From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNavigating the Neutral Steel Market Landscape in the Russian Federation Amid EU Import Cuts

Recent legislative movements in the European Union affecting Russian steel imports point to potential market changes. The European Parliament committee backs proposal to ban Russian steel and the EU Parliament Trade Committee supports major cut in steel import quotas signal a tightening of access for Russian steel in European markets, directly impacting regional production dynamics.

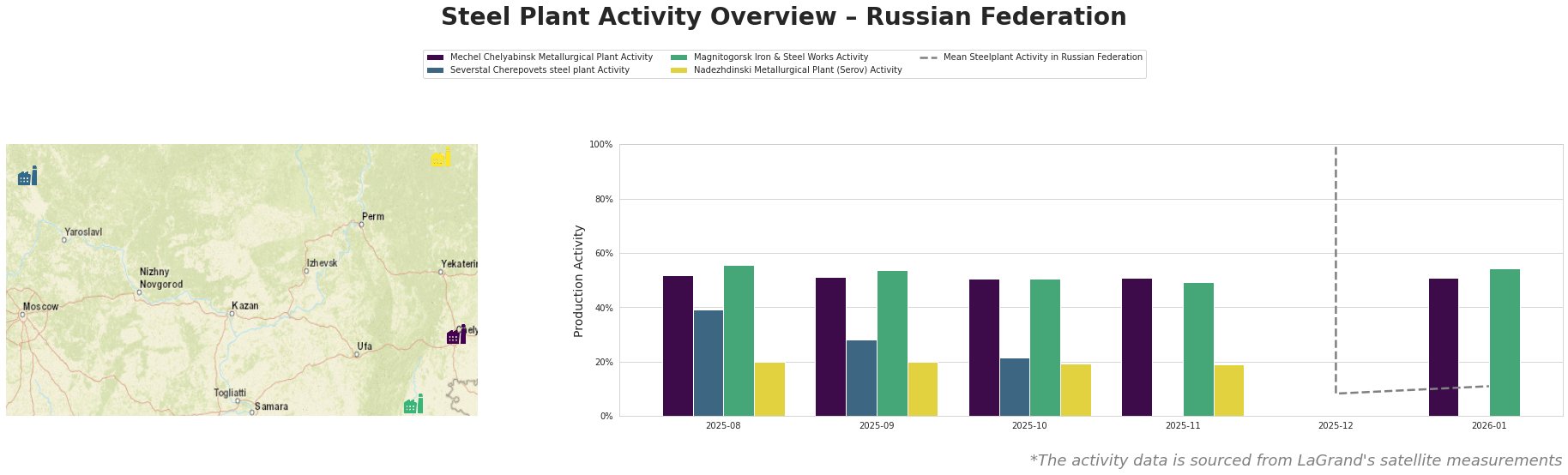

In response to significant geopolitical pressures and trading reconfigurations, satellite-observed activity levels among major Russian steel plants have shown muted trends. For instance, the activity at Mechel Chelyabinsk Metallurgical Plant experienced a notable decline from 51% in October 2025 to 11% in January 2026, while Severstal Cherepovets observed a gradual decline, remaining at 22% in October 2025 before recovering slightly to 54% by January 2026. These fluctuations indicate a direct relationship with the evolving import bans as per the recent news.

The Mechel Chelyabinsk Metallurgical Plant, primarily producing semi-finished and finished rolled steel, saw its activity drop from 51% to 11%, reflecting a broader uncertainty in trade and demand potentially tied to the EU’s newly established regulations. In contrast, Severstal Cherepovets, which boasts a considerable capacity of 12,000 million tons and remains well posited in semi-finished and finished segments, rebounded from 22% to 54%, possibly due to domestic market adjustments to mitigate the impact of reduced EU access.

Magnitogorsk Iron & Steel Works reported steady activity levels but did not experience the same volatility, indicating resilience amid the uncertainty created by the EU’s proposals. Meanwhile, Nadezhdinski Metallurgical Plant had minimal activity levels, highlighting its vulnerability in this shifting landscape, as it has struggled to gain traction with relevant downstream industries.

As potential supply disruptions loom due to tightening EU restrictions, steel buyers are advised to secure contracts with plants demonstrating resilience, particularly Severstal Cherepovets and Magnitogorsk Iron & Steel Works. Proactive monitoring of satellite data over the coming months will be crucial, as ongoing geopolitical dynamics could alter plant activities and market availability. Steel analysts should be prepared for volatility influenced by regulatory decisions impacting import quotas and tariffs as established in the European Parliament’s Trade Committee proposal.

Strategically, purchasing decisions should prioritize suppliers with the capacity for competitive pricing in a landscape marked by potential overcapacity, responding to calls for tighter scrutiny of imported materials as articulated in the recent trade discussions.