From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Market Faces Severe Downturn: Production Hits Seven-Year Low Amid Weak Demand

With the steel market sentiment across Asia firmly negative, China’s recent production decline significantly impacts regional dynamics. As reported in “China’s steel production has been falling for the seventh month in a row“ and “China’s Steel Production Hits Seven-Year Low in 2025 Amid Weak Domestic Demand and Export Surge,” China’s steel output fell to 960.81 million tons in 2025, a 4.4% drop from the previous year. Satellite observations revealed a consistent downward trend correlating with these reports, notably a 10.3% decrease in December’s production, which signifies a continuing adverse industry trend driven by weakened domestic demand due to real estate market crises.

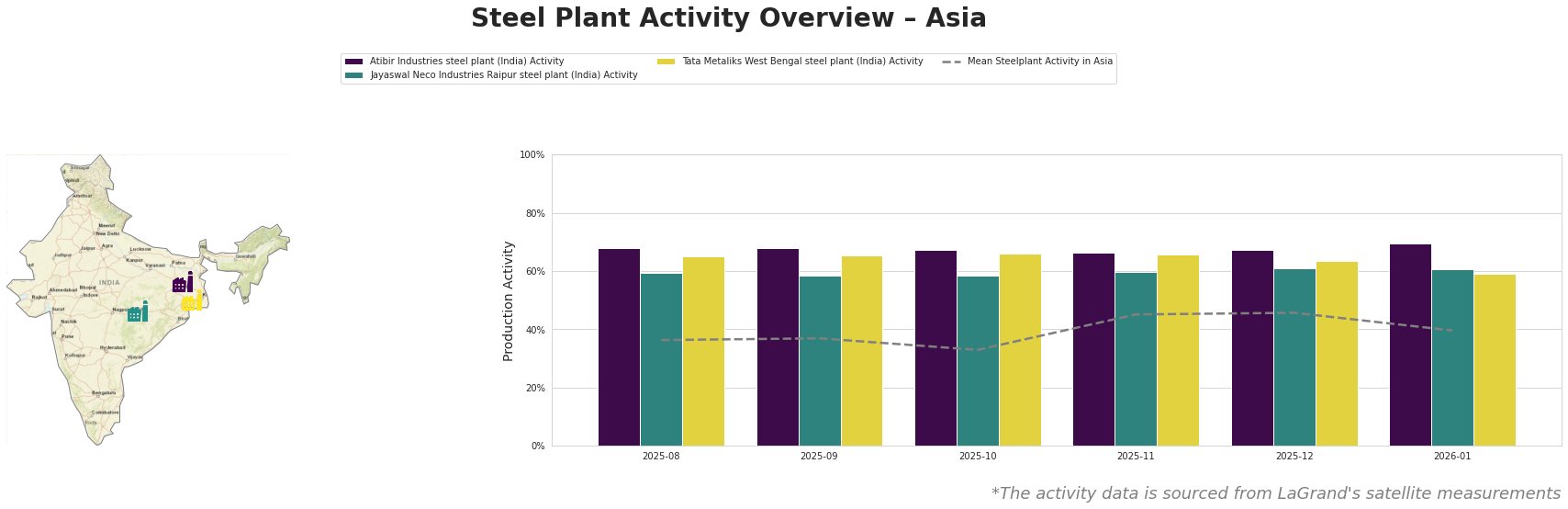

Atibir Industries in Jharkhand exhibited resilience with activity peaking at 69% in January 2026 despite China’s steel production challenges. This aligns with improvements among a subset of Chinese steel mills focusing on profitable product transitions, as indicated by the news articles; however, domestic influences remain critical. Conversely, Jayaswal Neco and Tata Metaliks demonstrated subdued activity with peaks at 61%; this follows a broader trend of declining utilization rates amid an increasingly difficult environment for meeting domestic demands for steel.

Jayaswal Neco Industries operates an integrated system leveraging both Blast Furnace and DRI technologies, which peaked at 61% activity in December 2025. The activity increase aligns with the rising export trend as reported, but the overall decline in domestic production calls for scrutiny. The “steel production in China has fallen below 1 billion tons“ article directly links to Jayaswal’s situation, highlighting potential risk in continued low domestic demands.

Tata Metaliks, with a production capacity of 255,000 tons, also noted fluctuating productivity, hitting 63% activity in December while remaining vulnerable to the same domestic market pressures described in “China reduced iron ore production by 2.8% y/y in 2025.”

As we analyze these dynamics, several pressing supply concerns emerge particularly for steel buyers in Asia.

-

Supply Disruptions: The continued contraction in steel output foreshadows potential supply shortages, particularly from Chinese exporters, which could exacerbate price volatility and disrupt procurement strategies.

-

Recommended Actions:

- Buyers should secure contracts promptly to avoid reliance on possibly volatile imports exacerbated by decreased production capacity, as reflected in projected reductions of approximately 3% in 2026.

- Focus on local procurement options such as Atibir Industries to mitigate risks associated with global market fluctuations.

- Continuous monitoring of satellite activity levels to gauge real-time production shifts will be essential for adapting purchasing strategies effectively.

In summary, the overwhelming sentiment of declining steel production coupled with the observed plant activity significantly indicates a challenging landscape for steel procurement in Asia, necessitating strategic actions from market analysts and buyers alike.