From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market on the Rise: Positive Demand Signals Seen from China and Industry Activity

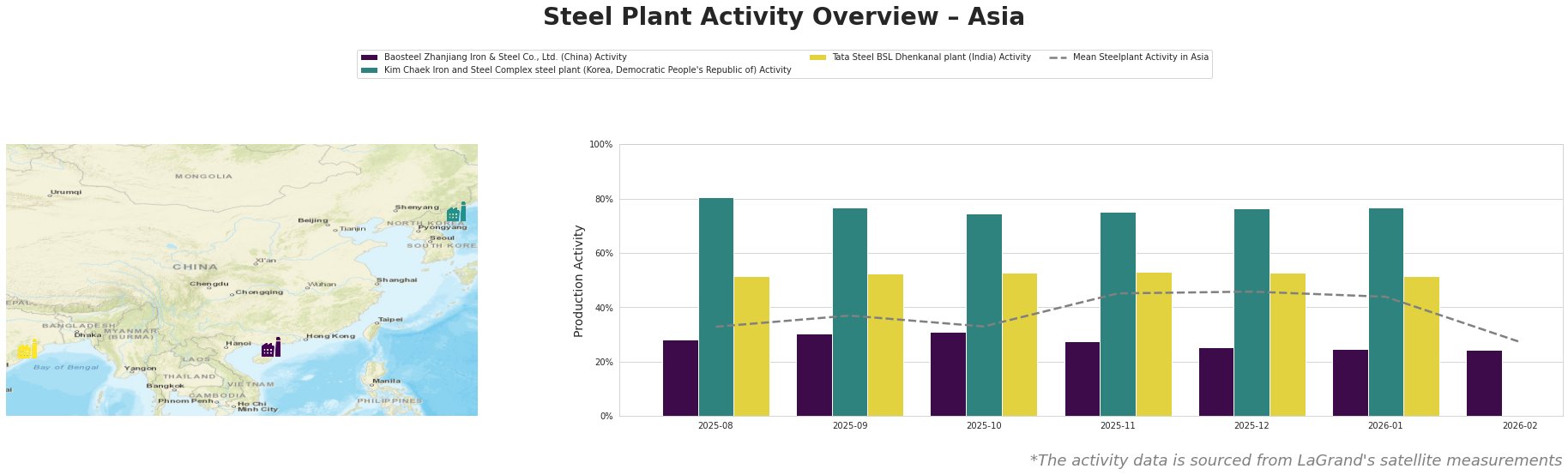

Recent developments in the Asian steel market spotlight significant developments, especially from China’s automotive sector, which is expected to bolster steel demand by 2026, as reported in “Automotive sector to drive steel demand in China in 2026.” This positive sentiment aligns with recent satellite data showing varied activity levels at selected steel plants, further elucidating market trends.

Measured Activity Overview

Notable trends from the data indicate Baosteel Zhanjiang exhibited a sharp decline in activity from 31% in October 2025 to 25% in December 2025, which does not correlate with any news developments. However, Kim Chaek’s activity remained relatively high, maintaining levels around 75–81%, suggesting resilience amidst broader market fluctuations. In contrast, Tata Steel BSL’s stability around 52-53% hints at sustained operational reliability, despite minor dips.

Baosteel Zhanjiang Iron & Steel Co., Ltd.

Baosteel Zhanjiang, a key player in Guangdong, showed a sharp decline in activity to 25% as of December 2025, down from 31% in October the same year. This reduction contrasts with the broader market trends signaling a potential increase in automotive steel demand as articulated in “Automotive sector to drive steel demand in China in 2026.” Yet, with no direct links established between this news and Baosteel’s performance, the causes remain unclear.

Kim Chaek Iron and Steel Complex

The Kim Chaek Iron and Steel Complex remains an outlier in its activity levels, consistently operating between 75-81%. This stability amidst market volatility may suggest efficient operations or strong product demand, although no recent news articles provide a direct relation to these activity levels.

Tata Steel BSL Dhenkanal Plant

Tata Steel BSL’s activity levels have held steady around 52-53%, well above the mean for the region. The plant’s consistent output aligns with the overall positive sentiment in the steel market, although specific linkage to any of the recent articles was not established.

Evaluated Market Implications

Given the strong expected demand from the automotive sector in China, particularly for electric vehicles, steel buyers should closely monitor both Baosteel Zhanjiang and Kim Chaek for potential supply opportunities. However, the recent drop in activity levels at Baosteel Zhanjiang could indicate a supply disruption risk, suggesting buyers secure contracts in advance to mitigate shortages.

In conclusion, procurement strategies should focus on strengthening relationships with suppliers like Tata Steel BSL and closely observe Kim Chaek‘s output stability while being prepared for potential fluctuations at Baosteel Zhanjiang based on upcoming market conditions driven by the automotive sector developments.