From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong and Positive Shifts in Asia’s Steel Market: Insights and Procurement Recommendations

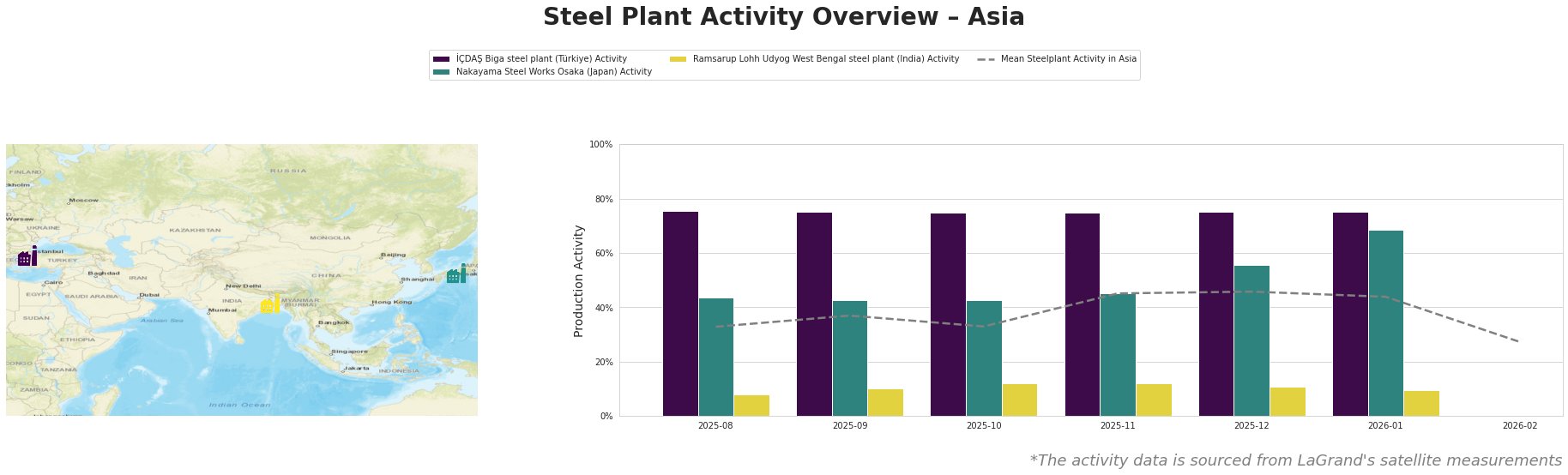

The steel market in Asia is experiencing significant optimism driven by recent developments in trade relations between India and the US. Noteworthy articles such as “India-US Trade Deal Will Pave Way For Stronger Ties, Mutual Growth: Amit Shah“ and “India-US Settled The Trade Deal At 18% — And That’s Fine | Profit Opinion“ underscore a major reduction in tariffs and enhanced trade dynamics, positively influencing market activity levels. Notable satellite-observed activity data reveals a peak in overall steel plant utilization before a recent decline, marked by variability across specific facilities.

The İÇDAŞ Biga steel plant in Türkiye experienced stable activity, consistently operating at 75% utilization across several months, indicating robust demand for its semi-finished and finished rolled products. This steady performance aligns with India’s commitment, as noted in “India-US Trade Deal Will Pave Way For Stronger Ties, Mutual Growth: Amit Shah,” to enhance steel purchasing under reduced tariffs, likely fostering a continuous demand for Turkish steel exports.

Conversely, the Nakayama Steel Works Osaka showed good performance, hitting a peak activity of 68% in January 2026 before a decline to 0% activity observed in February. While no explicit connections can be drawn to specific news articles, the overall trade environment improves outlooks for Japanese steelmakers considering tariff alleviations noted in the recent agreements.

Ramsarup Lohh Udyog’s activity remained low, peaking at only 12% in late 2025, currently lagging behind the mean activity level in Asia. This plant’s performance directly contrasts the positive sentiment surrounding trade agreements as there are no recent articles indicating improvements that could be leveraged for a recovery in production.

Across Asia, the steel market’s overall activity has dipped to a mean of 27% in February 2026, suggesting a short-term risk of supply disruptions. To mitigate this, procurement professionals should focus on securing contracts with the İÇDAŞ Biga steel plant given its consistent output and readiness to engage in increased exports to leverage the newly favorable trade dynamics. Additionally, monitoring potential recovery in Nakayama’s operations could provide advantageous sourcing opportunities in the near future.