From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in India’s Steel Market: EU Free Trade Agreement Sparks Growth

India’s steel sector is poised for significant growth, bolstered by the recent “India, EU Sign Historic Free Trade Agreement: Auto To Agri Food Tariffs — Here Are Five Key Highlights“ and “The EU and India have agreed on a historic trade deal“ articles from January 27, 2026. The Free Trade Agreement (FTA) is set to reduce tariffs on a wide range of goods, including those in the automotive sector, which is a significant consumer of steel. This regulatory shift could enhance production across the industry and aligns with observed increases in satellite activity at major steel plants.

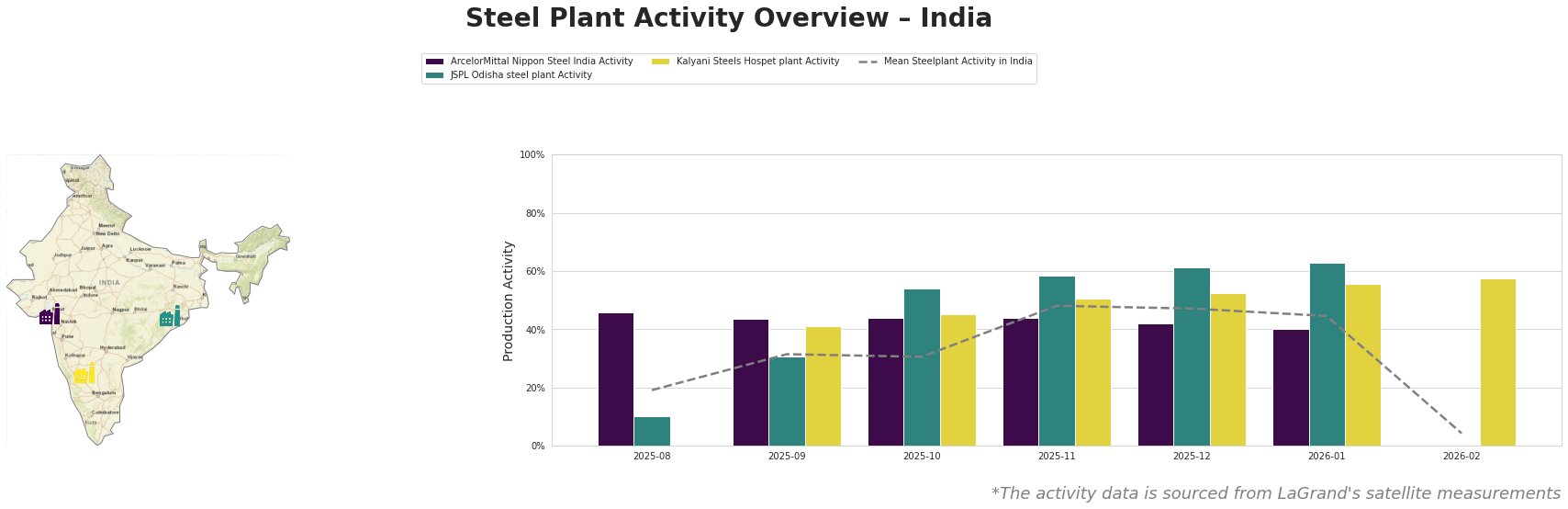

Activity levels show a noticeable increase, particularly for JSPL Odisha, which rose from 31% to 63% between September 2025 and January 2026. The growth in activity at JSPL coincides with the FTA’s implications for the automotive and building sectors. However, there’s a sharp drop in February 2026, where the mean activity plummets to 4%—a likely indicator of seasonal fluctuations rather than a direct impact from the FTA.

ArcelorMittal Nippon Steel India maintains robust activity at around 40-46%, indicating consistent operation levels. This plant’s established presence in the automotive and infrastructure sectors, which are anticipated to benefit from tariff reductions as outlined in recent news headlines, could lead to further enhancements in productivity.

JSPL Odisha shows a critical spike in January 2026 activity, which may be linked to rising demand following the FTA. However, the abrupt decrease in February highlights potential short-term supply disruptions or market adjustments as companies respond to the newly favorable tariffs.

Conversely, Kalyani Steels Hospet maintains stable activity levels around 56% in January, showcasing its resilience. Its specialization in rolled products aligns well with increased demand from construction and infrastructure sectors, promoted by the FTA’s new market landscapes.

Steel procurement professionals should consider prioritizing relationships with JSPL Odisha and ArcelorMittal Nippon Steel India given their propensity for growth and alignment with the FTA. The likelihood of product shortages in February suggests early procurement strategies could prevent disruptions. Meanwhile, monitoring Kalyani Steels for consistent supply might also be prudent as the sector recalibrates post-FTA.