From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market in Asia: Rising Activity and Positive Outlook Amid Dollar Weakness

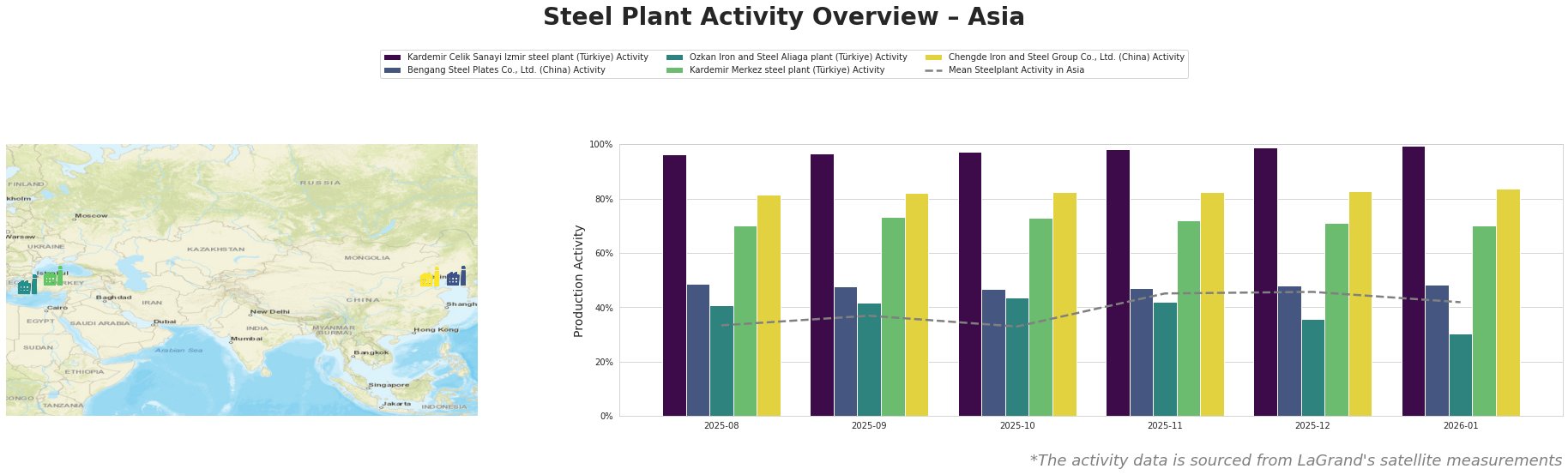

The Asian steel market is currently experiencing an upsurge in activity levels, driven notably by recent currency dynamics. According to the news article “Dollar Falls Amid Japan Intervention Risk, Gold Up: Markets Wrap,” the weakening dollar has positively influenced Asian currencies, which supports steel pricing and demand. This sentiment is corroborated by observed increases in activity at key steel plants across the region.

The Kardemir Celik Sanayi Izmir steel plant reported a peak activity level at 100% in January 2026, reflecting strong operational momentum. This rise aligns with the positive backdrop created by the dollar’s downturn as outlined in “Asian Currencies Gain As Dollar Weakens Before Fed: Markets Wrap,” emphasizing improved market sentiment among buyers.

Conversely, Ozkan Iron and Steel Aliaga plant’s activity dropped to 30% in January 2026, marking the lowest level observed over the monitored period. No direct link can be established with recent news articles to explain this drop, suggesting potential localized operational or market-specific issues warranting further investigation.

The Bengang Steel Plates Co., Ltd. remains robust with consistent activity around 48.0%, while the Kardemir Merkez steel plant and Chengde Iron and Steel Group Co., Ltd. showcase stable operations around 70% and 84% respectively.

In light of these observations, steel buyers may consider prioritizing procurement from the Kardemir Celik Sanayi Izmir and Chengde Steel Group, where heightened activity indicates readiness for fulfilling orders efficiently. Additionally, they should monitor plants like the Ozkan Iron and Steel Aliaga, which may face internal challenges impacting production levels, signaling potential supply disruptions.

This market landscape indicates a positive trajectory for Asian steel procurement, particularly in the context of strengthening local currencies against a weaker dollar, encouraging more favorable buying conditions.