From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Growth in Europe’s Steel Market Driven by Increased Ukrainian Exports

In Europe, the steel market sentiment is optimistic due to significant upticks in Ukrainian exports. Recent articles like “Ferroalloy exports from Ukraine grew by 21% y/y in 2025“ and “Flat steel exports from Ukraine grew by 11.2% y/y in 2025“ highlight that despite fluctuations, such as a drastic drop in December exports, this surge in exports correlates with enhanced activity at European steel plants.

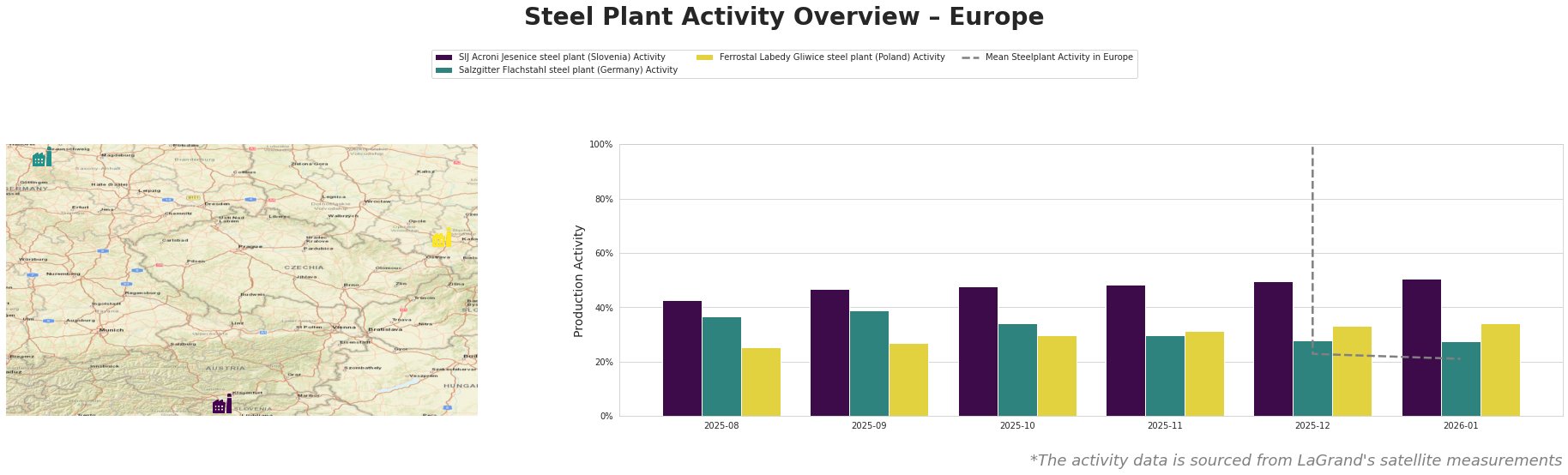

Measured Activity Overview

The mean activity of steel plants across Europe peaked in August 2025 (326.22) but has since experienced fluctuations, notably dropping to 21.0 by January 2026. Notable increases in activity were observed at the SIJ Acroni Jesenice steel plant, maintaining a stable performance with a rise to 50% by December, while Salzgitter Flachstahl’s activity fell significantly in December. Ferrostal Labedy Gliwice’s activity showed resilience, recovering in January. These changes coincide with the growth in exports reported in the articles, providing a clear link between increased demand and plant activity.

SIJ Acroni Jesenice Steel Plant

The SIJ Acroni Jesenice steel plant is a key player in producing flat rolled steel products, with a capacity of 726,000 tons and no traditional blast furnace operations, relying solely on electric arc furnaces (EAF). Activity levels rose from 43% in August to 50% by December 2025. This increase aligns with the “Flat steel exports from Ukraine grew by 11.2% y/y in 2025,” due to improved demand for flat rolled products, primarily from Poland, suggesting this facility is capitalizing on regional demand for Ukrainian offerings.

Salzgitter Flachstahl Steel Plant

Located in Lower Saxony, the Salzgitter Flachstahl steel plant’s production relies on integrated processes with a capacity of 5.2 million tons. Activity declined from 39% in September to just 27% by January. This downturn may be related to market adjustments following fluctuations in Ukrainian exports, such as the insights from “Flat steel exports from Ukraine grew by 11.2% y/y in 2025,” indicating competitive pressures in pricing and availability.

Ferrostal Labedy Gliwice Steel Plant

The Ferrostal Labedy Gliwice steel plant, with a capacity of 500,000 tons, mainly produces semi-finished and finished steel products through EAF technology. Its activity improved from 25% in August to 34% in January 2026, suggesting a positive trajectory amidst overall volatility as reported in related articles. The plant’s responsiveness to demand for long rolled products, as highlighted in “Ukraine increased exports of long rolled products by 45.4% y/y in 2025,” emphasizes a strategic alignment with regional market trends.

Evaluated Market Implications

Potential supply disruptions may arise due to decreased export levels, particularly noted in “Ferroalloy exports from Ukraine grew by 21% y/y in 2025,” where December exports dropped significantly. For procurement professionals, it is recommended to secure contracts for Ukrainian steel products while the market remains active. Key purchasing areas should focus on flat and long rolled products, aligning with high demand patterns observed in Poland and adjacent markets. The positive export trends and the activity enhancements at the SIJ Acroni and Ferrostal plants indicate a window of opportunity that industry players can leverage for strategic procurement decisions.