From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook in South America: Activity Trends and Strategic Insights

Venezuela’s recent legal reforms and improved oil export dynamics are positively impacting broader economic activities, crucial for the steel sector in South America, as highlighted in “Venezuela overthrows Chavez-era oil laws“ and “Venezuela’s crude revival makes slow start.” These changes are mirrored by shifts observed in satellite data from key steel plants, indicating a promising uptick in activities.

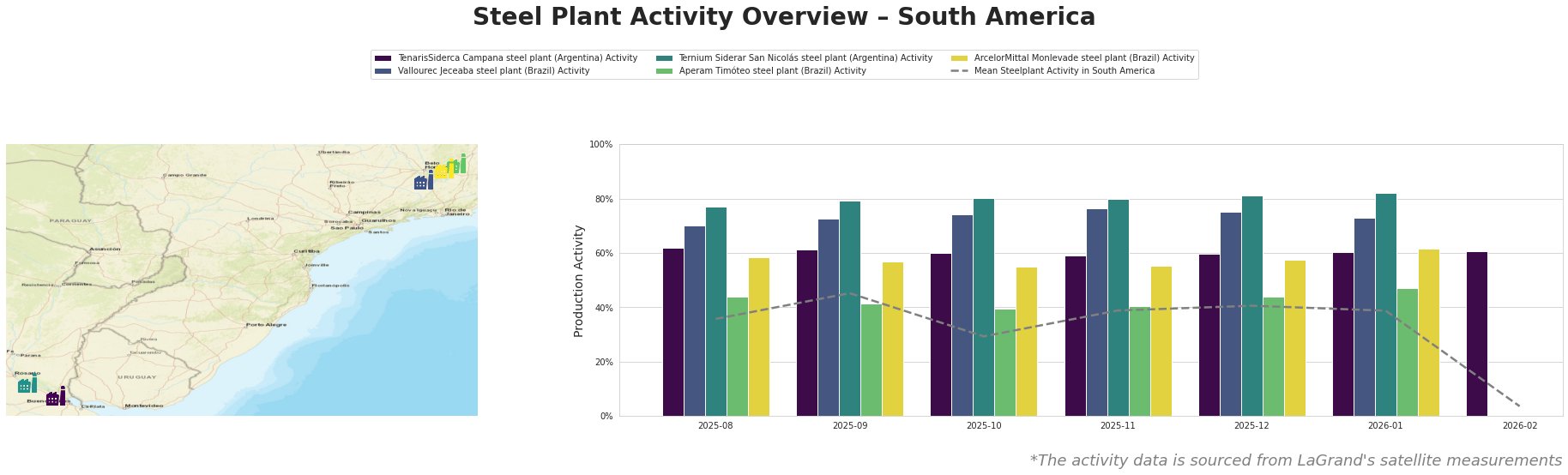

Measured Activity Overview: The steel plant activity predominantly remained above the regional average, reflecting robust operations. Notably, the Ternium Siderar plant showed consistent strength, peaking at 82% in January 2026. The Vallourec Jeceaba plant was steadily active at approximately 73-76%, while TenarisSiderca fluctuated around 60%. The recent reforms from Venezuela may bolster demand for steel products, particularly if the construction and energy sectors respond positively. The shift indicates potential for increased orders, especially for seamless steel pipes from TenarisSiderca, which cater primarily to the energy sector.

TenarisSiderca, with a capacity of 1.3 million MT for crude steel, has demonstrated stable activity, consistently near 60%, even amid wider fluctuations. The plant focuses on seamless steel pipes, essential for Venezuela’s oil and gas sector, thus aligning with positive developments from the recent articles. Its vertical integration through DRI and EAF technologies further enhances reliability.

Vallourec Jeceaba shows strong activity levels associated with its robust sourcing from local iron ore mines and an established energy sector client base. Reinforced by the favorable economic environment hinted at by the recent legal reforms, this plant’s performance positions it well to capitalize on upcoming demands.

ArcelorMittal Monlevade experienced a notable recovery, reaching 61% activity in January 2026, driven likely by increased demands for finished rolled products in automotive and infrastructure sectors. As Venezuela re-engages with international oil markets, demands for construction materials could see a surge, benefitting plants like Monlevade.

Evaluated Market Implications: Traders should closely monitor potential supply timeline adjustments, particularly regarding TenarisSiderca’s responsiveness to energy sector demands. Given the improvements in Venezuela’s oil legal framework (as noted in “Venezuela overthrows Chavez-era oil laws”), procurement strategies should lean towards securing contracts with South American steel suppliers, especially for products aligned with revitalized energy projects. This ensures preparedness for anticipated escalations in steel demand as foreign investments are likely to channel into the country, aligning with the revealed upswing in plant activities.