From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Overview for Asia: Severe Decline Amid Uncertain Global Trade Dynamics

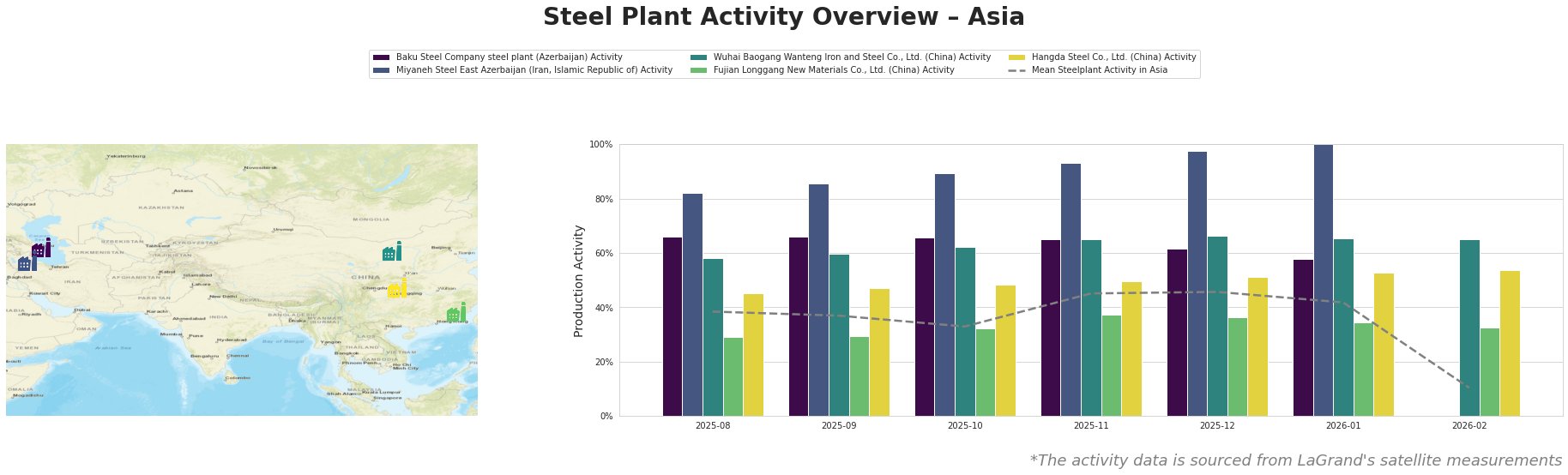

Steel activity across Asia has plummeted significantly, driven by geopolitical tensions and uncertain trade policies. Recent news articles, particularly “Zölle gegen China brachten USA keine Jobs, zeigt Studie“, highlight the ineffectiveness of U.S. tariffs on Chinese imports, leading to market instability that adversely impacts steel production. This shift is corroborated by satellite observations, which show drastic drops in operational levels at key plants.

Recent monthly activity data illustrates a concerning trend across major Asian steel producers:

This data reveals a sharp decrease in the mean activity to 10% by February 2026, significantly below the historical average. Notably, several plants have experienced operational inconsistencies, particularly Baku Steel Company, which remains relatively stable yet is being overshadowed by larger regional declines. The setback to 58% activity in January reflects an ongoing contraction related to the economic fallout from U.S.-China trade tensions, as noted in “Trumps gemischte Signale an China.”

Baku Steel Company maintains its activity levels due to its strategic focus on electrical arc furnace (EAF) production, registering only a slight decline from 66% in January to activity unreported in February. The correlation to U.S. tariffs and their failure to stimulate domestic job growth—highlighted in the aforementioned studies—implies potential challenges ahead for operations reliant on export markets.

Miyaneh Steel East Azerbaijan has demonstrated robust performance with activity peaking at 100% in January, though it abruptly drops off with no recent observation in February. The news concerning U.S. trade policies might hint at uncertainty affecting their operational decisions.

Wuhai Baogang Wanteng Steel and Fujian Longgang New Materials Co. remain entrenched but at lower activity levels, revealing a vulnerability to shifts in demand influenced by international pricing pressures exacerbated by tariffs.

Hangda Steel, despite improvements, saw declines which illustrate the broader market sentiment turning towards a severe contraction—a clear reflection of global supply chain strains.

The observed patterns indicate significant implications for procurement strategies. Steel purchasers in Asia should consider diversifying their sources, particularly leveraging more stable suppliers such as those in Azerbaijan, which, despite external pressures, are exhibiting resilience. Prioritizing contracts with suppliers demonstrating lower dependency on the Chinese market may offer a buffer against looming supply disruptions influenced by ongoing geopolitical issues. Explicit attention should be drawn to anticipated shortages resulting from the steep decline in average activity levels, necessitating proactive engagement with suppliers to secure inventory ahead of potential scarcity.