From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook in Asia: Activity Levels Surge Amid Strategic Developments

Steel production activities in Asia have shown strong resilience recently, with notable rises in operational levels at major manufacturing plants. Notably, Sherwin-Williams (SHW) Q4 2025 Earnings Transcript points to cautious growth in Asia, while A O Smith AOS Q4 2025 Earnings Call Transcript indicates improved profitability and demand recovery, particularly in India. However, the influence of a slowdown in the US EV market as highlighted in Slowing US EV market hits S Korean LGES’ battery sales could exert pressure on South Korean manufacturers without directly affecting steel production metrics in the region.

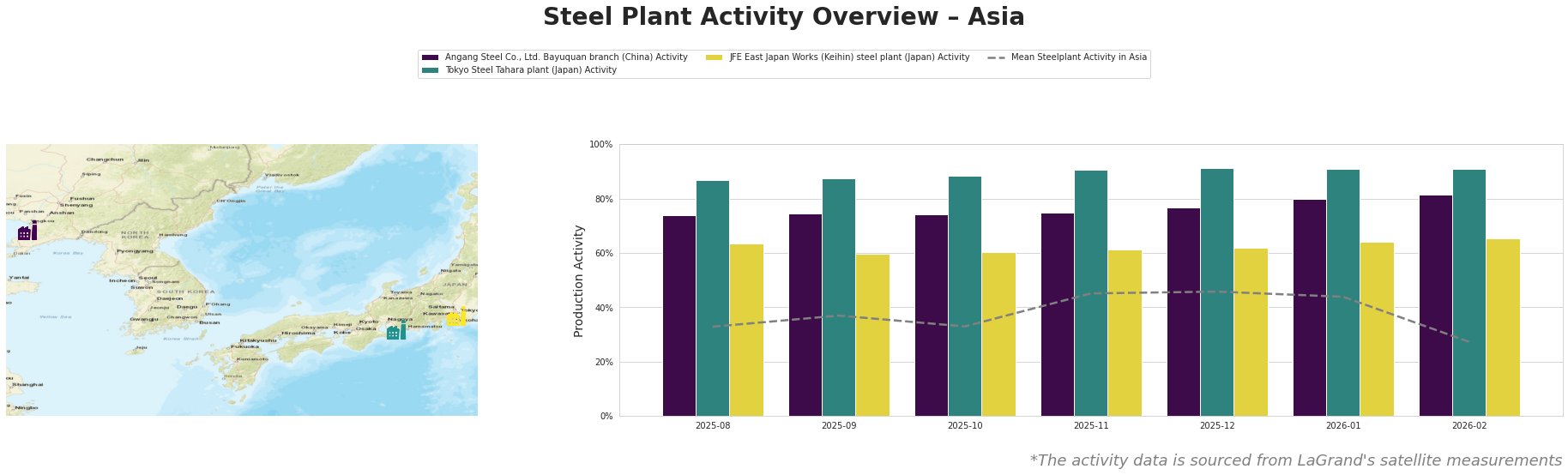

The majority of steel plants in Asia have experienced significant increases in activity levels, with the Tokyo Steel Tahara plant maintaining a robust output at 91% in the last two months measured. This aligns with the reported 8% growth in high-efficiency boiler sales within A O Smith’s global segment, despite some downturn in China. Conversely, Angang Steel Co. displayed a slight drop to 80% in January but reflects an overall positive trend tailored to increasing demand.

Angang Steel Co., Ltd. Bayuquan branch reached a peak activity level of 80% in January 2026 from 74% in August 2025, showing an upward trend responsive to market demand in the region. This upward trajectory mirrors Sherwin-Williams’ assertions of cautious growth opportunities in Asia.

In contrast, Tokyo Steel Tahara plant maintained a stable operation, fluctuating between 87% and 91% activity, indicating resilience amid operational challenges but with potential downside connected to external pressures from policies mentioned in Sherwin-Williams’ Q4 earnings.

Similarly, JFE East Japan Works (Keihin) showed stability around 60% to 64% activity. However, with its mixed production processes, it might be shielded from fluctuations in single sectors, although it is closely watching the developments in US policies impacting overall North Asian markets.

The outlook suggests that while current production levels are promising, potential supply disruptions from external economic factors, such as those affecting South Korea’s LG Energy Solutions, could arise.

Actionable Recommendations:

– Steel buyers should consider increasing procurement from Angang Steel and Tokyo Steel, which are currently performing strong, as highlighted by recent activity levels and growth projections.

– It is advisable to evaluate contracts and supply agreements from the JFE East Japan Works given their stable performance amid cautious market conditions.

– Stay informed on geopolitical challenges and potential shifts in demand linked to developments in the EV sector, as indicated by LGES‘s declining sales.

This market analysis highlights a generally positive trend within Asia’s steel production landscape, urging procurement professionals to seize current opportunities while preparing for potential shifts fueled by external economic factors.