From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook on European Steel Market: Key Insights from January 2026

The European steel market currently presents a positive sentiment, characterized by mixed production trends across the region. Notable reports such as “Global steel production fell by 2%” and “France reduced steel production by 8.7% y/y in 2025” highlight specific declines, but also point to resilience in countries like Spain and Austria. Satellite-observed activity reveals a strong performance from select steel mills, indicative of underlying robustness despite broader challenges.

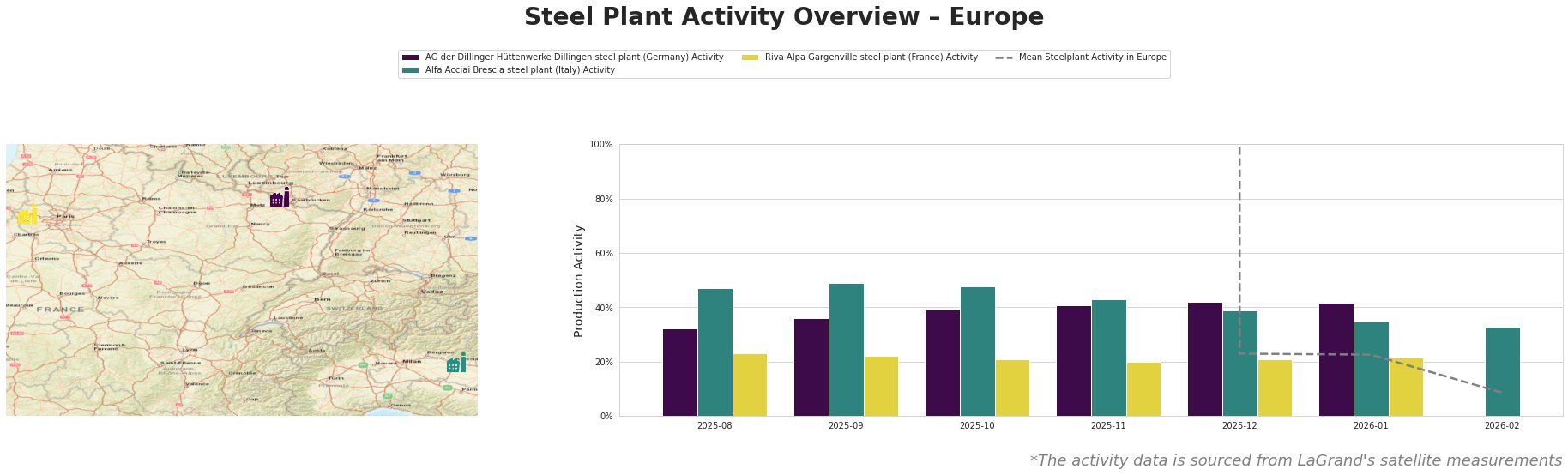

Activity levels at the AG der Dillinger Hüttenwerke Dillingen steel plant remained relatively stable around 42% in December and January, which aligns with “French longs prices edge higher despite weak demand,” indicating consistent output amid price adjustments. The Alfa Acciai Brescia steel plant observed a decrease from 49% in September to 35% in January, which aligns with the mixed production signals in the region, although no direct link to specific news articles can be drawn. Conversely, the Riva Alpa Gargenville steel plant has shown lower activity levels, dropping to 22% which corresponds with the overall downtrend noted in French steel production (as per “France reduced steel production by 8.7% y/y in 2025.”).

In contrast, Spain’s steel production increased by 0.7% y/y, showcasing a degree of growth against the backdrop of broader declines. Companies like ArcelorMittal operating in Spain benefit from increased competition and potentially improved market positioning, enhancing procurement opportunities for buyers.

Given the recent data and trends, steel buyers should:

– Consider procurement adjustments focused on countries demonstrating production increases, such as Spain, as suppliers may have more capacity and flexibility.

– Monitor price trends closely, especially in markets like France, where price increases of €5-10/tonne are being introduced but may face resistance from weak demand.

– Prepare for potential supply disruptions particularly from plants experiencing significant activity dips, such as the Riva Alpa in France, as they may struggle to meet demands in the near future.

The overall stability in selected plants combined with positive price signals in certain regions presents actionable opportunities for buyers looking to navigate the European steel market successfully.