From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Market Outlook: Severe Activity Declines Amid Trade Tensions

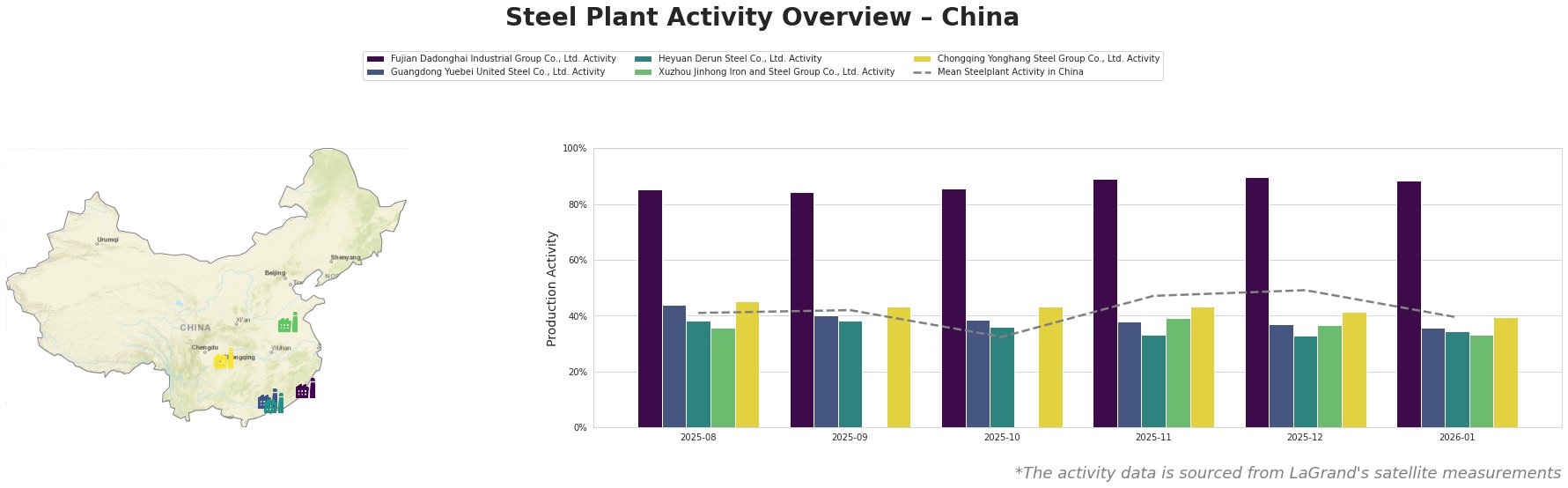

China’s steel industry faces significant challenges, characterized by marked reductions in plant activity levels, as highlighted in the articles Trumps Zollpolitik lässt deutsche Exporte in die USA einbrechen and Europas Macht ist im Zollkonflikt begrenzt. Recent satellite data reveals a downward trend in production levels across various steel plants, indicating a consequential response to rising global trade tensions, particularly influenced by U.S. trade policies.

Fujian Dadonghai Industrial Group Co., Ltd. reported consistent high activity levels, peaking at 90.0% in December 2025, but a notable dip to 89.0% was recorded in January 2026. Despite retaining relatively high production, the marginal drop correlates with the broader sentiment of market instability presented in Trumps Zollpolitik lässt deutsche Exporte in die USA einbrechen, emphasizing the adverse implications of global trade narratives on local markets.

In Guangdong, Yuebei United Steel’s activity has fluctuated, declining from 44.0% to 36.0% by January 2026. The downturn corresponds with the heightened trade conflicts illustrated in Europas Macht ist im Zollkonflikt begrenzt, signaling a potential risk for sustaining steel supply relative to demand in the domestic market.

Heyuan Derun Steel Co., Ltd. exhibited erratic trends, where activity remains lower due to a form of market stagnation attributed to external pressures, though recent figures indicate a minimal recovery yet still below the mean. In contrast, Xuzhou Jinhong and Chongqing Yonghang’s activity levels mirror the overall negative trend, with Xuzhou witnessing a drop to 33.0% in January 2026.

Given the current context, potential supply disruptions are likely, particularly for Guangdong-based plants, which have demonstrated declining operational metrics amid rising competition from U.S. tariffs impacting global steel dynamics. Steel procurement professionals should consider delaying new contracts with Guangdong facilities, while assessing potential imports that may offer advantages amid local supply constraints.

In summary, buyers are advised to strategize procurement alternatives, particularly focusing on regions with more stable activity patterns and preparedness for potential price volatility stemming from ongoing trade tensions.