From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimizing Steel Procurement in China’s Resilient Market: Insights from Recent Activity Trends

China’s steel market sentiment remains positive despite recent fluctuations, driven by a comprehensive evaluation of production and import data. Notably, the article “China has reduced iron ore production” highlights a 2.8% year-on-year reduction in iron ore production, coupled with a substantial 8.2% increase in iron ore imports in December 2025. This aligns with satellite data showing stable activity levels in key steel plants.

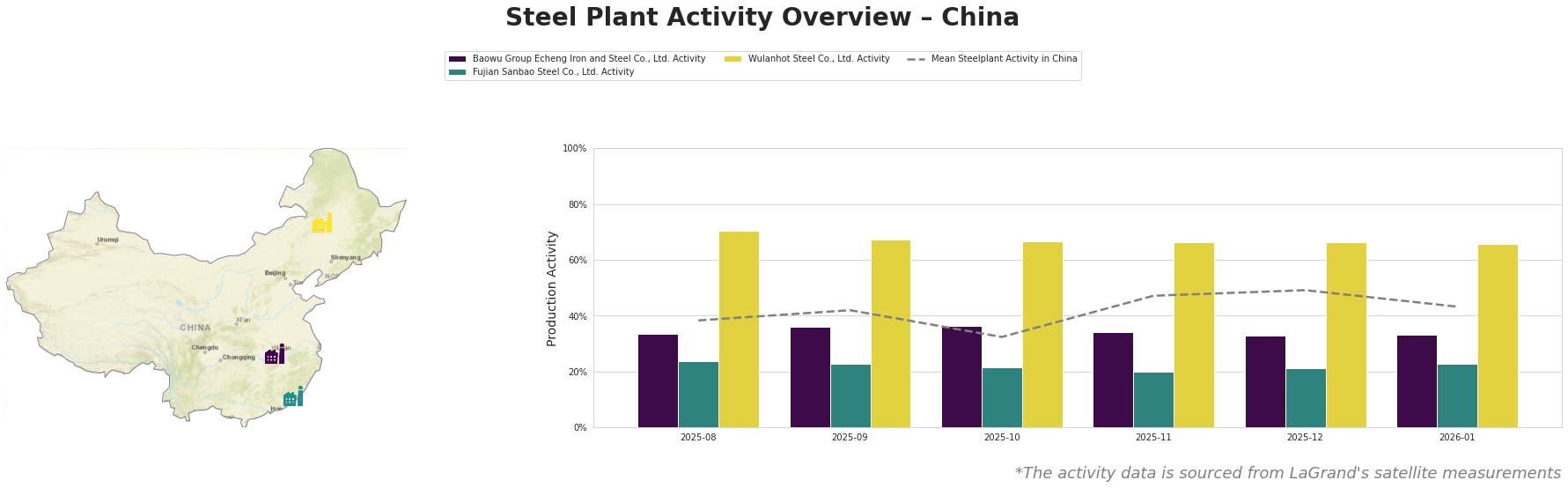

Measured Activity Overview

Activity levels at the Wulanhot Steel Co., Ltd. reached a peak of 70% in August 2025, significantly outpacing the mean activity of 38%, but showed a slight downturn to 66% by December. Conversely, Fujian Sanbao Steel Co., Ltd. displayed a consistent downward trend, closing out December with an activity level of 21%, indicating potential capacity underutilization and alignment with the concerns addressed in the “China reduced iron ore production by 2.8% y/y in 2025” article regarding demand fluctuations.

Plant Insights

Baowu Group Echeng Iron and Steel Co., Ltd. operates with a capacity of 4.4 million tonnes, with an integrated steelmaking process using BOF technology. The plant’s activity fluctuated but remained relatively low, around 33% in December. The decline in overall steel production (960.81 million tonnes in 2025) per the mentioned articles may have contributed to these reduced activity levels.

Fujian Sanbao Steel Co., Ltd., with a capacity of 4.62 million tonnes, has seen declining operational activity, marked by a low of 20% in November. The plant’s focus on finished and semi-finished products aligns with demand in sectors like building and infrastructure, yet its reduced activity highlights a mismatch with current market dynamics.

Wulanhot Steel Co., Ltd., functioning at a capacity of 1.05 million tonnes, maintained higher operational levels despite recent declines. The drop from 70% to 66% suggests adjustment phases rather than severe disruptions, likely reflective of broader market trends, including shifts in export activities reported in the steel production data.

Evaluated Market Implications

Potential supply disruptions may arise primarily from Fujian Sanbao Steel Co., Ltd., where capacity underutilization could limit availability. Steel buyers are advised to closely monitor this plant alongside the broader market, especially given the implications of declining domestic steel production.

Recommended procurement actions involve securing contracts with Wulanhot Steel Co., Ltd., as its activity levels remain competitive, supported by ongoing patterns of robust export activity. Buyers should validate iron ore sourcing agreements in light of fluctuating local production, as highlighted by the increased iron ore imports trend. Strategic purchases should consider the anticipated shifts in demand across infrastructure and energy sectors, leveraging the insights on production availabilities and export dynamics to mitigate risks and capitalize on growth opportunities in the coming quarters.