From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Steel Market in North America: Tariff Threats Influence Plant Activity but Stability Prevails

Recently, the North American steel market has experienced fluctuations in plant activity levels against a backdrop of ongoing tariff threats. Notably, President Donald Trump’s statements in “Trump threatens 100pc tariff on Canada“ and “Trump warns Canada is being taken by China, says 100% tariffs are coming if they become a ‘drop off port.’ Do this now“ have correlated with observed changes in steel plant activity.

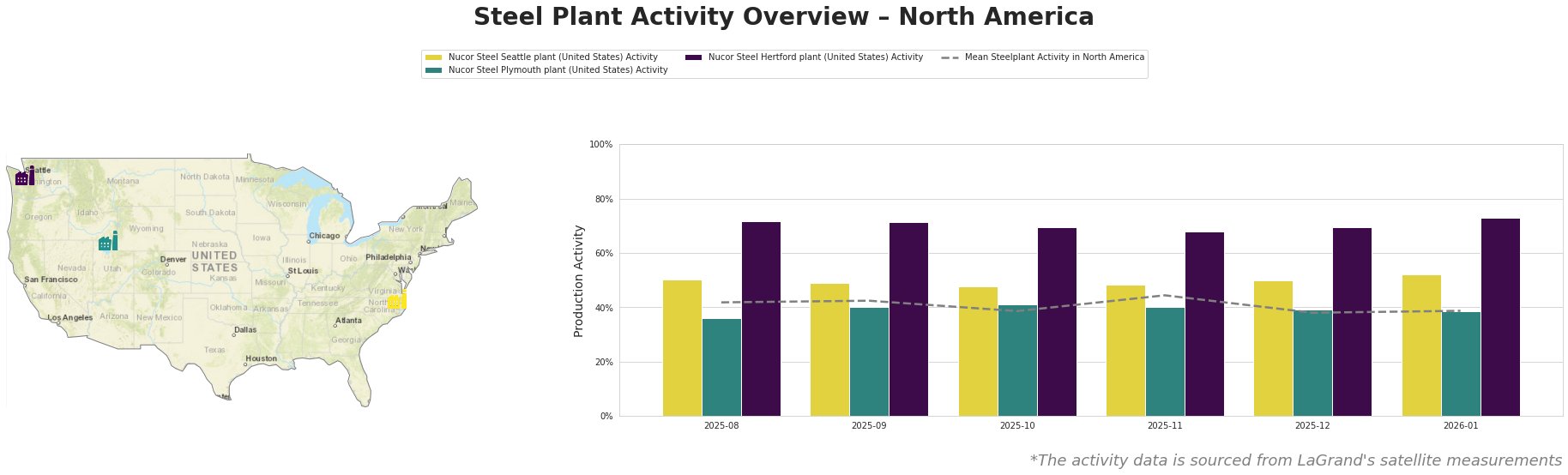

Activity at the Nucor Steel Seattle plant increased from 50.0% in August to 52.0% in January, suggesting a stable operational capacity. This rise may reflect an adjustment in response to geopolitical tensions highlighted in “Trump threatens 100pc tariff on Canada”, although no direct causal link to the tariff threats is established.

The Nucor Steel Plymouth plant experienced a slight fluctuation, maintaining an activity level between 36.0% and 41.0% during the monitored period, with no significant peaks correlating to the news articles. The activity states remain below the mean, indicating a relatively muted response to regional trade concerns.

Conversely, the Nucor Steel Hertford plant showed consistent activity, maintaining a strong performance with a peak of 73.0% in January. This robust performance could reflect strategic business decisions independent of the emerging trade threats, suggesting a capacity to weather market fluctuations regardless of external pressures.

Given these observations, the current market sentiment is neutral, albeit with underlying concerns about potential supply disruptions driven by geopolitical factors. Steel buyers should consider the following actionable insights:

-

Diversification of Procurement Sources: Given potential 100% tariffs as noted in Trump’s warnings, it is prudent for buyers to diversify their supplier base beyond Canada to mitigate the risk of sudden cost increases.

-

Monitoring Plant Performance: Keep abreast of the activity levels at major plants such as Nucor’s facilities. The stability of the Nucor Steel Hertford plant may indicate reliable sourcing capacity in the short term despite tariff uncertainties.

-

Strategic Inventory Management: Buyers should consider increasing inventory levels to buffer against potential supply disruptions, especially for regions like North Carolina where active plants demonstrate resilience in fluctuating market conditions.

These specific actions are recommended to mitigate risk based on the observed correlation between market news and real activity measured via satellite data.