From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report Europe: Strong Growth Signals Amid Rising Demand and Prices

Europe’s steel market is experiencing a Very Positive sentiment as demonstrated by a 12% increase in construction works in Ukraine as reported in the article Construction works performed in Ukraine in 2025 increased by 12% y/y. This increase is linked to heightened activity levels in local steel plants, particularly in light of significant increases in construction steel prices by 2.5% to 2.7% in January 2026, as noted in Domestic prices for construction steel rose by 2.5–2.7% in January.

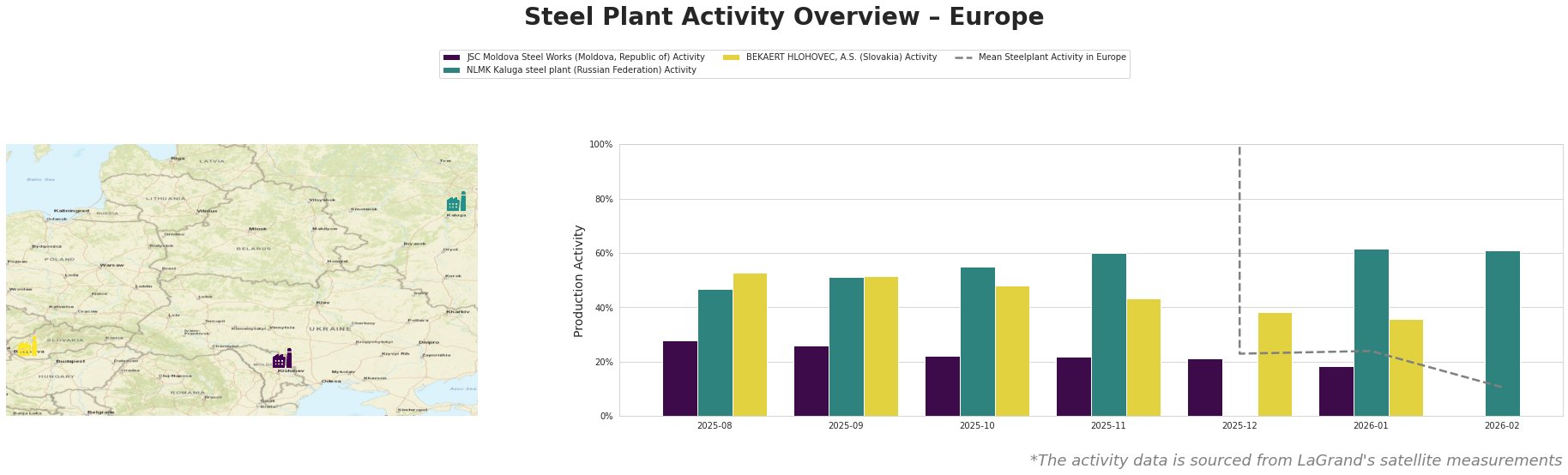

Measured Activity Overview

Activity levels across plants remain varied, with NLMK Kaluga performing strongly, reaching 62% in January 2026, while JSC Moldova Steel Works struggled, dropping to 18% in the same month. Notably, the overall mean activity across observed plants has significantly declined to 11% by February 2026, signaling potential supply chain disruptions.

Plant Insights

JSC Moldova Steel Works

JSC Moldova Steel Works, utilizing an Electric Arc Furnace (EAF) technology with a capacity of 1,000 tons of crude steel, recorded decreasing activity levels with a drop from 22% to 18% between October 2025 and January 2026. This decline corresponds with less demand in local markets despite the ongoing construction boom highlighted in Construction works performed in Ukraine in 2025 increased by 12% y/y.

NLMK Kaluga Steel Plant

In contrast, NLMK Kaluga experienced an upward trend, climbing to 62% activity in January 2026. This surge can be linked to increased demand for high-quality products such as rebar and channels, matching the price appreciation observed in Poland’s market, as detailed in the article Prices for Polish rolled products continue to rise amid higher costs and less import pressure. The plant’s EAF capacity of 1,500 tons positions it well to meet rising market requirements.

BEKAERT HLOHOVEC

Although BEKAERT HLOHOVEC’s activity stability remained uncertain, its operations have been adaptive to varying market conditions, particularly in the automotive and construction sectors. However, no direct correlations with the recent news articles could be established regarding production changes, reflecting a need for closer monitoring.

Evaluated Market Implications

Given the fluctuations in plant operations, steel procurement professionals should be cautious:

– The drop in activity at JSC Moldova Steel Works could signal potential supply interruptions in semi-finished to finished rolled products.

– NLMK Kaluga’s rising activity levels suggest a robust supply of construction-related steel, and buyers should consider increasing stock orders from this plant to mitigate future pricing pressures.

– Procurement strategies should reflect the upward trend in construction steel prices in Ukraine and Poland. Thus, proactive purchasing from NLMK Kaluga is advised to capitalize on increasing demand while managing the risk of rising costs stemming from material shortages.

In conclusion, actionable insights include strengthening supply agreements with reputable suppliers like NLMK Kaluga while preparing for potential disruptions linked to JSC Moldova steel production capabilities, as influenced by current market dynamics and construction stimulus trends.