From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook for Asia: Activity Levels Rising Amidst Optimistic Business Environment

Recent analysis indicates a very positive sentiment in the Asian steel market, supported by satellite-observed activity data and relevant industry developments. As highlighted in the Graco (GGG) Q3 2024 Earnings Call Transcript and the Sanmina (SANM) Q4 2024 Earnings Call Transcript, there are early signs of stabilization in the industry, particularly despite mixed performance in sectors influenced by ongoing developments in the Asia-Pacific region. This aligns with increased activity levels at major steel plants, signaling a potential uptick in production capabilities.

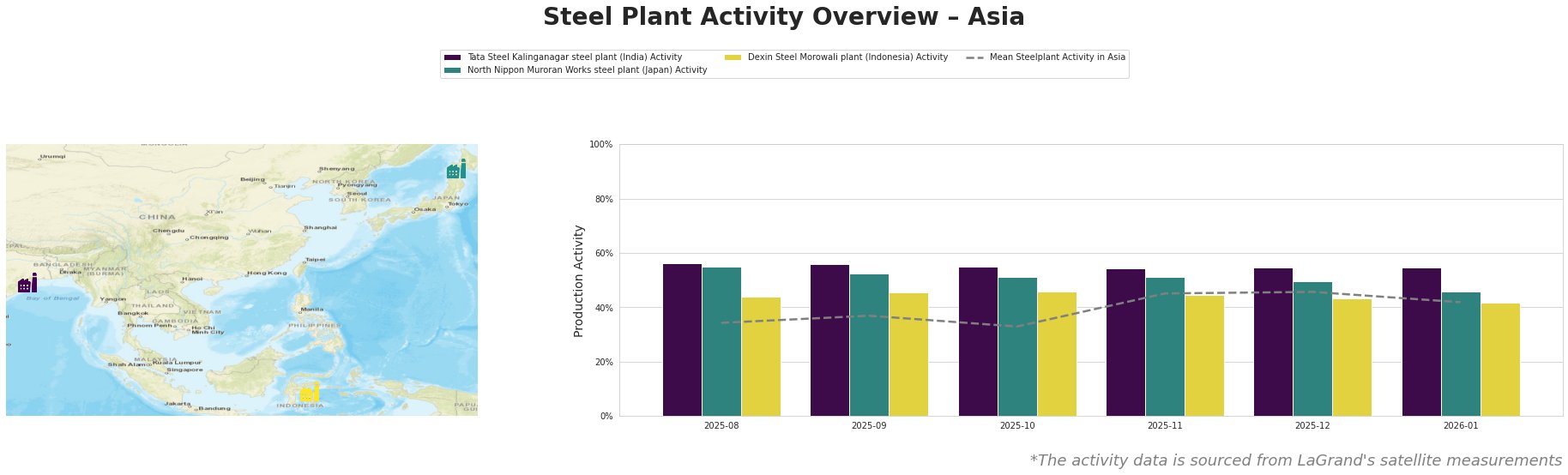

The data shows a remarkable increase in mean activity levels, peaking at 46.0% in December 2025. Specifically, the Tata Steel Kalinganagar plant demonstrated stable activity, consistently above 54.0%, underscoring its robust operational capacity aligned with growing domestic demand. The North Nippon Muroran Works remained steady around 51.0%, while the Dexin Steel Morowali plant showed fluctuations but remained competitive.

For Tata Steel Kalinganagar, the continued prosperous activity levels suggest a reliable supply capability, especially vital as General Motors (GM) reports Q4 earnings beat indicating strong customer demand in the automotive sector, directly relevant given Tata’s exposure to this market. Despite a stable activity level of 55.0% in January 2026 with no major drops, it’s crucial to monitor potential operational challenges that may arise as demand rebounds.

Conversely, North Nippon Muroran Works saw a noticeable decline to 46.0% in January 2026, although this decrease does not correlate with any recent news indicating disruptions, making it vital for buyers to verify supply reliability.

Dexin Steel Morowali experienced an activity reduction to 42.0% in January, indicating potential pressures on operational capacity that should be closely watched to mitigate supply risks amid increased demand.

Market Implications

Steel buyers and market analysts should remain poised for potential supply disruptions primarily from the Dexin Steel Morowali plant. It is advisable to secure long-term procurement agreements, particularly with Tata Steel Kalinganagar, which shows consistent operational stability supporting sustained delivery capabilities. Monitoring ongoing financial performances from leaders like GM will further provide insights into automotive sector demands influencing the steel market landscape.