From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Sentiment Prevails in Asian Steel Market Amid Plant Activity Decline

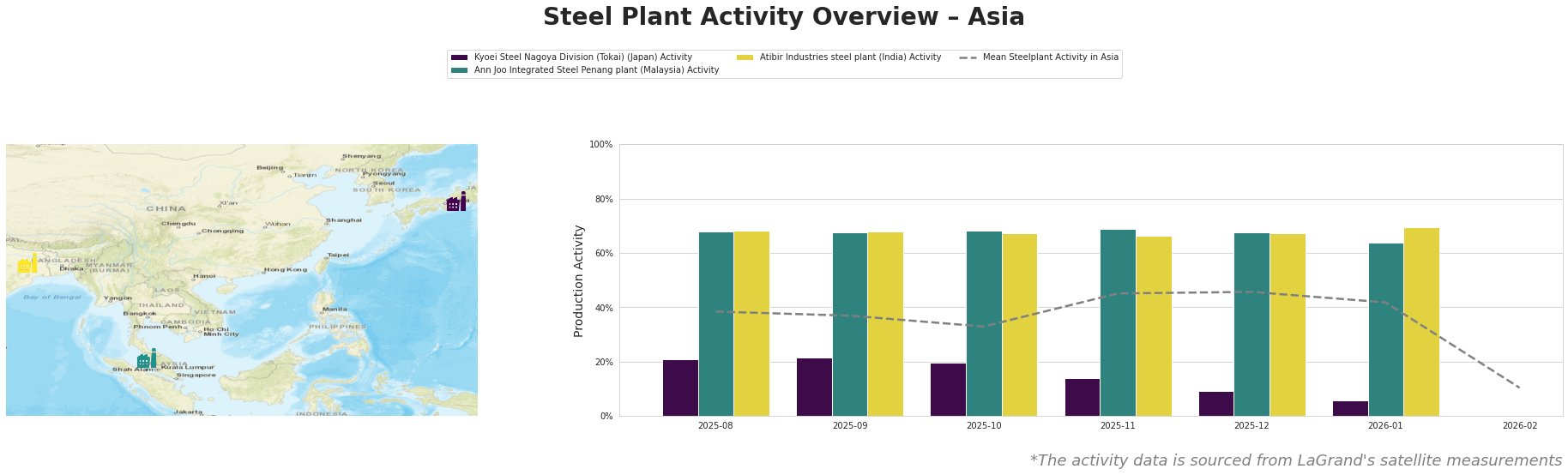

Recent developments in the Asian steel market indicate a negative sentiment stemming from notable declines in steel plant activities, particularly in Japan and India. The satellite-observed activity levels at Kyoei Steel Nagoya Division and Atibir Industries have significantly decreased, correlating with changes in market dynamics influencing demand. Notably, “India’s HPCL not seeking Venezuelan crude for now“ adds pressure by limiting operational flexibility concerning material sourcing.

Activity at Kyoei Steel Nagoya Division has seen a dramatic decline from 21.0% to just 6.0% over six months, translating to a 71.4% drop. The plant, which operates with a single Electric Arc Furnace (EAF), specializes in finished rolled products and has reported operational slowdowns without a direct connection to recent news articles.

In contrast, Ann Joo Integrated Steel Penang has remained relatively stable, despite dipping from 68.0% to 64.0% in January, signaling resilience in its integrated steel production capabilities. However, challenges may arise from regional competition and the market’s overall downturn.

Conversely, Atibir Industries demonstrated slight improvement in January, moving from 66.0% to 69.0%. This minor uptick, however, is overshadowed by the broader market deterioration, as indicated by the general decline in mean activity across Asia.

The steel market faces critical implications with potential supply disruptions. Declining activity levels signal constrained production capabilities, notably at Kyoei Steel and Ann Joo Integrated, which may struggle to meet demand. Procurement teams should consider diversifying suppliers to mitigate reliance on declining production plants, particularly in Japan and Malaysia.

For immediate strategic action, steel buyers should prioritize securing contracts with regions displaying stable or rising activity, like Atibir Industries, while preparing contingency plans to address potential supply shortages as associated production capabilities dwindles further. Reliance on regional crude sources must be evaluated, especially considering insights from news articles such as “India’s HPCL not seeking Venezuelan crude for now”, which underscores the shifting availability and sourcing strategies within Asian markets.