carbon Border Adjustment Mechanism (CBAM) and ongoing anti-dumping investigations. This environment has seen stakeholders in Northern Europe quote prices of €820 for HDG and €790-810 for CRC, bolstered by constrained domestic supply amid reported transaction prices for imports around €720-730 per tonne DDP.

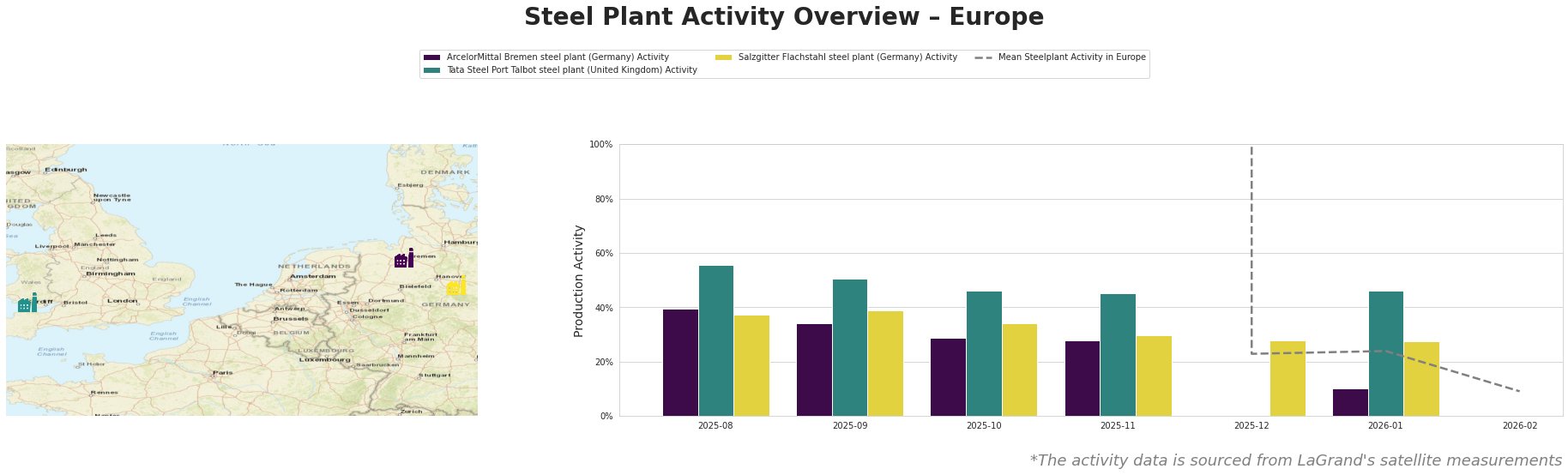

Measured Activity Overview

Activity levels showed a substantial drop at the ArcelorMittal Bremen plant, plummeting to 10% in December 2025 from 40% in August 2025. This aligns with the cautious market response described in “European longs prices tick up,” where demand remained sluggish and impacted production schedules. In contrast, Tata Steel Port Talbot exhibited stable activity around 46% during this time, reflecting relatively stronger demand. The Salzgitter Flachstahl plant also observed their activity decline to 28% in December 2025, correlating with overall market contraction noted in the price rigidity reported.

ArcelorMittal Bremen’s significant decline does not directly connect to a specific news article but aligns with broader trends that indicate challenges in sustaining production levels amid fluctuating demand and costs. Similarly, while activity was higher at Tata Steel Port Talbot, this does not correlate with any recent news but indicates a stronger regional demand, especially as described in “European domestic HRC prices rise.”

Evaluated Market Implications

Potential supply disruptions are apparent with the ArcelorMittal Bremen plant’s diminished activity and the ongoing pressures from both the CBAM and anti-dumping measures. Steel buyers should focus on securing contracts for CRC and HDG products at current rates before potential price hikes materialize, particularly considering the rising domestic prices and limited import options showcased. Responding proactively to current pricing structures and anticipating increases could optimize procurement strategies effectively.

Additionally, it would be prudent for buyers in Southern Europe to engage with reliable suppliers given the reported tight supply, especially while prices are stable. In markets showing stronger demand, like Tata Steel Port Talbot, ensuring ongoing supply relations may yield competitive pricing and guarantee availability amidst potential future volatility in the broader market landscape.