From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Sentiment in Asia’s Steel Market: China’s Production Plummets Amid Weak Domestic Demand

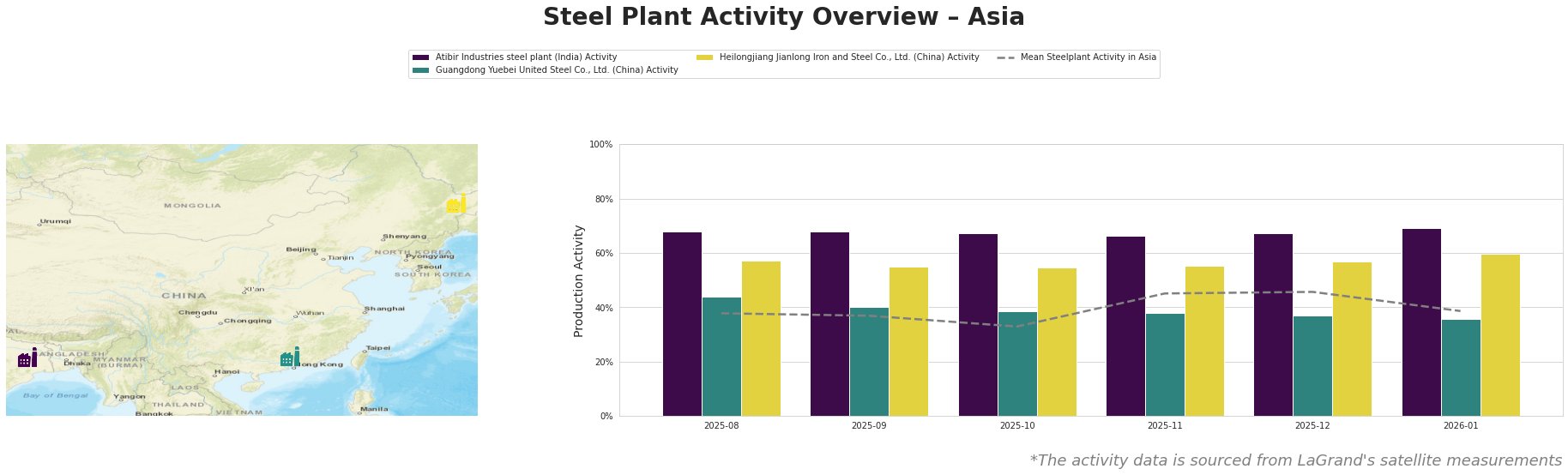

In Asia, particularly in China, the steel market is facing significant challenges as “Steel production in China fell to a seven-year low in 2025” due to a continuing crisis in the real estate sector that has dampened domestic demand. Satellite data corroborates this decline, showing a reduction in activity at major steel plants, particularly through the end of 2025 and into early 2026.

Atibir Industries in India displayed comparatively stable activity levels, holding close to the mean, maintaining activity around 67-69% during late 2025, while Guangdong Yuebei United Steel Co., Ltd. in China experienced a decline, with only 36% activity noted in January 2026, corresponding with the report “China’s crude steel output down 44 million mt in 2025, lowest monthly volume in Dec,” revealing weak domestic demand. Heilongjiang Jianlong Iron and Steel Co., Ltd.’s activity remained somewhat resilient at 60%, aligning with the broader drop but showing a higher engagement compared to its peers.

Atibir Industries’ activity (69% in January 2026) suggests potential output stability despite the wider regional downturn. Meanwhile, Guangdong’s production, as noted in “China’s steel production has fallen below 1 billion tons,” indicates a contraction phase, correlating with the focus on reducing emissions through production limits. Heilongjiang’s relatively stable operation at 60% amidst broader declines may signal either operational efficiency or contractual commitments ensuring continued production.

Given the negative sentiment reflected in “China’s Steel Production Hits Seven-Year Low in 2025 Amid Weak Domestic Demand and Export Surge,” prospective supply disruptions could occur, particularly with Guangdong Yuebei United Steel Co., Ltd. experiencing pronounced declines. Steel buyers should consider prioritizing procurement from Atibir Industries or Heilongjiang Jianlong to leverage their more stable activity levels in the short-term, particularly as Chinese exports rise significantly but could be at risk from ongoing regulatory challenges noted in the articles.

Strongly align sourcing decisions with regional production sentiments and the capacity to meet contracts, ensuring flexibility amidst this uncertain landscape.