From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Steel Market Outlook: North America Amidst International Tensions

Steel market dynamics in North America are facing neutrality as recent discussions over Greenland ownership by U.S. authorities raise concerns about potential trade disruptions. Articles titled “Donald Trump in Davos: Militärischer Eingriff in Grönland vom Tisch – Zollkrieg voraus?“ and “Trump open to talks over Greenland’s future“ highlight the precarious geopolitical landscape that could influence steel procurement and pricing. However, a direct correlation between these political developments and specific shifts in steel plant activity remains unestablished.

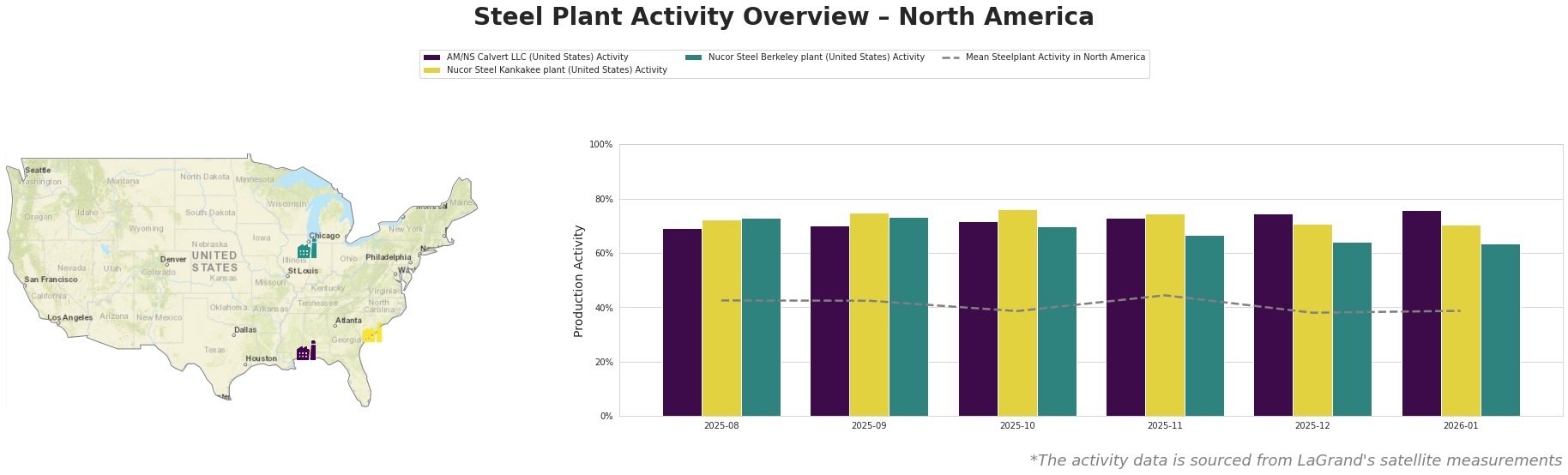

The AM/NS Calvert LLC plant in Alabama shows a positive trend, with activity rising from 69% to 76% in January 2026. In contrast, both Nucor plants— Kankakee and Berkeley— experienced fluctuations, with the Kankakee plant peaking at 76% in October before dropping to 70% by January. The Berkeley plant declined from 73% in September to 64% in December and January, indicating significant volatility affecting production. This observed instability may be mildly exacerbated by geopolitical uncertainties, as discussed in the news articles.

AM/NS Calvert LLC

The AM/NS Calvert facility, utilizing Electric Arc Furnace (EAF) technology, primarily manufactures hot-rolled and cold-rolled products targeting various sectors such as automotive and infrastructure. Activity at this plant increased to 76% in January 2026, up from 75% in December. Although this positive uptick reflects consistent product output, no direct linkage to the recent geopolitical tensions surrounding Greenland ownership can be established.

Nucor Steel Kankakee Plant

The Kankakee plant, known for its EAF technology and primarily producing bars and gratings, peaked at 76% activity in October 2025 before decreasing to 70% by January 2026. This decline may reflect a broader trend influenced by the uncertainty highlighted in “Donald Trump in Davos: Militärischer Eingriff in Grönland vom Tisch – Zollkrieg voraus?”, although no specific causality can be drawn.

Nucor Steel Berkeley Plant

The Berkeley plant, which also employs EAF technology to produce beams and sheets, observed a decline in activity from 73% in September to a significant drop to 64% in January 2026. As with its counterpart in Kankakee, this decline in output exists in a backdrop of potential trade war implications discussed in various articles, yet lacks a direct cause-effect relationship.

The potential for supply disruptions appears centered around perceptions of political instability, particularly concerning anticipated tariffs and international relations. Given this landscape, steel buyers should prepare for price volatility and potentially increased procurement costs. An actionable recommendation is to consider diversifying suppliers and locking in prices soon to mitigate risks associated with fluctuating geopolitical climates, which could affect tariffs and trade agreements.