From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Overview: Positive Sentiment Amidst Plant Activity Changes

In Europe, the steel market exhibits a positive sentiment as evidenced by recent developments. “Reel trips to the North-West of Europe could not surprise the buyers“ highlights ArcelorMittal’s price hike to 700 euros per ton, correlating with observed steady production levels at various plants. Meanwhile, “Downstream flat steel prices in Europe steady while CBAM, AD probe limit import options“ underscores the stability in cold-rolled and hot-dipped galvanized steel prices, suggesting potential pricing resilience amid supply constraints.

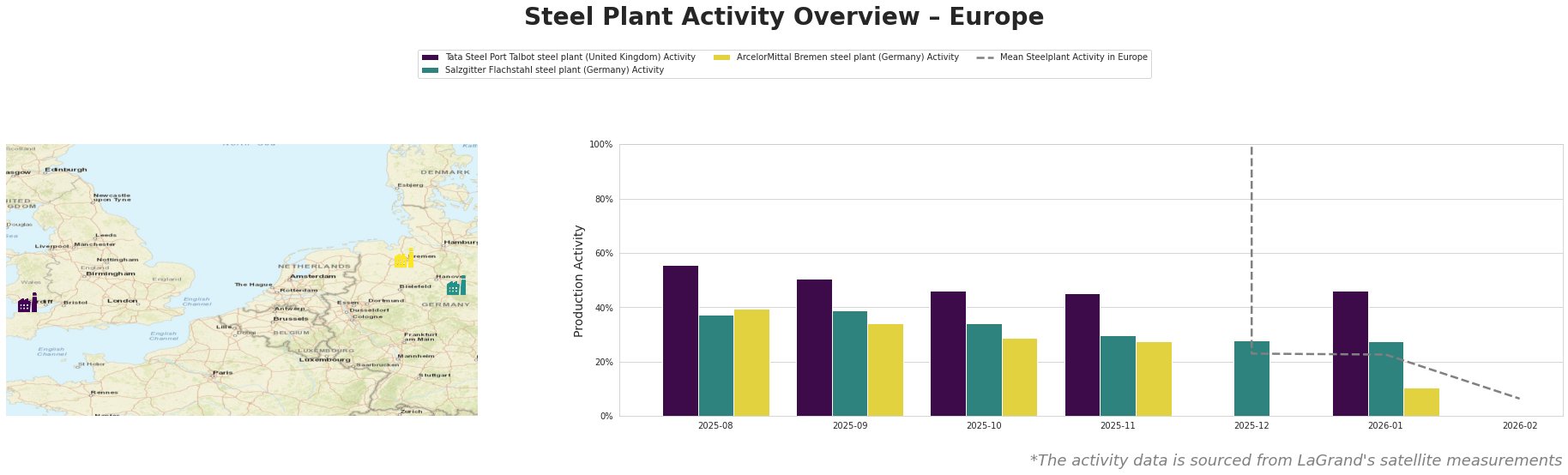

The Tata Steel Port Talbot plant in Wales shows a strategic recovery with an increase to 46% activity in January 2026 after a significant drop to 23% in December 2025. This aligns partially with the cautious stabilization mentioned in “Reel trips to the North-West of Europe could not surprise the buyers,” where buyers are gradually adjusting to price changes. In contrast, Salzgitter Flachstahl’s activity dipped to 27%, signaling potential supply issues as broader European market conditions remain cautious. Notably, ArcelorMittal Bremen’s decline to 10% in January raises flags for potential disruptions at this major plant, disconnecting from the overall market growth hinted in the news articles.

Given these dynamics, steel purchasers should consider immediate procurement strategies focused on securing supplies from plants like Tata Steel Port Talbot, where activity levels indicate recovery and capability to meet demand. The challenges faced by ArcelorMittal Bremen, coupled with CBAM’s restrictive effects on imports, suggest that buyers might negotiate aggressively with local producers to lock in favorable pricing forecasts before anticipated increases in Q2 2026, as indicated by “Downstream flat steel prices in Europe steady.”