From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Outlook for Asia: Activity Plummets Amid Trade Tensions and Tariffs

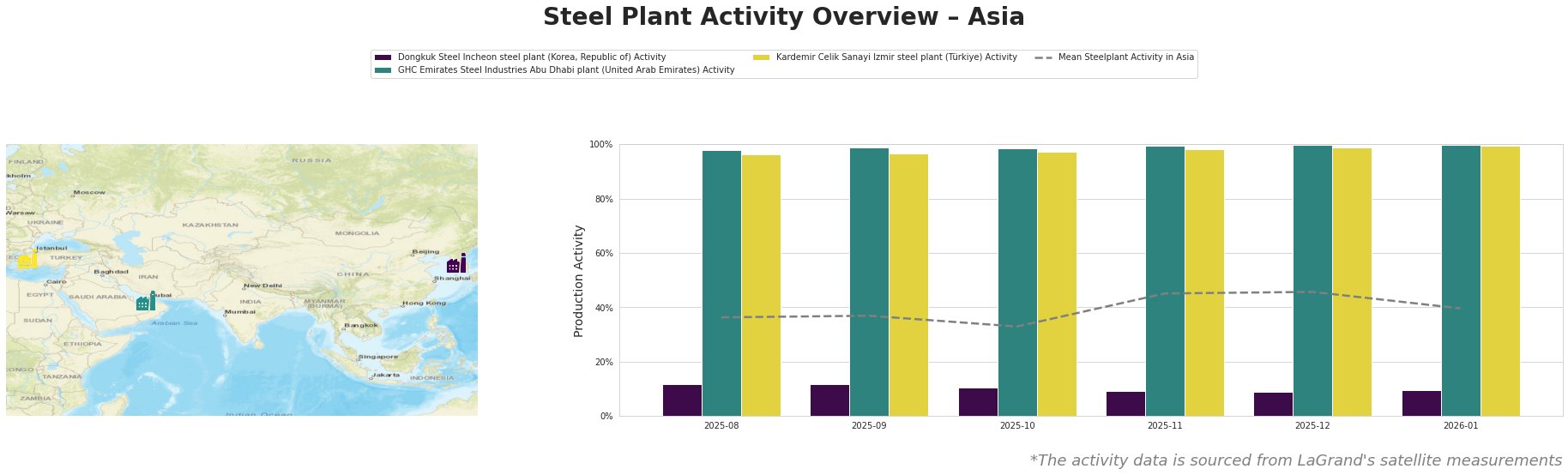

Recent developments in the Asian steel industry reflect a Very Negative market sentiment, primarily driven by escalating trade conflicts, notably those surrounding Canada’s attempts to align closer with China. Significant articles such as “Trump Threatens 100% Tariff On Canada For Drawing Close To China“ and “Carney pushes back on Trump’s 100% tariff threat over China trade deals with Canada amid tensions“ underscore the risks of further tariff impositions, impacting steel trade dynamics in the region. Satellite data has shown drastic reductions in steel plant activities, directly correlating with these geopolitical pressures.

The Dongkuk Steel Incheon plant in South Korea has shown a concerning downturn in activity, dropping to 9% in December and 10% in January with activity levels far below the mean of 40% for the region. Given the context from “Trump Threatens 100% Tariff On Canada For Drawing Close To China”, this decline may reflect heightened uncertainty in market conditions, negatively affecting production decisions due to potential tariff threats.

Conversely, the GHC Emirates Steel Industries in Abu Dhabi and Kardemir Celik Sanayi in Turkey have maintained relatively high operational levels, achieving 100% activity in January; however, the sustained high levels indicate potential supply pressures if regional trade relations worsen. There appears to be no explicit correlation between these higher activity levels and the news articles.

Evaluated Market Implications

Supply disruptions are anticipated, particularly for the Dongkuk Steel Incheon plant, which has been struggling to maintain activity levels, in contrast to the stability exhibited by other plants. The latest tariff threats, as cited in multiple news articles, suggest it would be prudent for steel buyers to secure procurement from regions less susceptible to U.S. tariffs, particularly focusing on supplies from the UAE or Turkey where production has been more consistent.

Steel buyers are advised to prioritize contracts with plants that demonstrate resilience against policy shifts, ensuring terms incorporate flexibility to respond to ongoing trade negotiations. Careful monitoring of geopolitical changes is essential to navigate the current landscape, especially for upcoming procurement cycles.