From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCanada Steel Market Update: Navigating Tariff Threats and Activity Trends

Recent geopolitical tensions have impacted the Canadian steel market, particularly illustrated by President Donald Trump’s threats of a 100% tariff on imports from Canada linked to trade agreements with China. The Trump warns Canada is being taken by China, says 100% tariffs are coming if they become a ‘drop off port.’ Do this now article emphasizes these potential impacts, which could provoke market instability, notably in U.S. trade relations. Despite this, no direct correlation has been established between these tariff threats and recent activity levels at Canadian steel plants.

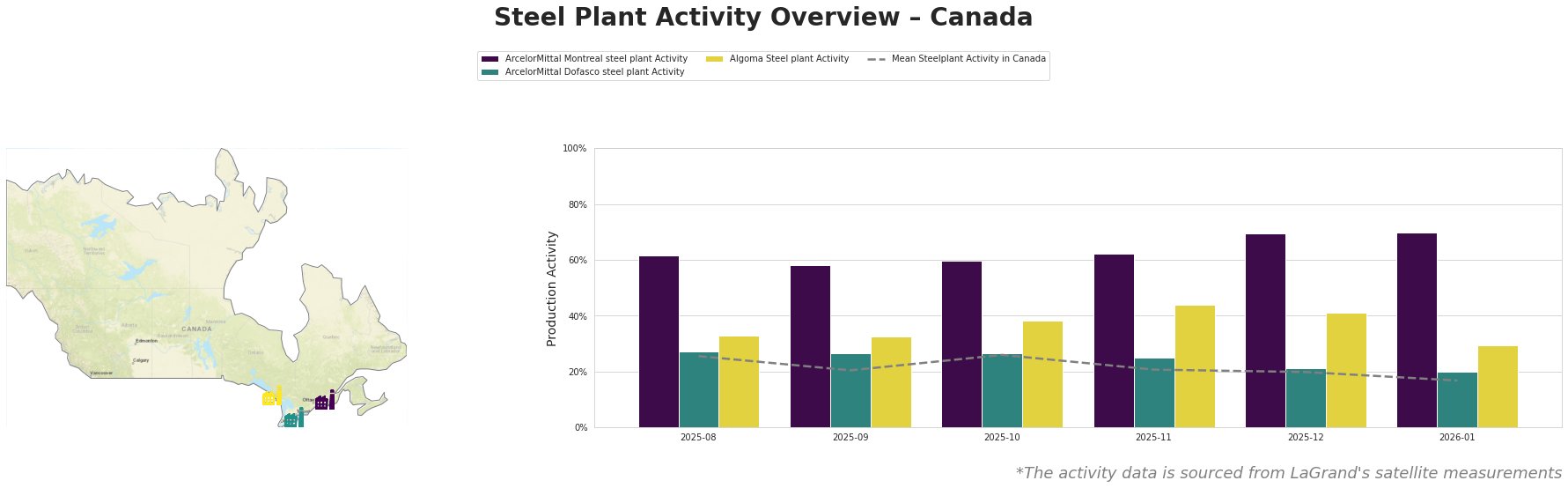

The ArcelorMittal Montreal steel plant recorded steady activity, peaking at 70.0% in January 2026. This increase occurred amidst rising tensions around tariffs but cannot be directly linked to any specific news. In contrast, the ArcelorMittal Dofasco steel plant exhibited a decline to 20.0% in the same period, showing a significant drop that might correlate with the growing uncertainty around international trade but lacks a definitive connection to the named articles. Lastly, Algoma Steel’s activity dropped to 30.0%, indicating weakening dynamics without an explicit relation to current news.

Given the ongoing tariff threats linked to the Trump threatens 100pc tariff on Canada, procurement professionals should closely monitor developments that could hinder import-export operations. Specific recommendations include:

- Evaluate supply chain resilience, particularly sourcing from plants with stable performance like ArcelorMittal Montreal, which maintained strong activity levels amid geopolitical pressures.

- Establish flexible forward sourcing agreements with Dofasco and Algoma to mitigate potential disruptions arising from perceived import tariff escalations, as historical performance shows fluctuations that may be exacerbated by external pressures.

Strategically adapting to these conditions will position organizations to navigate uncertainties and capitalize on available market opportunities.