From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Thrives: India Set for EU Export Growth Amid Strong Plant Activity

Recent activity across Asia’s steel plants indicates a robust market sentiment, particularly in India, driven by anticipated changes in EU regulations. The article India Hopeful Of Preferential Treatment For Its Steel Exports Under New EU Regulations highlights India’s optimism regarding its steel exports to the EU, suggesting that preferential tariff treatment could enchant its market share, now at 10%. Furthermore, the India-EU FTA lifts end-user outlook, steel impact muted underscores the integration of long-term strategies for India, even as immediate impacts may be subdued by carbon-related regulations.

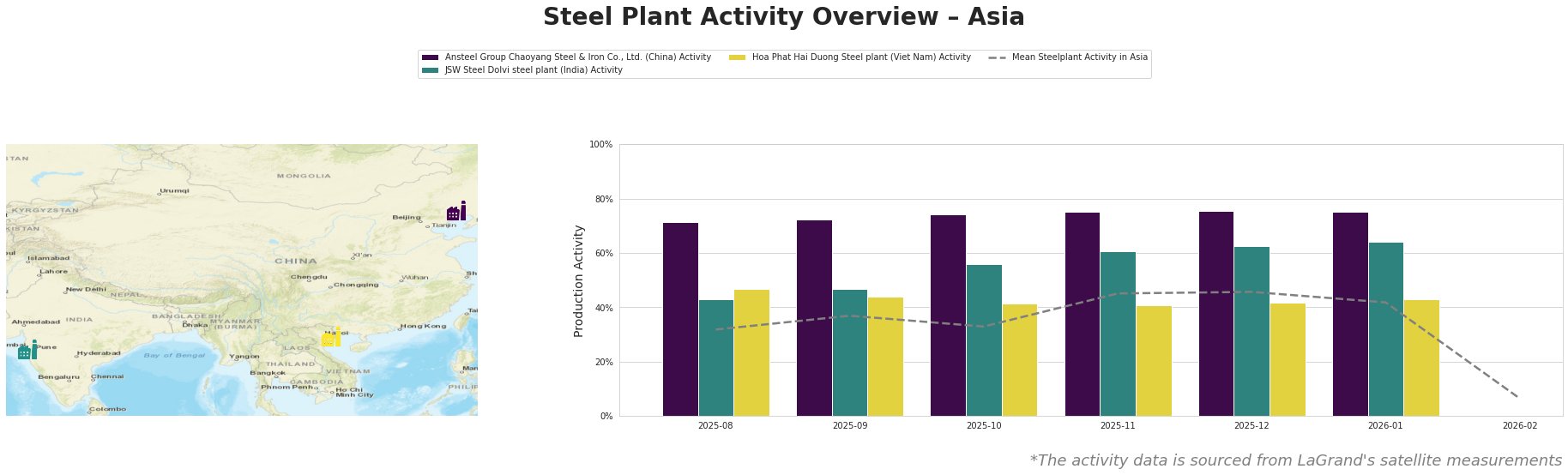

Recent satellite activity data reveals consistent operational levels among key players:

Ansteel Group Chaoyang Steel in Liaoning has maintained impressive activity, peaking at 75% in January, which is significantly above the regional mean, reflecting stability and potential resilience amid evolving trade conditions linked to India-EU agenda reframes steel priorities. This connection aligns with India’s proactive strategy to cater to EU markets.

JSW Steel’s Dolvi plant in Maharashtra also exhibits a strong performance, climbing to 64% activity in January, correlating with increased domestic demand as projected in the India-EU FTA lifts end-user outlook, steel impact muted. This suggests that buyers can expect a strong supply from this facility, reinforcing its critical role in the supply chain.

Hoa Phat Hai Duong, while experiencing fluctuations, remains comparatively stable around 41-47% activity levels. However, the dips indicate possible challenges ahead that procurement teams should monitor, given the potential pressures from regulatory changes discussed in India and EU’s agenda revisits steel production priorities.

In summary, steel buyers should prepare for an increased supply from Indian producers, especially as preferential trade agreements unfold. Continuous monitoring of activity levels, especially from plants like Ansteel and JSW, is essential to navigate potential supply disruptions while capitalizing on competitive pricing dynamics. Engaging in strategic long-term partnerships with these plants may also be beneficial to hedge against any regulatory impacts anticipated in the near future.