From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook: Strengthening Activity in Asia Amid Currency Gains

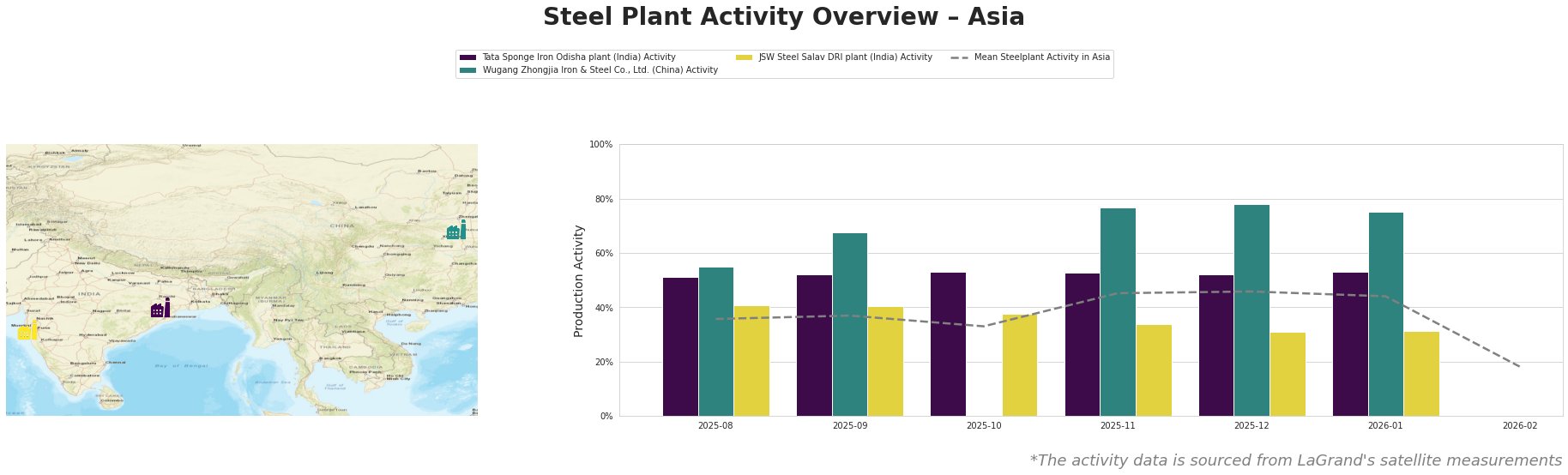

Recent developments in the Asian steel market reflect a positive outlook driven by a combination of monetary factors and improving plant activity levels. The articles titled “Asian Currencies Gain As Dollar Weakens Before Fed: Markets Wrap“ and “Stock market today: S&P 500 breaches 7,000 mark Wall Street braces for Fed decision, Big Tech earnings“ correlate with a notable increase in the activity levels at major steel plants in Asia. Specifically, the Tata Sponge Iron Odisha plant and Wugang Zhongjia Iron & Steel Co. showed resilience, with their activity levels stabilizing despite broader industrial volatility.

The Tata Sponge Iron Odisha plant maintains relatively high activity, peaking at 53% in January 2026, reflecting steady operations likely supported by positive currency trends, as indicated in “Asian Currencies Gain As Dollar Weakens Before Fed: Markets Wrap.” Meanwhile, the Wugang Zhongjia Iron & Steel Co. saw its activity peak at 78% in December 2025 but did not recover in January—no direct connections to a particular event were found. Conversely, the JSW Steel Salav DRI plant shows a declining trend, dropping to 31% activity despite the regional positive sentiment, with no apparent links to recent news.

Evaluated Market Implications

Potential supply disruptions could arise from the JSW Steel Salav DRI plant, which has not rebounded in activity despite favorable market conditions and could suggest downstream implications for steel delivery schedules. Steel procurement professionals should prioritize sourcing from the Tata Sponge Iron Odisha and Wugang Zhongjia Iron & Steel Co. due to their stronger activity levels.

Given the observed market sentiment aligned with easing monetary policy, as outlined in “Gold Extends Record Rally, US Stock Futures Drop: Markets Wrap,” buyers are encouraged to secure contracts promptly to capitalize on favorable prices and stable supply availability. The anticipated advancements in AI and technology, highlighted in “Stock market today: S&P 500 breaches 7,000 mark Wall Street braces for Fed decision, Big Tech earnings,” could also signal an uptick in demand for steel products. Adjusting strategies to enhance procurement from active and resilient plants while monitoring the JSW plant’s performance may prove essential in navigating the evolving market landscape.