From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineRobust Growth in North America’s Steel Sector Amid Global Economic Adjustments

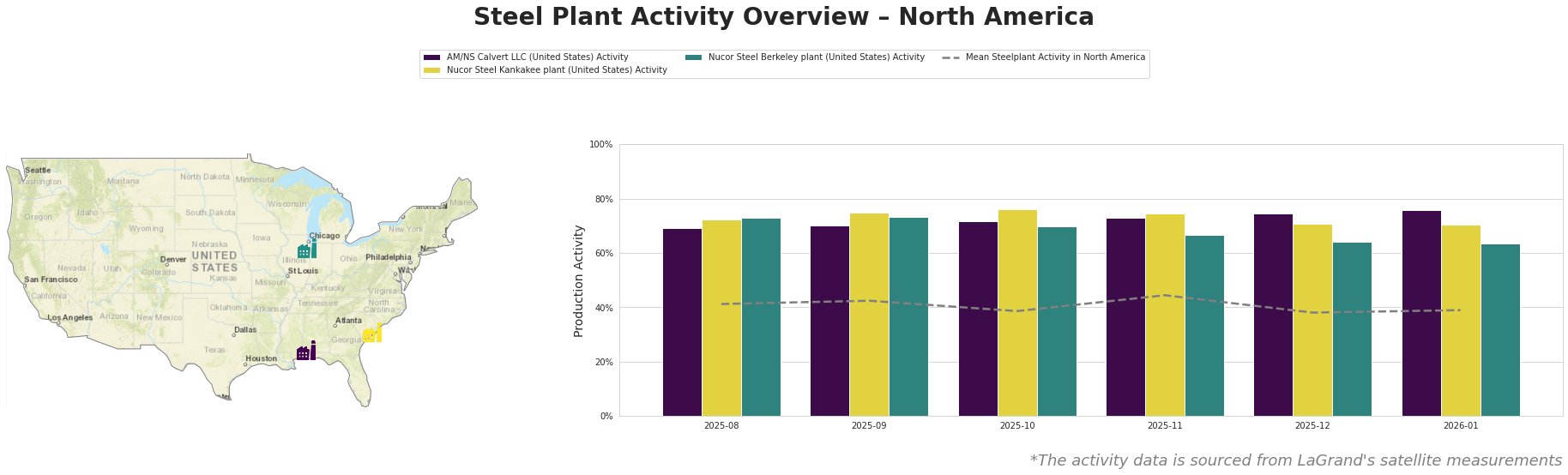

Steel activity in North America is experiencing a positive trend, as observed in satellite data linked to ongoing geopolitical developments discussed at the World Economic Forum. Notable news, particularly “Donald Trump in Davos: Militärischer Eingriff in Grönland vom Tisch – Zollkrieg voraus?“, highlighted a decrease in tensions regarding U.S.-European relations, contributing to favorable market reactions, including gains in the stock indices. This context aligns with observed increases in operational activity at key steel plants.

The activity at AM/NS Calvert LLC has shown stability, peaking at 76% in January 2026, suggesting a ramp-up in operations that aligns with the positive sentiment stemming from reduced geopolitical tensions. The plant, which operates electric arc furnaces (EAF) in Alabama, primarily supplies the automotive and infrastructure sectors, signaling growing demand.

Nucor Steel Kankakee plant exhibited its highest activity at 76% in October 2025, which echoes strengthening market conditions. As a crucial facility for producing finished rolled products, activity levels have fluctuated minimally, hinting at consistent demand in the automotive and infrastructure segments that align with the uptick in economic optimism from the Davos discussions.

Conversely, the Nucor Steel Berkeley plant has seen slight declines towards the end of 2025, with levels decreasing to 64% by December. Despite these drops, the plant remains a significant supplier to the energy and tools sector, further establishing its importance in relation to the overall market recovery.

The positive market sentiment is likely to continue, but potential trade conflicts stemming from Trump’s calls for tariff negotiations as indicated in “Davos: ++ „Europa geht nicht in die richtige Richtung“, sagt Trump – Lob für Merz ++ Liveticker“ could disrupt supply chains specifically within European engagements.

For steel buyers, capitalizing on current production rates at AM/NS Calvert LLC and Nucor Steel Kankakee plant can secure favorable prices and supply, particularly as global uncertainties may prompt fluctuations in steel availability moving forward. Buyers should focus procurement on these plants to mitigate potential supply disruptions associated with any trade tensions that may arise.